Gold Price Forecast: XAU/USD challenges $1,900 after piercing September’s low

XAU/USD Current price: $1,901.80

- Wall Street entered a sell-off spiral following generally disappointing United States data.

- The yield on the 10-year Treasury note flirted with the 2007 high amid renewed concerns.

- XAU/USD extends its slump and aims to test the August low at $1,884.77 a troy ounce.

Spot Gold accelerated its slide on Tuesday, with XAU/USD plummeting to $1,900.83, its lowest in almost two weeks. The US Dollar surged on the back of a worsening market mood at the beginning of the week, as investors got spooked by central banks’ pledges to keep rates higher for longer and dismal United States (US) data.

The US CB Consumer Confidence Index extended its slump in September to 103.0, easing from an upwardly revised 108.7 in August. The Present Situation Index ticked marginally higher to 147.1, although Expectations declined to 73.7, well below the 80 level, usually a hint towards an upcoming recession. Also, New Home Sales were down 8.7% in August, much worse than the previous 4.4% advance. On a positive note, the Richmond Fed Manufacturing Index improved in September to 5 from -7 in the last month.

Meanwhile, Minneapolis Federal Reserve Bank President Neel Kashkari hit the wires. Among other things, he said there’s a 60% probability of a soft landing and a 40% probability that the Fed will have to raise rates significantly higher to tame inflation. He also added that falling inflation next year might justify backing off the Federal funds rate to stop it from getting tighter.

Investors are concerned monetary tightening will continue for longer than anticipated as policymakers last week made it clear they are not ready to let it go. Most central banks from around the world reaffirmed their commitments to maintain rates higher for longer, delaying the chances of a rate cut into late 2024.

Wall Street entered sell-off mode following the releases, fueling demand for the US Dollar and keeping XAU/USD at the lower end of its monthly range. Earlier in the day, the yield on the 10-year Treasury note peaked at 4.56%, its highest since 2007 when it peaked at 4.57%.

XAU/USD price short-term technical outlook

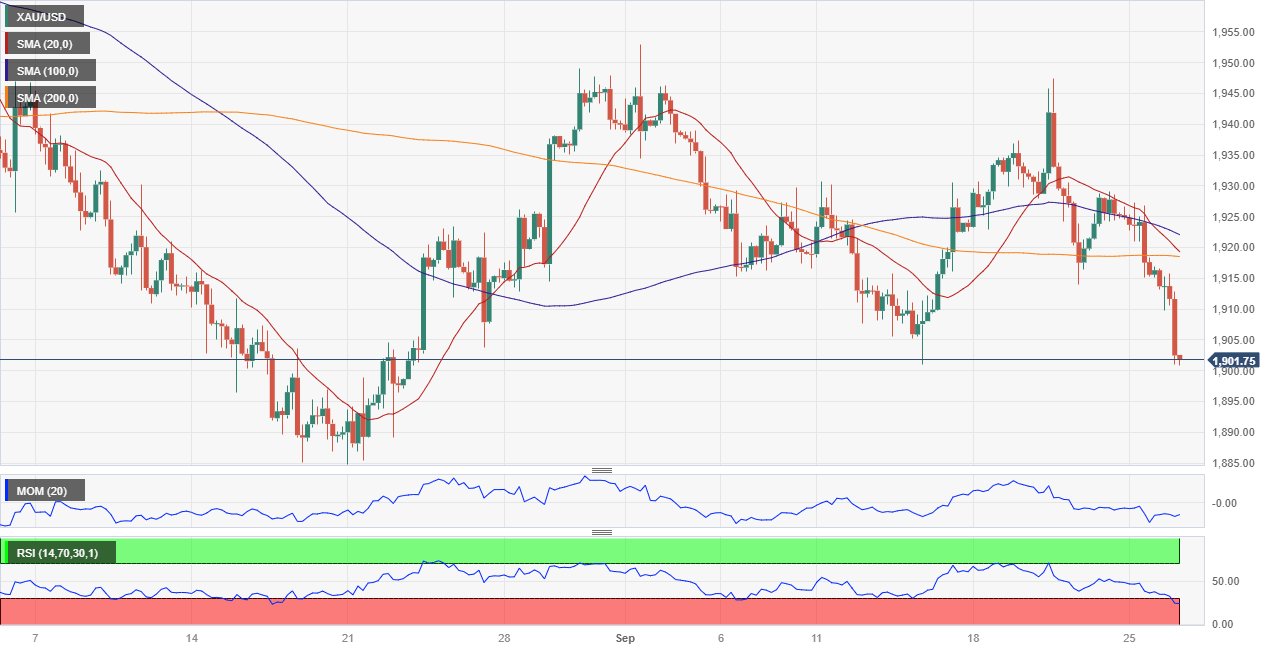

From a technical point of view, the daily chart for XAU/USD hints at another leg south. XAU/USD is sharply down for a second consecutive day, accelerating its slump below all its moving averages. The 100 Simple Moving Average (SMA) is the one heading most firmly lower, although it stands above converging 20 and 200 SMAs. At the same time, the Momentum indicator turned modestly lower, just below its 100 lien, while the Relative Strength Index (RSI) indicator heads firmly north at around 39 without signs of bearish exhaustion.

For the near term, the 4-hour chart also favors a bearish extension, as the pair plunged below a flat 200 SMA, while the 20 SMA gains downward traction above it. At the same time, technical indicators head south almost vertically, with the RSI maintaining its downward slope despite being in oversold territory. XAU/USD is currently below its former September low at $1,901, with investors now looking for a test of the August monthly low at $1,884.77.

Support levels: 1,901.00 1,884.70 1,872.90

Resistance levels: 1,907.70 1,921.80 1,933.30

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.