Gold Price Forecast: XAU/USD corrects near-term extreme overbought conditions

XAU/USD Current price: $2,239.91

- Upbeat United States data confirmed Federal Reserve’s conservative approach to rate cuts.

- Stock markets returned from the long weekend with a soft tone, Wall Street dips.

- XAU/USD retreats from record highs, retains its bullish stance.

Gold price retreats from a fresh record high of $2,265.58 a troy ounce. XAU/USD rallied during Asian trading hours but turned south during European ones. XAU/USD currently trades around $2,240, as the US Dollar gathered momentum following the release of a much-better-than-anticipated United States (US) ISM Manufacturing PMI. The report showed that economic activity in the manufacturing sector expanded in March after contracting for 16 consecutive months, with the index jumping to 50.3 from 47.8 in February.

S&P Global also released the final estimate of its Manufacturing PMI, which was confirmed at 51.9, below the 52.5 expected but still with expansionary levels. The report added that “signs of improving wider economic conditions and market demand fed through to a further expansion of US manufacturing production in March, with the rate of expansion hitting a 22-month high. The rate of job creation also quickened, but new order growth softened.”

Meanwhile, Wall Street turned south. US indexes are down following the extended weekend, with the Dow Jones Industrial Average down over 200 points. Markets are posting a late reaction to Friday’s events. On the one hand, the Bureau of Economic Analysis (BEA) reported that the core Personal Consumption Expenditures (PCE) Price Index rose 0.3% MoM and 2.8% YoY in February, as expected. On the other hand, Federal Reserve (Fed) Chairman Jerome Powell participated in an interview open to questions, in which he repeated that the Fed is in no hurry to cut rates, as economic growth remains strong and inflation is above target.

Treasury yields are firmly up, with the 10-year note offering 4.33%, up 12 basis points (bps) and the 2-year note yielding 4.71% after adding 10 bps, both flirting with March highs.

XAU/USD short-term technical outlook

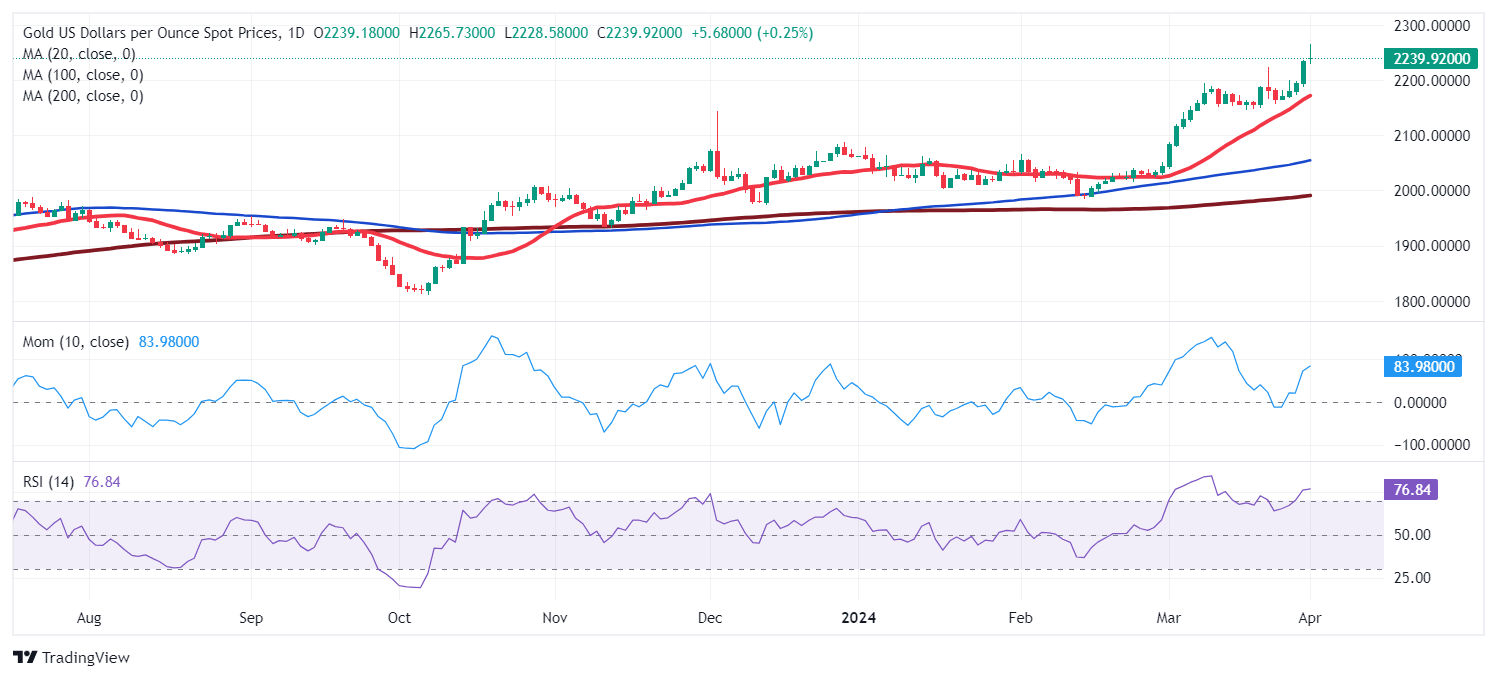

The daily chart for the XAU/USD pair shows it filled an opening gap and bounced back while currently trading unchanged around its daily opening. The same chart shows moving averages maintain their bullish slopes far below the current level, reflecting bulls’ dominance. At the same time, technical indicators have lost their upward strength but remain within positive levels, with the Relative Strength Index (RSI) indicator currently consolidating around 76, with no signs of giving up.

Spot gold is correcting near-term extreme overbought conditions, as the 4-hour chart shows technical indicators retreated sharply, heading south almost vertically although well above their midlines. At the same time, moving averages have partially lost their upward momentum but are developing below the current level, with the 20 SMA currently providing dynamic support at around $2,208.05.

Support levels: 2,228.40 2,208.05 2,184.70

Resistance levels: 2,250.00 2,265.60, 2,280.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.