Gold Price Forecast: XAU/USD closes the week above 50 DMA, what’s next?

- Gold price is retreating from near five-week highs amid resurgent USD demand.

- US Treasury yields are struggling amid China data led risk-aversion wave.

- XAU/USD could retest the 50 DMA level at $1,782, with eyes on Fed minutes.

Gold price is reversing Friday’s rebound above $1,800, as bears return at the start of the week. Buyers appear to lack follow-through upside momentum, as souring risk sentiment revives the US dollar’s safe-haven appeal. Chinese July Retail Sales, Industrial Production and Fixed Asset Investment data missed market expectations and triggered a wave of risk-aversion. Further, the unexpected rate cuts by the People’s Bank of China (PBOC) also spooked investors, as the Chinese economic recovery weakens. The broad dollar rebound exerts renewed downside pressure on the USD-priced bullion. Amidst risk-off flows, the demand for government bonds resurges and knocks down the Treasury yields, although the bright metal fails to capitalize on falling yields. Traders also remain cautious, as they continue assessing the Fed’s tightening bets next month following softer US inflation data while brewing American-Sino tensions over Taiwan also keep the dollar supported.

Also read: Gold Weekly Forecast: Uptrend will start as soon above resistance level 1824,6

On Friday, XAU/USD surged $1,804 and delivered a weekly closing above the $1,800 mark, despite the parallel rise in the dollar, as well as, the yields. The greenback rebounded firmly after the preliminary August estimate of the UoM Consumer Sentiment Index rose to three-month highs of 3.6 points to 55.1 from a July reading of 51.5. Meanwhile, the Prelim Inflation Expectations gauge eased from 5.2% to 5% in July. The Treasury yields also jumped, as the easing US inflation outlook fuelled a risk rally on Wall Street.

Looking forward, the main event risk of this week remains the Fed July meeting’s minutes, which will be published on Wednesday. The minutes will offer indications on the Fed’s tightening path, with market pricing a 55% chance of a 50 bps rate hike in September while that of a 75 bps lift-off stands at 45%, at the moment. Ahead of the FOMC minutes, the US Retail Sales data will be closely examined. Amid a lack of first-tier US economic events this Monday, the Fed sentiment and USD valuation will remain the main drivers for the precious metal.

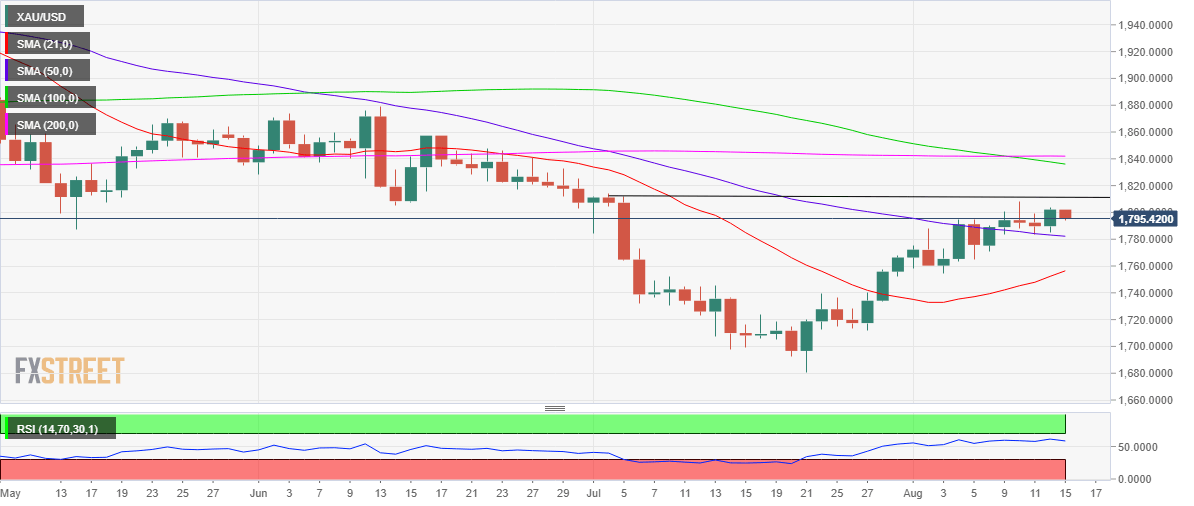

Gold price technical outlook: Daily chart

Technically, gold price is back below $1,800 mark, dropping towards the bearish 50-Daily Moving Average (DMA) at $1,782.

Daily closing below the latter is critical to offsetting the recent recovery momentum. Bears will then look out for the $1,770 round figure, below which the 21 DMA at $1,756 will be tested.

The 100 and 200 DMA bear cross remain in play while the 14-day Relative Strength Index (RSI) turns south while still above the midline.

On the upside, another strong attempt above $1,800 mark will probe the monthly high of $1,808, above which fresh buying opportunities will emerge.

The next stop for bulls is seen at the July 5 high at $1,812 should the uptrend sustain in the coming days.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.