Gold Price Forecast: XAU/USD could extend range trade around $1,650, as focus shifts to US GDP

- Gold price remains on the back foot amid an extended risk rally.

- Easing aggressive Fed tightening bets keep USD, yields under pressure.

- XAU/USD remains stuck in a range, awaits US data for a fresh direction.

Gold price is treading water around $1,650 so far this Tuesday, confined in a tight range amid a broadly subdued US dollar, volatility in Chinese stocks and extended weakness in the Treasury yields across the curve. The greenback paused its minor recovery attempt after China’s indices swung into gains after Monday’s brutal sell-off on reports that the government intervened in the country’s stock markets. The overnight risk rally on Wall Street also extended into Asia and kept dollar bulls in check, allowing gold bears to take a breather. Looking ahead, investors will await the Eurozone and the US sentiment data for fresh trading impetus. Traders will trade with caution ahead of this week’s earnings reports from top US tech and retail giants. Meanwhile, anxiety before the ECB and the US advance Q3 GDP data could also leave investors on the edge, refraining from placing big bets on the bright metal. The ECB is seen hiking rates by 75 bps this week, as they stay committed to warding off inflation.

Also read: Gold fluctuations around $1,680 inflection

XAU/USD price started the week on a volatile note, initially climbing above $1,670 before closing Monday in the red just below $1,650. The yellow metal rallied hard in the first half of the day, as the US dollar extended its corrective decline amid the renewed market optimism, as Rishi Sunak took over the UK’s premiership. Markets remained hopeful that Sunak could eventually bring stability and relief to the country’s financial markets. Further, the non-interest-bearing also benefitted from soft US S&P Global Manufacturing and Services PMIs, which raised hopes that the Fed could begin to slow its pace of policy tightening later in the year. Easing Fed rate hike expectations lifted the sentiment on Wall Street, which resulted in fresh selling in the bullion.

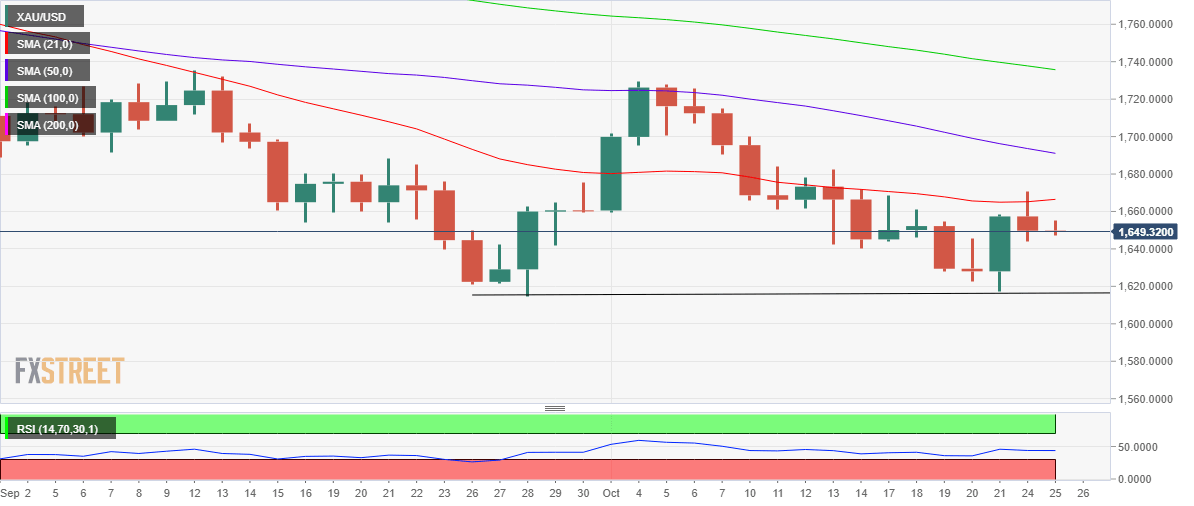

Gold price technical outlook: Daily chart

Gold price is likely to extend its range play between the 21-Daily Moving Average (DMA) at $1,666 and the strong support near $1,615 ahead of the critical events this week.

The 14-day Relative Strength Index (RSI) remains below the midline, keeping the downside risks intact.

Any recovery attempt will need acceptance above the 21DMA on a daily closing basis. The next upside barrier is seen at Monday’s high of $1,671.

The October 13 high at $1,683 will challenge bearish commitments should the recovery gather steam.

However, if the latest leg down extends, then Monday’s low at $1,644 will offer immediate support, below which the $1,630 round number will be tested.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.