Gold Price Forecast: XAU/USD corrects before taking on lifetime highs

- Gold price pulls back to $2,400 early Friday, having hit fresh two-month highs at $2,425 on Thursday.

- The US Dollar rebounds with Treasury bond yields after softer US CPI data spiked September Fed rate cut bets.

- The USD/JPY recovery post-FX intervention also supports the Greenback.

- Gold price remains a ‘buy-the-dips’ trade amid the bullish technical setup on the daily chart.

Gold price is reversing to test the $2,400 threshold early Friday, staging a minor pullback from a new two-month top set at $2,425 on Thursday. Traders now look forward to the US Producer Price Index (PPI) data and looming risks of more Japanese forex (FX) market intervention for the next push higher in Gold price.

Gold price consolidates weekly gains

Gold price is on track to witness a third consecutive week of gains, sitting at its highest level since May. Despite the latest pullback Gold price remains exposed to upside risks, as a September interest rate cut by the US Federal Reserve (Fed) is almost a done deal after the softer-than-expected June US Consumer Price Index (CPI) data released on Thursday.

The US CPI climbed 3.0% YoY in June, slowing from a 3.3% increase in May and below the 3.1% expected print. Meanwhile, the annual core CPI inflation dipped to 3.3% in the same period, against the market consensus of 3.4%. On a monthly basis, CPI fell 0.1% while core CPI rose 0.1%. Both readings fell short of expectations.

Bets for a September Fed rate cut spiked to above 90% following the dismal US inflation data, according to the CME Group’s FedWatch Tool, compared to a 74% chance seen pre-CPI release. The US Dollar was slammed alongside the US Treasury bond yields, in the aftermath of the US inflation data, with the pain exacerbated by the USD/JPY sell-off.

The Japanese Yen rallied hard, as the US CPI gloom was joined by Japan’s forex market intervention, smashing USD/JPY over 300 pips in a matter of an hour. Against this backdrop, Gold price stormed through the $2,400 barrier to hit the highest level in two months.

In the day ahead, Gold price could see an extension of the corrective downside if the US Dollar recovery gathers traction. However, traders will likely remain wary ahead of the US PPI inflation report and the preliminary Michigan Consumer Sentiment and Inflation Expectations, which could reinforce fresh selling around the US Dollar. This, in turn, could trigger a fresh leg higher in Gold price. The end-of-the-week flows could also play a pivot role in the Gold price action.

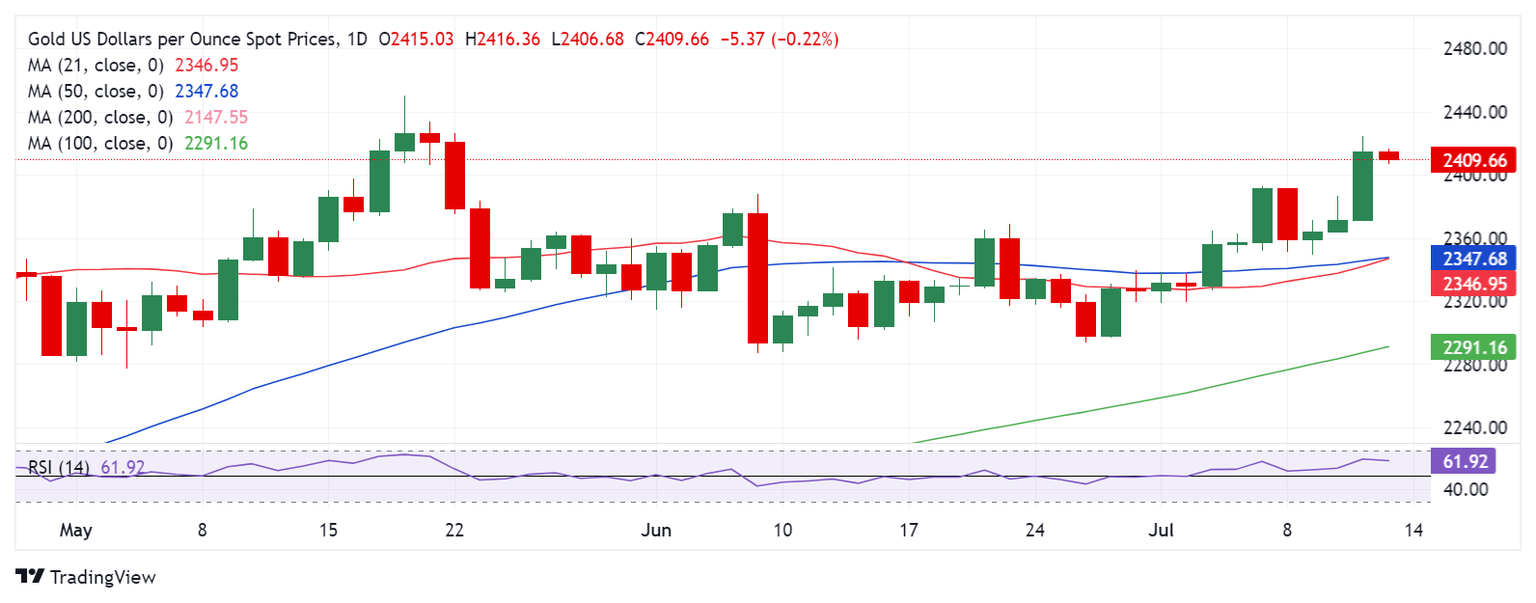

Gold price technical analysis: Daily chart

The short-term technical outlook for Gold price continues to suggest a retest of the all-time highs at $2,450, as the 14-day Relative Strength Index (RSI) holds its position well above the 50 level.

Adding credence to the bullish potential, the 21-day Simple Moving Average (SMA) is on the verge of crossing the 50-day SMA from below, which if realized on a daily closing basis will confirm a Bull Cross and revive the Gold price upside.

Gold buyers need to yield a decisive break above the two-month high of $2,425 to retake the record highs of $2,450.

On the downside, if the pullback gains momentum, Gold price could face immediate support at the previous week’s high near $2,390.

The next bearish target is seen at the previous day’s low of $2,371, below which the $2,350 psychological level will come into play.

All in all, Gold price remains a good buying opportunity on every pullback.

(This story was corrected on July 12 at 07:41 GMT to say that "the 21-day Simple Moving Average (SMA) is on the verge of crossing the 50-day SMA from below, which if realized on a daily closing basis will confirm a Bull Cross and revive the Gold price upside," not Bear Cross).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.