Gold Price Forecast: XAU/USD consolidates gains around $2,260

XAU/USD Current price: $2,260.96

- Upbeat United States macroeconomic data failed to support the US Dollar.

- Federal Reserve officials kept pouring cold water on rate-cut hopes.

- XAU/USD keeps posting record highs without signs of bullish exhaustion.

Spot Gold resumed its advance on Tuesday, resulting in XAU/USD reaching a fresh all-time high of $2,276.90 in the American session. The US Dollar pared gains at the beginning of the day and lost some additional ground after Wall Street’s opening, despite generally upbeat United States (US) data and the poor performance of US indexes.

The country reported that February Factory Orders were up 1.4%, beating the 1% expected and improving from -3.8% in January. Also, according to the US Bureau of Labor Statistics (BLS), the number of job openings on the last business day of February stood at 8.75 million. The figure surpassed the previous 8.74 million, downwardly revised from 8.86 million. The headline figure shows the labor market is still far from cooling as the Federal Reserve (Fed) would like.

Finally, several Fed officials hit the wires, although only Cleveland Federal President Loretta Mester referred to monetary policy. Mester was cautious, as despite saying she still expects the Fed can cut rates later this year, she warned that moving rates down too soon or too quickly would risk the progress made on inflation.

Wall Street is under strong selling pressure as government bond yields soar. The yield on the 10-year Treasury note peaked at 4.40% today, its highest since last December, while the 2-year note offers 4.70%, not far below the year peak.

XAU/USD short-term technical outlook

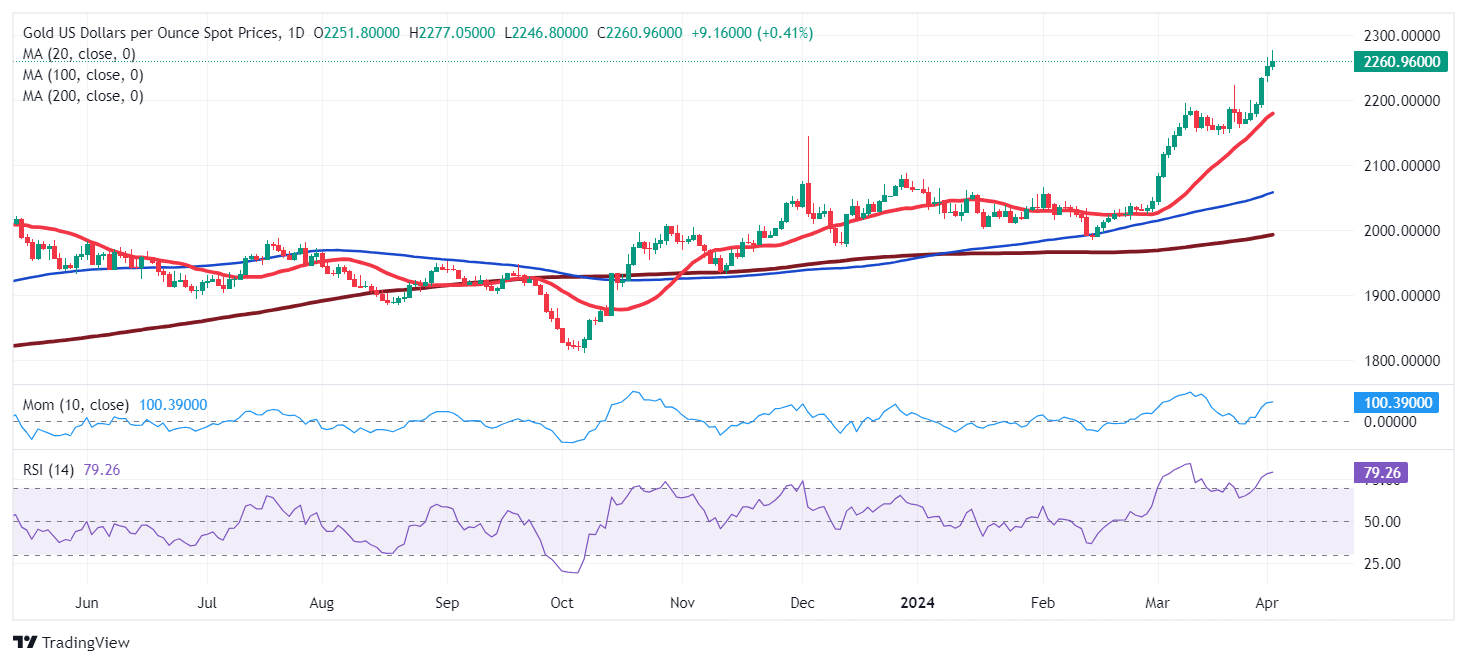

XAU/USD bullish trend remains firm in place, according to the daily chart, as the pair has consistently advanced beyond bullish moving averages. The 20 Simple Moving Average (SMA) maintains its bullish slope above bullish, longer ones, which also offer upward slopes. At the same time, the Momentum indicator remains significantly positive, reflecting sustained buying interest. Finally, the Relative Strength Index (RSI) indicator stands in overbought territory, further reflecting the upward strength.

The XAU/USD pair 4-hour chart offers a similar picture, as the bright metal extends gains well beyond bullish moving averages, reflecting the prevalent uptrend. Furthermore, the widening distance between the price and the moving averages suggest that the bullish momentum is gaining strength. Technical indicators reinforce the bullish narrative, holding within overbought readings. Despite losing upward strength, the case for a downward extension seems limited as the price holds around $2,260.

Support levels: 2,250.70 2,234.50 2,217.90

Resistance levels: 2,277.10 2,290.00 2,310.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.