Gold Price Forecast: XAU/USD consolidates before a sustained break above $2,530

- Gold price stalls a three-day uptrend early Wednesday, just shy of $2,530.

- The US Dollar attempts a bounce amid a risk-off mood, as Treasury bond yields stay sluggish.

- Gold traders turn cautious ahead of Fedspeak and Nvidia earnings report.

- Gold price daily technical setup points to a fresh lifetime high in the making.

Gold price has returned to the red but remains within this week’s familiar range above $2,500 early Wednesday. Gold price replicates the negative action seen during Tuesday’s Asian session, awaiting speeches from US Federal Reserve (Fed) policymakers for fresh hints on the interest-rate outlook.

Gold price awaits Fedspeak for fresh impetus

Further, a sense of caution prevails, as markets remain wary ahead amid looming Middle East geopolitical risks ahead of the highly anticipated Nvidia earnings due later this Wednesday and Friday’s US inflation data.

Amidst a risk-off mood, the US dollar (USD) finds fresh haven demand, which acts as a heading for the Gold price. However, sluggish US Treasury bond yields could limit the US Dollar’s uptick, cushioning the Gold price downside.

Meanwhile, dovish Fed expectations and simmering Middle East geopolitical tensions will continue to lend support to Gold price. White House spokesman John Kirby said on Tuesday that the US believes Iran is postured and poised to deliver an attack on Israel.

Additionally, the Israeli army mobilized thousands of soldiers from special units in preparation for the large-scale operation in the northern West Bank, lasting a long time.

Despite the bullish sentiment around Gold price, the upcoming Fedspeak will provide a fresh trading impetus to Gold price. Markets are currently pricing in a 32% probability of 50 basis points (bps) rate reduction in September while the odds of a 25 bps cut stand at 68%, the CME Group’s FedWatch Tool showed on Wednesday.

On Tuesday, Gold price witnessed a good two-way price movement, initially correcting slightly from near the record high of $2,532 on haven demand for the US Dollar. However, the Greenback came under intense selling pressure in sync with the US Treasury bond yields after a strong US 2-year note auction results of the $69 billion sale.

The USD failed to find any inspiration from an improvement in the US Conference Board (CB) Consumer Confidence data and a tech sell-off in the US and Chinese equities.

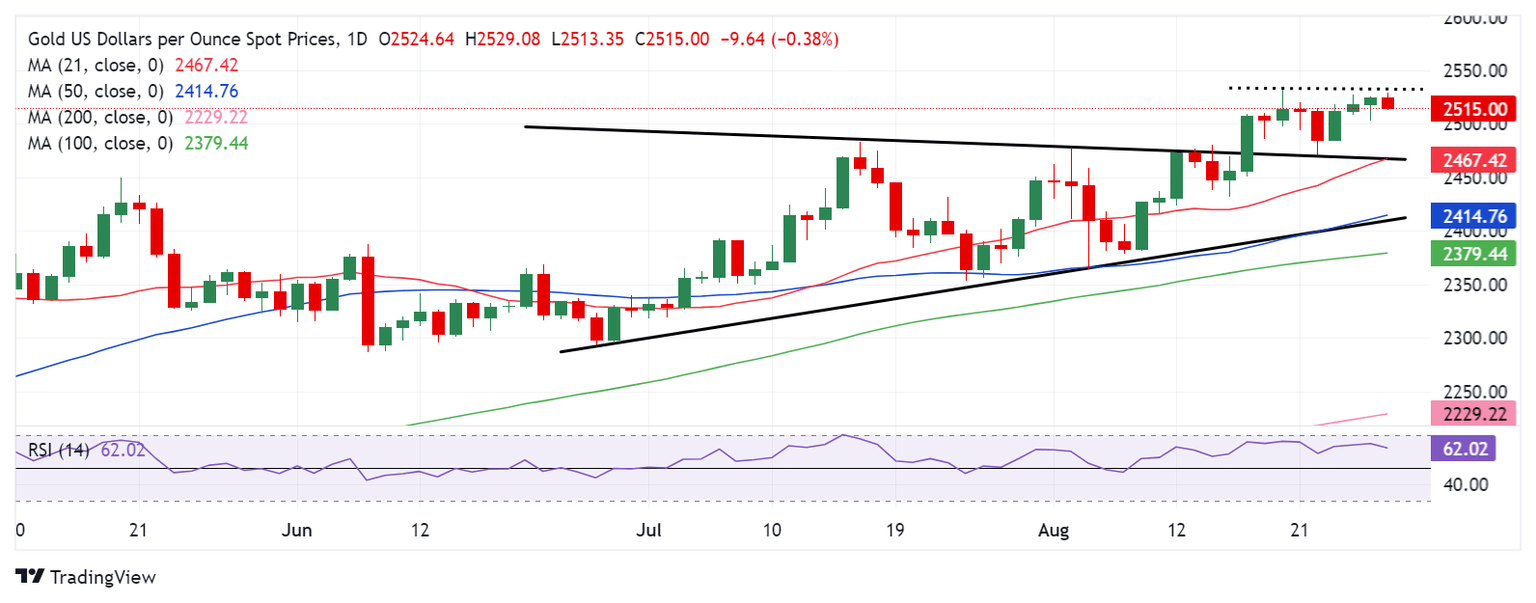

Gold price technical analysis: Daily chart

Nothing has changed for the Gold price from a short-term technical perspective, with the upside risks intact so long as buyers defend the triangle resistance-turned-support at $2,466.

The 21-day Simple Moving Average (SMA) closes in on that level, making it a strong support.

It’s worth mentioning that Gold price consolidates its upside break from a symmetrical triangle confirmed a couple of weeks ago.

Meanwhile, the 14-day Relative Strength Index (RSI) turns lower but holds comfortably above 50, currently near 61, justifying the bullish outlook.

Gold buyers need to recapture the record high of $2,532 to take on the next key barrier at the $2,550 level.

Acceptance above the latter could challenge the $2,600 round level en route to the triangle target, measured at $2,660.

On the flip side, the initial demand area is seen at the $2,500 threshold for Gold buyers, below which Friday’s low of $2,485 will be challenged.

A sustained breach of the latter could expose the downside toward the abovementioned triangle resistance-turned-support at $2,466.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.