Gold Price Forecast: XAU/USD defends key $2,545 support; what’s next?

- Gold sellers take a breather on Friday, bracing for more US data and Fedspeak.

- The US Dollar and Treasury yields consolidate Fed Chair Powell speech-led upside.

- Gold price rebounds from critical $2,545 support but the daily RSI remains bearish.

Gold price is looking to build on the previous rebound early Friday in search of a fresh impetus amid persistent US Dollar (USD) buying and mixed activity data from China.

Gold price struggles as US data looms

Even though China’s Retail Sales data jumped by 4.8% in October, Industrial Production disappointed markets with a 5.3% growth in the same period. The Fixed Asset Investment stayed unchanged at 3.4% in the year through October.

The mixed Chinese data dump amplified economic concerns as markets remain wary over the country’s stimulus efforts to ramp up growth. Asian stocks are a mixed bag so far this Friday, with the sentiment undermined by the decline in Chinese indices.

The uncertainty around the future interest rate cuts by the US Federal Reserve (Fed) also remains a drag on the markets, especially after Fed Chair Jerome Powell said late Thursday that there was no need to rush rate cuts with the economy still growing, the job market solid and inflation still above the 2% target, tempering expectations for a rate cut next month, per Reuters.

The US Dollar saw a fresh leg higher as the short-end US Treasury bond yields rallied hard on Powell’s hawkish shit, sending non-yielding Gold price as low as $2,537. However, bargain hunting crept in and allowed Gold price to recover some ground.

The focus now shifts toward a fresh batch of US economic data releases, including the top-tier Retail Sales report, for a fresh direction impetus. Meanwhile, more speeches from Fed policymakers will also entertain traders as they guage whether the Fed will continue its easing trajectory beyond December.

According to Reuters, “Fed fund futures for next year slumped with December off seven ticks and imply just 71 basis points of rate cuts by end-2025. A rate cut next month is no longer a high-probability event, with just 61% priced in, down from 82.5% in the prior session.”

The hawkish turn in the Fed’s policy stance was also backed by the US Producer Price Index (PPI) data for October, which was released on Thursday. The annual headline PPI increased 2.4% in October after rising 1.9% in September, adding signs of the economy losing disinflationary momentum.

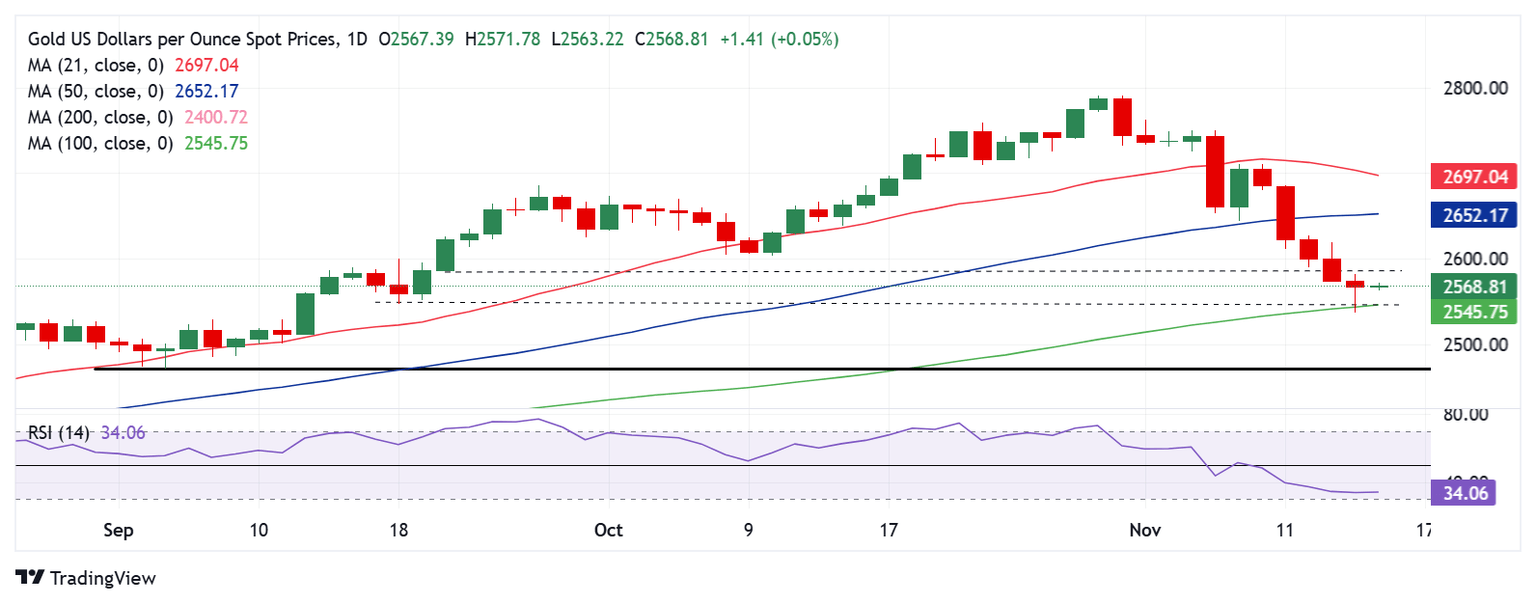

Gold price technical analysis: Daily chart

The short-term technical outlook for Gold price remains more or less the same, with any recovery attempts likely to be short-lived as long as the 14-day Relative Strength Index (RSI) stays bearish.

As of writing, the leading indicator rebounds slightly to near 34 after prodding the oversold threshold a day ago.

This RSI movement correlates to the Gold price recovery from the critical support of $2,545, the confluence of the 100-day Simple Moving Average (SMA) and the September 18 low.

Gold buyers need to recapture the $2,580 demand area on a daily closing basis to extend the turnaround above $2,600.

Further up, the November 13 high of $2,619 will test the bearish commitments.

On the flip side, the immediate support is seen at the abovementioned strong support of $2,545.

A sustained break below the last will initiate a fresh downtrend toward the $2,500 threshold, with the next bearish target seen at the September 4 low of $2,472.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.