Gold Price Forecast: XAU/USD defends critical $1850 support, not out of the woods yet

- Gold sees a dead cat bounce before it resumes the sell-off.

- Covid vaccine optimism lifts economic recovery hopes, downs stimulus demand.

- XAU/USD to remain at the mercy of risk sentiment, US dollar dynamics.

Gold (XAU/USD) plunged 5% and hit the lowest in six weeks at $1850 in Monday’s trading. The sell-off ensued after Pfizer Inc hailed the success of its COVID-19 vaccine trial and lifted the global stocks alongside Treasury yields on expectations of solid economic recovery. The American pharma giant said its COVID-19 vaccine, developed with German partner BioNTech SE, was more than 90% effective in preventing infection. The rally in Treasury yields fuelled the demand for the US dollar and weighed heavily on the yellow metal, as markets reassessed the need for additional stimulus from the Fed and Congress.

Gold is attempting a dead cat bounce so far this Tuesday, heading back towards the $1900 mark, as the Treasury yields retrace some of the previous gains and stall the dollar’s advance. The market mood has turned tepid probably on reports that China’s COVID-19 vaccine trial halted in Brazil due to death while the producer Sinovac is investigating the cause of the halt.

Amid a lack of significant macro news from the US docket in the day ahead, the broader market sentiment and dollar’s price action will be closely followed by gold traders. Also, a speech by President-elect Joe Biden, due at 1900 GMT, will remain in focus.

Gold: Short-term technical outlook

Hourly chart

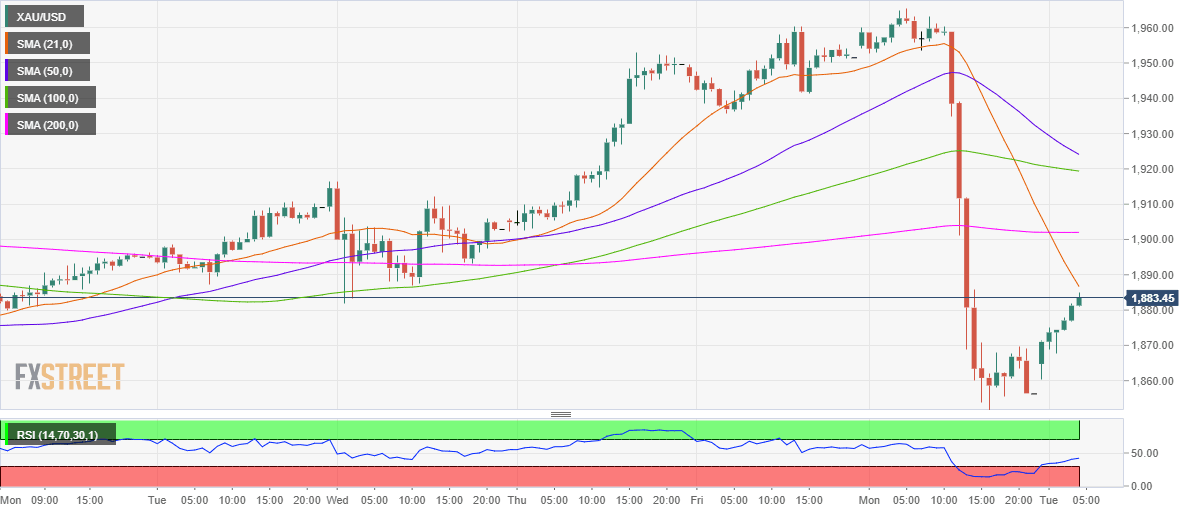

Gold challenges the bearish 21-hourly moving average (HMA) hurdle at $1887 on its road to recovery from multi-week troughs.

The hourly Relative Strength Index (RSI) has edged higher but remains in the bearish zone, suggesting the case for a rebound before the downside resumes.

Recapturing 21-HMA is critical for the bulls, with the next upside resistance seen at the horizontal 200-HMA at $1902.

On the flip side, acceptance below the key support at $1849, September 28 low, could revive the correction from record highs of $2075.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.