Gold Price Forecast: XAU/USD buyers turn cautious, as a Big week kicks in

- Gold price kicks off a big week on a negative note below $2,750 on Monday.

- The US Dollar finds support from higher Treasury yields, Middle East tensions.

- Technically, Gold price remains ‘buy-the-dips’ trade whilst above 38.2% Fibo level.

Gold price has lost its two-day recovery momentum, trading below $2,750 amid a quiet start to a big week on Monday. Gold buyers did find acceptance above the $2,740 static resistance on Friday but the further upside appears elusive on resurgent US Dollar (USD) demand.

Gold price focuses on Mideast tensions, key US data this week

The USD resumes the recent uptrend, drawing safe-haven demand amid further escalation in the Middle East tensions and uncertainty around the November 5 US presidential election.

Israel attacked Iran with a series of airstrikes early Saturday, saying it was targeting military sites in retaliation for the barrage of ballistic missiles the latter fired upon Israel on October 1, 2024.

Iran’s official newspaper reported, citing the Iranian Supreme leader Ayatollah Ali Hosseini Khamenei as saying that “the evil committed by the Zionist regime (Israel) two nights ago should neither be downplayed nor exaggerated.”

Additionally, markets are wagering a less aggressive easing cycle by the US Federal Reserve (Fed) on US economic resilience, which keeps the sentiment around the Greenback underpinned at the expense of the Gold price.

However, the downside of the Gold price remains capped due to renewed expectations of more stimulus measures from China. China’s Vice Minister of Finance Liao Min said earlier that the country will step up countercyclical adjustments of its macro policies to bolster economic recovery in the fourth quarter.

China is the world’s biggest Gold consumer and hence, hopes of an increase in physical demand for Gold on stimulus optimism favors buyers. Further, the festive season in India – the world’s no.2 yellow metal market – could also lend support to the bright metal.

Looking ahead, the US economic calendar is devoid of any high-impact data release, and hence, Gold price will remain at the mercy of risk trends. Additionally, a sense of caution could prevail amid Mideast concerns and heading into an action-packed US data docket, with all eyes on inflation and employment details.

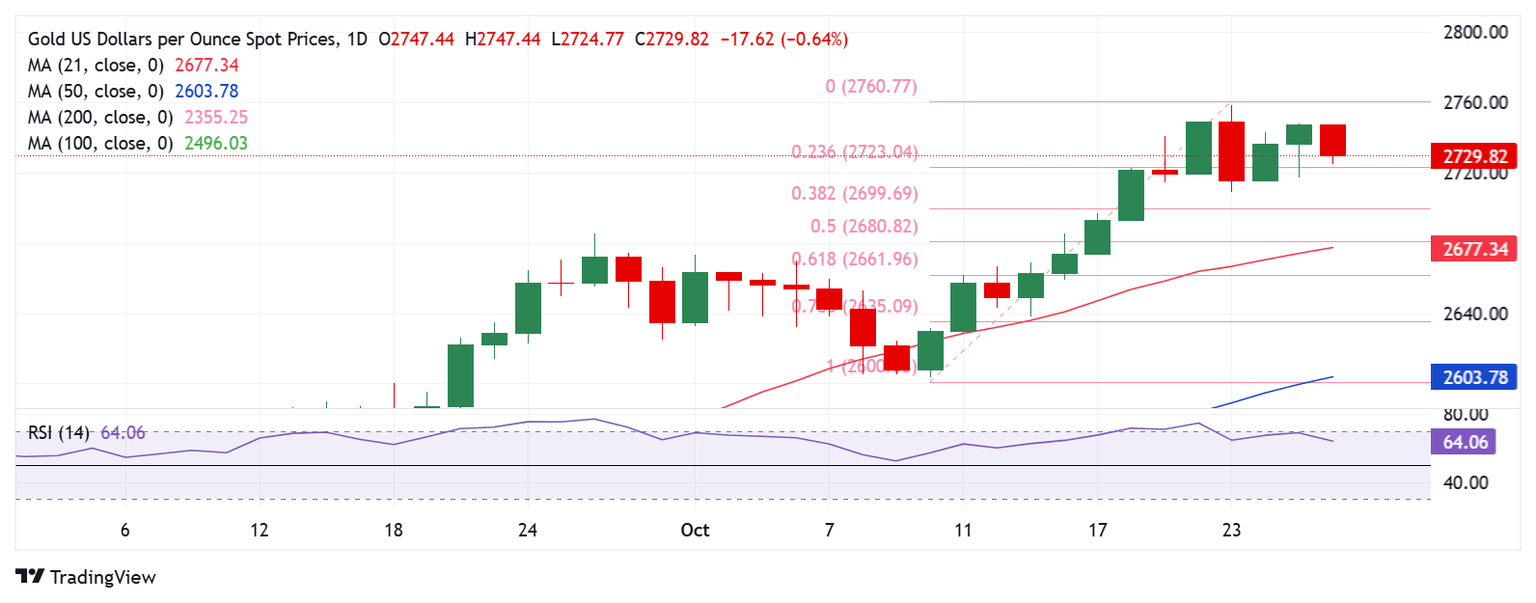

Gold price technical analysis: Daily chart

Gold price has tested $2,723, the 23.6% Fibonacci Retracement (Fibo) level of the latest record rally from the October 10 low of $2,604 to all-time high of $2,759, on its renewed downside.

Acceptance below that level on a sustained basis could extend the decline toward the 38.2% Fibo level of the same ascent at $2,700.

Further south, the 50% Fibo support at $2,681 will be challenged, where the 21-day Simple Moving Average (SMA) aligns.

Alternatively, Gold buyers could re-attempt the $2,750 psychological barrier if the 23.6% Fibo support at $2,723 holds.

The next relevant bullish target will be seen at the record high of $2,759.

The 14-day Relative Strength Index (RSI) is pointing lower but holds comfortable above the 50 level, currently trading near 64, suggesting that Gold price remains a good dip-buying trade at lower levels.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.