Gold Price Forecast: XAU/USD could revisit $1,900 area on hawkish Jerome Powell speech

- Gold price pauses a four-day uptrend but is set for the best week in six.

- US Dollar regains poise ahead of Jerome Powell speech at the Jackson Hole Symposium.

- Gold price battles with the 21-Daily Moving Average resistance at $1,919 amid bearish RSI.

Gold price is taking a breather early Friday, consolidating a four-day uptrend to two-week highs of $1,923 set on Thursday. The United States Dollar (USD) is taking charge amid risk-aversion, extending its previous rally, helped by the renewed strength in the US Treasury bond yields. Investors now await US Federal Reserve Chairman Jerome Powell’s opening remarks at the Jackson Hole Economic Symposium later in the day.

Jerome Powell speech in focus at the Jackson Hole Symposium

Gold price is struggling to extend the recent recovery momentum, as investors prefer to hold the US Dollar heading into the main event risk at the Fed’s annual economic conference at Jackson Hole, Chair Jerome Powell’s speech. A cautious market mood also favors the safe-haven demand for the US Dollar, limiting the upside in the Gold price.

Powell’s speech at the Jackson Hole event was previously a decisive one, as he delivered a strong message on the central bank’s commitment to fighting inflation, suggesting more interest rate hikes. At the 2023 symposium, Jerome Powell is likely to laud the US economic resilience, feeding into the rhetoric of a ‘higher for longer’ narrative. In such a case, markets are likely to read his message as hawkish, triggering a fresh upside in the US Dollar and the US Treasury bond yields at the expense of the Gold price.

Conversely, if Powell emphasizes the Fed’s data-dependent approach for future policy course and expresses concerns over economic growth and credit conditions, it could imply a less hawkish stance and smash the US Dollar across the board while providing the much-needed boost to the Gold price.

Meanwhile, the end-of-the-week flows combined with the pre-US Nonfarm Payrolls positioning could also influence the Gold price action heading into the weekly close.

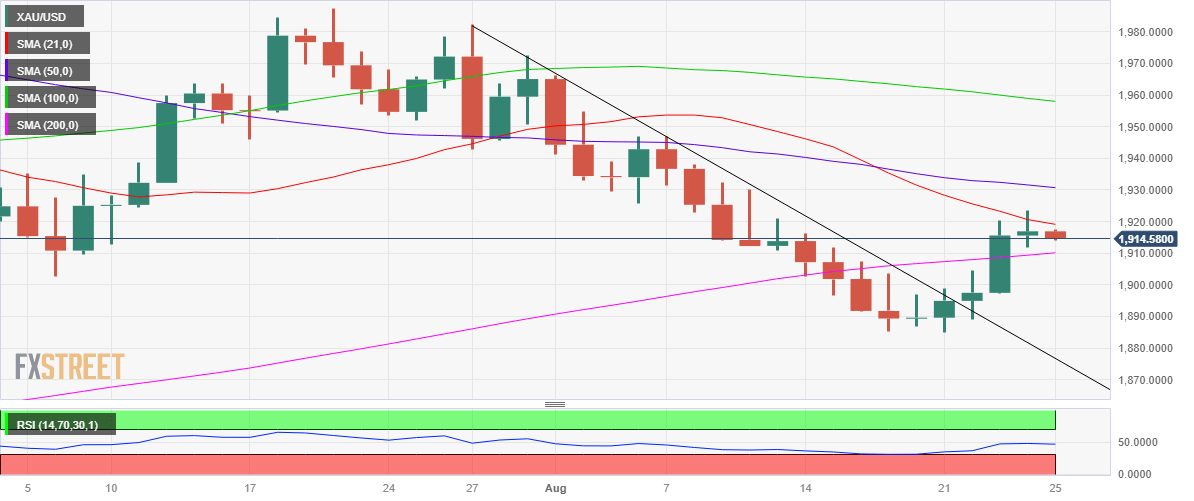

Gold price technical analysis: Daily chart

As observed on the daily chart, Gold price briefly recaptured the bearish 21 DMA at $1,919 but failed to close Thursday above the key barrier, reinforcing Gold sellers on Friday.

The Gold price retracement is likely to find initial demand at the mildly bullish 200 DMA at $1,910, below which a test of the $1,900 area will be inevitable.

The next critical support is seen at the descending trendline, pegged at $1,877.

The 14-day Relative Strength Index (RSI) is sitting just beneath the 50 level, pointing to potential downside risks for Gold price.

Alternatively, weekly closing above the 21 DMA could extend the recent recovery from five-month lows, with Gold buyers targetting the 50 DMA resistance at $1,931.

If Gold buyers manage to find a foothold above the latter, a fresh run toward the $1,950 psychological barrier cannot be ruled out.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.