Gold Price Forecast: XAU/USD corrects before resuming uptrend, focus on Russia-Ukraine crisis

- Gold price consolidates following Friday’s massive surge led by renewed Russia-Ukraine risks.

- World’s leaders meeting over Ukraine turmoil, FOMC minutes eyed this week.

- The golden cross remains in play, pullbacks could be seen as a good buying opportunity.

Friday saw an impressive turnaround in gold price, helping the bright metal post the biggest weekly gain since early May 2021. What turned the tide in favor of gold bulls? Traders were already brooding over aggressive and faster US Federal Reserve’s (Fed) rate hikes this year, in the face of hotter than expected American inflation figures, with hawkish Fedspeak building up for a 50-basis points (bps) March lift-off. However, the Russia-Ukraine geopolitical risks sparked off once again and revived hopes for gold optimists.

Gold price was trading near daily lows of $1,821 when a PBS NewsHour reporter, tweeted out that the US believes that Russian President Vladimir Putin has decided to invade Ukraine and already communicated those plans to the Russian military. The headline was enough to trigger a staggering $40 rally over the next hours. Tensions heightened on reports that the Russian invasion of Ukraine could begin next week, which hit the market sentiment and smashed Wall Street alongside a rush to safety in gold and US government bonds. The US Treasury yields, therefore, tumbled across the curve, adding to the bullish momentum in gold price.

Gold price is on a corrective mode on Monday, with markets rather tranquil amid the brewing Ukraine storm. Some talks of diplomacy and de-escalation from the US, UK and France have failed to comfort markets so far, as the Asian stocks are in a sea of red, although the US futures are back in the green zone. The US Treasury yields have stabilized while the dollar holds recent gains, triggering a pullback in gold price. Going forward, the looming geopolitical tensions between Russia and Ukraine will remain the biggest risks for markets, which could potentially keep gold price underpinned. Meanwhile, the hawkish Fed sentiment could return midweek ahead of Wednesday’s January Fed meeting’s minutes. Also, the US Retail Sales release will hog the limelight later this week. Overall, gold price is likely to experience huge volatility amidst the geopolitical developments, as world leaders will meet over the coming week to de-escalate the situation on the Ukrainian border.

Gold Price Chart - Technical outlook

Gold: Daily chart

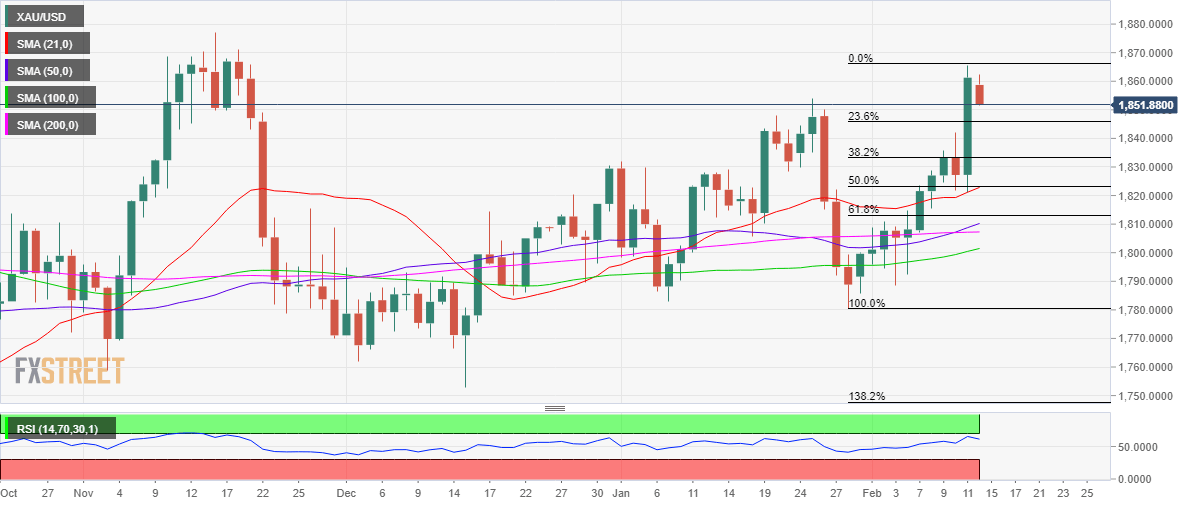

Gold price is trading around $1,850, as of writing, retreating from three-month highs of $1,866, as investors take profits off the table after the recent upsurge.

Immediate support is seen at $1,846, the 23.6% Fibonacci Retracement level (Fibo) of the rally from January 28 that peaked out last Friday.

Further south, the February 10 highs of $1,842 will be tested, below which floors could open up towards 38.2% Fibo level of the same ascent.

However, the correction appears short-lived for gold, as the golden cross remains in play while the 14-day Relative Strength Index (RSI) still holds comfortable above the central line, despite the latest downtick.

If buyers regain poise, then a retest of the multi-month highs will be inevitable.

The next critical resistance area is seen around $1,870-$1,872 price zone, which is the November peaks.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.