Gold Price Forecast: XAU/USD cheers dollar dumping, closes in on $2000

- Gold bulls unstoppable, as the US dollar keeps falling.

- Rallying Treasury yields fail to limit gold’s upside.

- Eyes on US ISM Manufacturing PMI and Employment sub-index.

Gold (XAU/USD) hit the highest levels in two weeks near the $1990 mark, as the bulls remain unstoppable, courtesy of the relentless declines in the US dollar across its main competitors. The yieldless gold continues to benefit from expectations of a low-interest-rate environment for a prolonged period in the aftermath of the Fed Chair Powell’s speech. The yellow metal finally dived out of the eight-day-long range above the $1977 hurdle, as it looks to regain the $2000 threshold.

The bullish tone in gold is also backed by the weak performance in the Asian equities following a softer close on Wall Street overnight. The continued rise in the coronavirus cases globally overwhelm the markets. Looking ahead, only a better-than-expected US ISM Manufacturing PMI and Employment sub-index could come to the rescue of the dollar bulls,

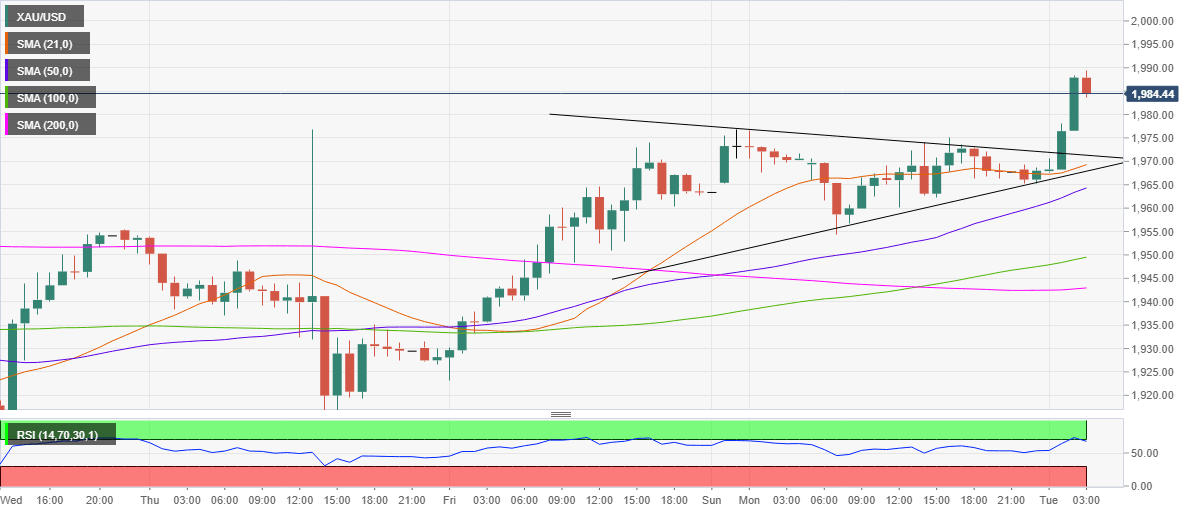

Gold: Hourly chart

Short-term technical perspective

On the hourly chart, Gold has displayed a pennant breakout, having closed the hour above the falling trendline (pattern) resistance at $1972.

The bullish breakout triggered a sharp rally towards the $1990 mark, especially after the price pierced above the 21-hourly Simple Moving Average (SMA), then at $1967.50.

Gold now looks to test the pattern target at $1994 en route the critical hurdle at $2000.

The hourly Relative Strength Index (RSI) has reversed from the overbought territory, still remains bullish near the 68 area.

The pattern resistance now support at $1972 will act as the immediate support, below which the $1970 level could be challenged. That level is the confluence of the 21-HMA and the pattern support.

Should the selling pressure accelerate the upward-sloping 50-HMA at $1964 could come into play.

Gold: Additional levels to consider

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.