Gold Price Forecast: XAU/USD consolidates weekly gains ahead of US PCE inflation

XAU/USD Current price: $2,042.45

- Federal Reserve officials' dovish comments undermine demand for the US Dollar.

- US Treasury yields extended their slides to fresh multi-week lows.

- XAU/USD's near-term picture suggests it could soon resume its advance.

Spot Gold trades at $2,040 a troy ounce, down on Wednesday as the US Dollar recovered some ground amid profit-taking ahead of first-tier data. The Greenback, however, remains weak amid renewed hopes the Federal Reserve (Fed) is done with monetary tightening.

Atlanta Fed president Raphael Bostic said he has more confidence that the downward trajectory of inflation will likely continue. "There's no question the inflation rate has slowed materially over the past year-plus," Bostic noted. On the contrary, the President of the Fed Bank of Richmond, Tom Barkin, said he is unwilling to take another interest rate hike off the table as he remains sceptical about being on track for 2% inflation. Still, the number of governors leaning towards the dovish side back the market's belief of no more rate hikes from the Fed.

Meanwhile, United States (US) government bond yields continue to retreat. The 10-year Treasury note offers 4.28%, while the 2-year note yields 4.66%, both at multi-week lows.

Market participants will now wait for US inflation data. The country will release the October Core Personal Consumption Expenditures (PCE)- Price Index, the Fed's favorite inflation gauge, foreseen at 3.5% YoY, down from 3.7% in September. Additional signs of easing price pressures will likely boost optimism and undermine USD demand.

XAU/USD short-term technical outlook

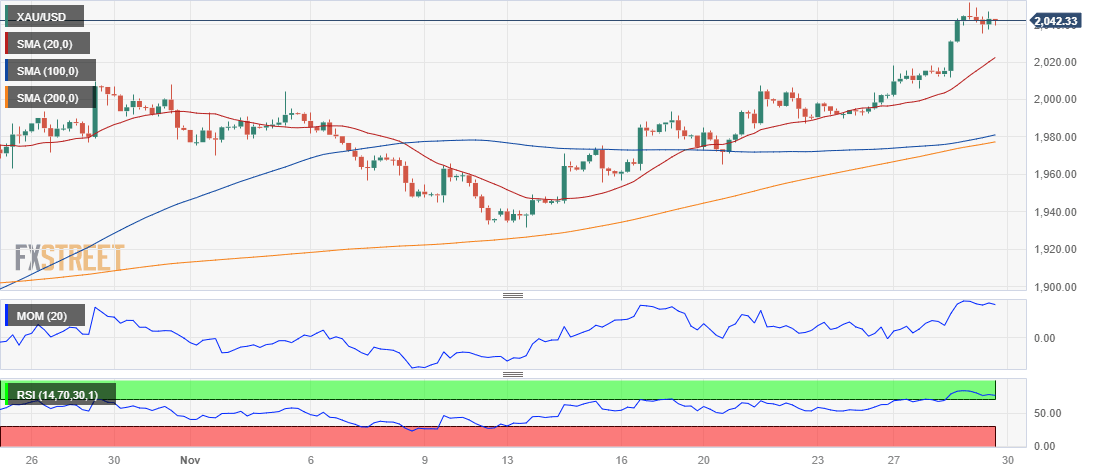

The daily chart for the XAU/USD pair shows that bulls have paused but retain control. The pair posted a higher high and a higher low while extending its advance above all its moving averages. Technical indicators, in the meantime, have lost their bullish strength, currently consolidating near overbought readings.

The 4-hour chart suggests XAU/USD may soon resume its advance. Technical indicators have retreated from extremely overbought levels and stabilized well above their midlines. At the same time, the 20 Simple Moving Average (SMA) maintains its firmly bullish slope, far below the current level while above the 100 and 200 SMAs.

Support levels: 2,035.40 2,021.40 2,005.70

Resistance levels: 2,048.20 2,062.90 2,074.90

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.