Gold Price Forecast: XAU/USD could test $1,900 if key support confluence fails

- Gold price sees a dead cat bounce ahead of fresh US data and Fedspeak.

- US Dollar and US Treasury bond yields cheer upbeat US ISM PMI, risk aversion.

- Gold sellers must crack key support at $1,916 for a sustained downtrend.

Gold price has found fresh buyers once again near $1,915, making a minor recovery attempt early Thursday. The United States Dollar (USD) is in a bullish consolidation phase near six-month highs, as US Treasury bond yields take a breather ahead of US economic data and Fedspeak.

Gold price at the mercy of risk trends, US Dollar

Risk-off flows extend into Asian trading on Thursday. China’s economic worries, resurfacing inflation concerns on higher oil prices, and increased bets for further US Federal Reserve (Fed) policy tightening continue to weigh on the market’s sentiment. The tepid mood keeps the buoyant tone intact around the safe-haven US Dollar, as it hangs near six-month highs against its major peers, allowing Gold price to stage a minor comeback.

However, it remains to be seen if the Gold price can defend the abovementioned strong support at $1,916 in the day ahead. The Gold price action will depend on the upcoming US weekly Jobless Claims and a slew of speeches from Federal Reserve policymakers for fresh cues on the central bank’s interest rate move, especially after Wednesday’s robust US ISM Services PMI data revived expectations that the Fed could go for one more rate hike this year.

The ISM Services PMI rose to 54.5 in August, the highest reading since February and up from 52.7 in July. The ISM Services PMI index of prices paid increased to 58.9 in August from 56.8 in July, suggesting new signs of inflationary pressures.

However, the US Dollar bulls ignored the dovish comments from Boston Fed President Susan Collins and tracked the ongoing rally in the US Treasury bond yields. Collins said, “the risk of inflation staying higher for longer must now be weighed against the risk that an overly restrictive stance of monetary policy will lead to a greater slowdown in activity than is needed to restore price stability.”

Later in the day, Fed policymakers Patrick Harker, Austan Goolsbee, John Williams, Raphael Bostic and Michelle Bowman are due to deliver their respective scheduled speeches, which could significantly impact the US Dollar-denominated Gold price.

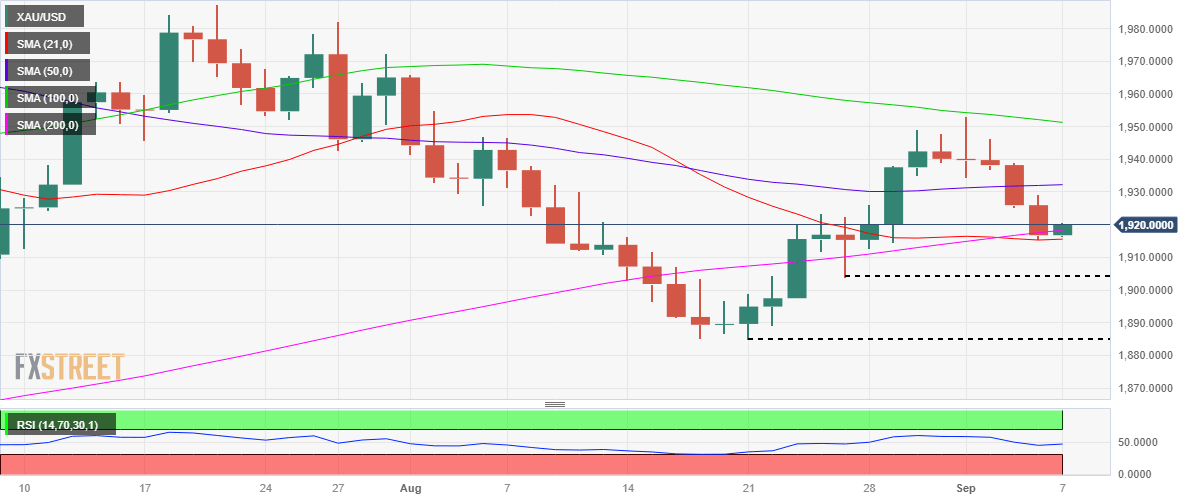

Gold price technical analysis: Daily chart

Gold price extended its five-day losing streak and hit fresh one-week lows at $1,915, having tested the confluence support of the 21- and 200-daily Moving Averages (DMA) at $1,916.

Gold buyers are currently defending the latter despite a bearish 14-day Relative Strength Index (RSI). The leading indicator suggests that the downside- potential remains intact in Gold price.

Therefore, a firm break below the said confluence support is needed on a daily closing basis to extend the downtrend toward the initial demand area just above the $1,900 mark, where the previous week’s low of $1,904 aligns.

The $1,900 threshold will then challenge bullish commitments, below which a test of the multi-month low of $1,885 will be inevitable.

Alternatively, the Gold price will need to recapture the 50 DMA support-turned-resistance at $1,932 on a daily closing basis to make another run toward the 100 DMA hurdle at $1,951.

Further up, the static resistance of $1,970 and the July 27 high of $1,982 will challenge the Gold price recovery.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.