Gold Price Forecast: XAU/USD defends the new support at $1,644, but for how long?

- Gold price keeps its recovery mode intact, as the US dollar bounce fades.

- Treasury yields fail to cheer risk-on sentiment led by the UK fiscal U-turn.

- XAU/USD could extend its range play below the critical $1,670 barrier.

Gold price is holding its previous upswing, as a brief US dollar rebound dies down amid persisting risk flows. The Asian traders cheer the Wall Street optimism, in the face of the UK fiscal policy reversal. The weakness in the US Treasury yields across the curve also weighs on the dollar and underpins the non-yielding yellow metal. Fading expectations of China doing away with its zero-Covid policy will likely support the metal, as it would mean more economic pain for the world’s largest consumer. Risk sentiment will probably play a critical role in the absence of top-tier economic data from the US. Eurozone ZEW sentiment surveys will be published later in the Europen session but the speeches from the Fed policymakers will be closely followed for fresh directives on the dollar, as well as, the yields.

Also read: Gold Weekly Forecast: Sellers to retain control unless XAU/USD reclaims $1,670

XAU/USD kicked off the week on the right footing, recovering from the previous week’s sell-off to two-week lows at $1,640. The bright metal found comfort from a global risk-on mood, lifted by the UK fiscal U-turn. The UK PM Liz Truss and the new Chancellor Jeremy Hunt scrapped almost all of the mini-budget announced on September 23, to rebuild credibility in the government and stability in the financial market. This move by the UK leaders helped calm nerves amid a data-light start to the week. Amidst the market optimism, the safe-haven dollar suffered even though the US rates hovered near multi-month highs. Further, rising expectations of an imminent German recession also lent support to traditional safety net gold. Aggressive Fed rate hike expectations, however, capped the recovery gains in the bullion. Meanwhile, bulls stayed away from the key technical resistance seen at the $1,670 level.

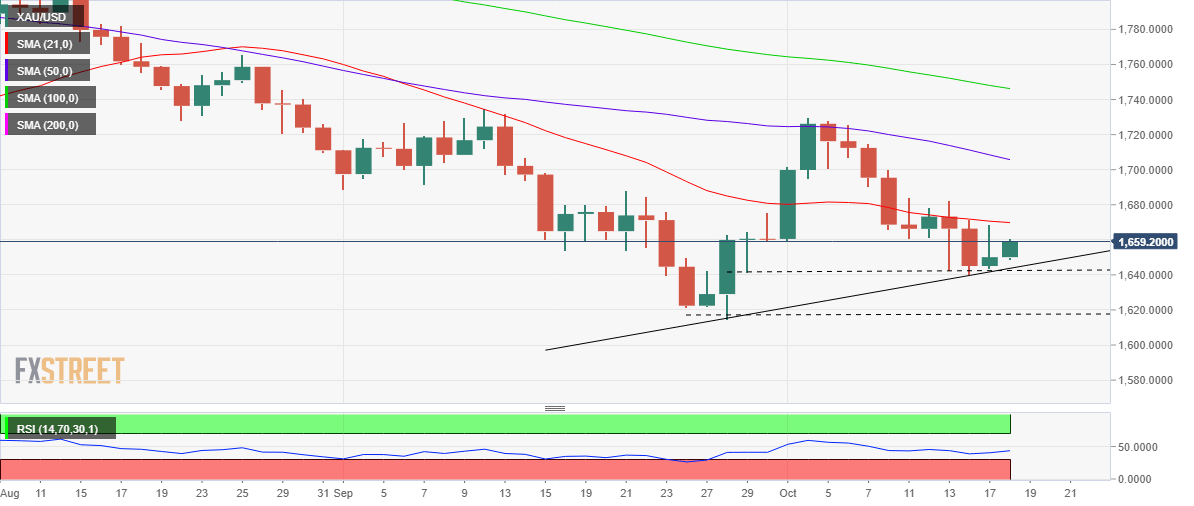

Gold price technical outlook: Daily chart

Gold price has found new support in the rising trendline at $1,644, which is connecting the 2022 lows and Friday’s low.

The mildly bearish 21-Daily Moving Average (DMA) at $1,670 continues to limit the upside attempts.

The 14-day Relative Strength Index (RSI) has edged higher but remains below the 50.00 level, keeping bears hopeful.

The immediate upside barrier is seen at the previous intermittent lows around $1,660, above which the $1,670 key resistance will be retested.

Unless bulls find a firm foothold above the latter, any recovery attempts in the bright metal would be easily sold-off.

Sellers, however, need a daily candlestick closing below the $1,640 demand area to kick off a fresh downswing towards the 2022 lows of $1,615.

The last line of defense for bulls is envisioned at the $1,600 mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.