Gold Price Forecast: XAU/USD comes under pressure ahead of Powell

- The US Dollar shows signs of life following recent YTD lows.

- Markets’ attention remains on Powell’s speech at Jackson Hole.

- XAU/USD faces initial resistance at its record top past $2,530.

XAU/USD faces some renewed selling pressure and adds to Wednesday’s losses, returning to the sub-$2,500 region per ounce troy.

The corrective decline in the precious metal was accompanied by quite a marked rebound in the Greenback, all after the US Dollar Index (DXY) broke below the key 101.00 support for the first time since December 2023 during the previous day.

Adding to the downward pressure on the yellow metal, US yields bounced across the spectrum as market participants digested the dovish tone from the FOMC Minutes released on Wednesday and started to warm up for the upcoming speech by the Federal Reserve’s (Fed) Chair Jerome Powell at the Jackson Hole Symposium on Friday.

Although the FOMC Minutes suggested that an interest rate cut could be imminent as early as next month, Powell’s upcoming speech might provide additional insights into his perspective on this possibility and, more crucially, reveal the potential magnitude of the cut. At present, CME Group’s FedWatch Tool indicates a nearly 75% chance of a 25 bps rate reduction at the September 18 gathering.

If there are indications of a larger cut, say 50 bps, it is anticipated to put significant pressure on the Greenback and enable Gold to test recent highs. Regardless, the US Dollar is likely to remain under close watch for the time being, which may limit any decline in bullion prices.

XAU/USD short-term technical outlook

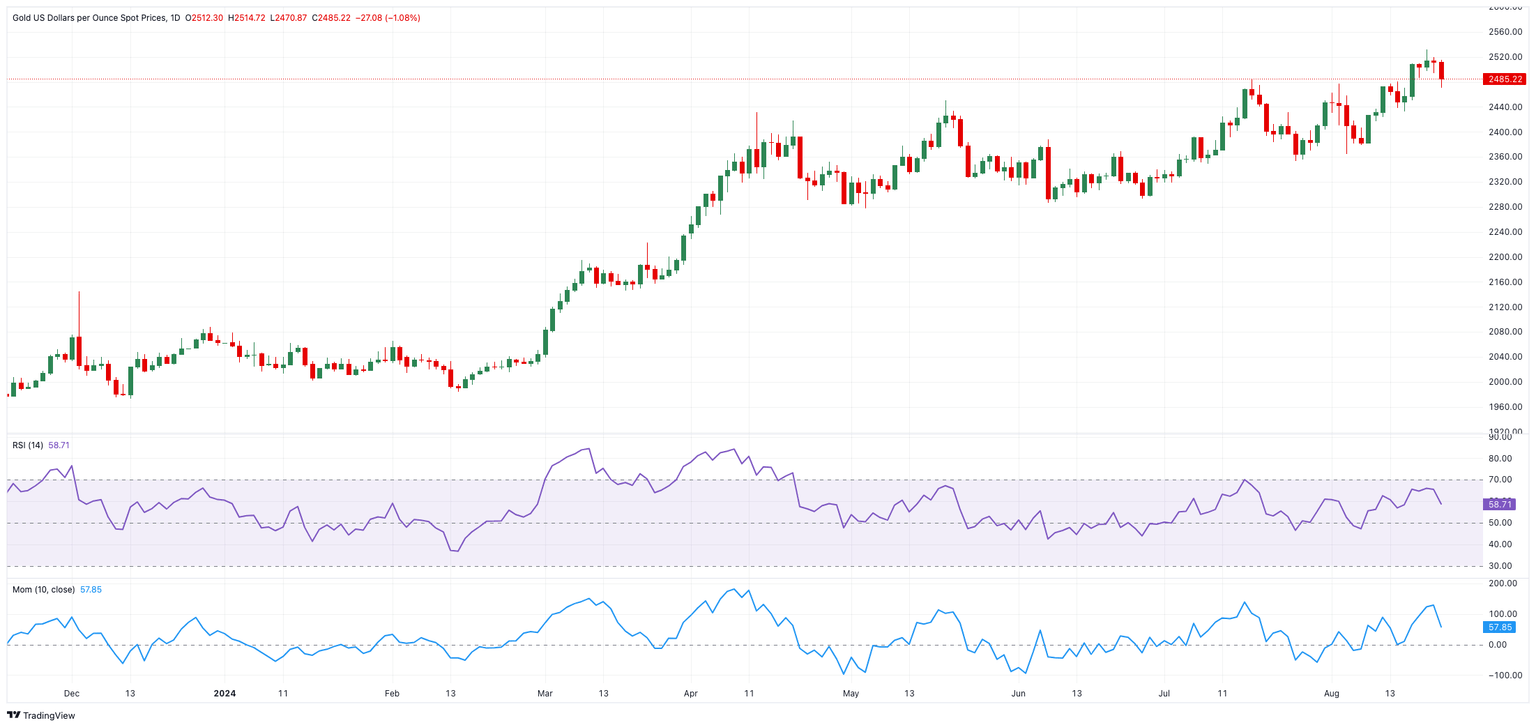

The daily chart shows XAU/USD navigating above all of its moving averages, with a bullish 55 Simple Moving Average (SMA) speeding north at about $2,390, as well as bullish lengthier ones. Meanwhile, technical indicators (RSI and Momentum) receded from recent tops, while the daily ADX indicates a stable trend for the time being.

In the short term, and according to the 4-hour chart, the corrective decline persists. XAU/USD is now facing the next support at the 100-SMA at $2,452 prior to $2,432, which appears underpinned by the more relevant 200-SMA at $2,428. A sustained breakdown of this region could open the door to a deeper retracement to $2,379, ahead of $2,364.

Support levels: 2,470.85 2,432.22 2,428.35

Resistance levels: 2,519.18 2,531.76 2,535.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.