Gold Price Forecast: XAU/USD buyers turn cautious ahead of US inflation data, monthly close

- Gold price is taking a breather early Thursday after a five-day winning streak.

- The US Dollar and US Treasury bond yields consolidate the downside ahead of PCE inflation data.

- Overbought conditions could limit Gold price upside, as end-of-the-month flows could dominate.

Gold price is consolidating the previous pullback from six-month highs of $2,052 in Asian trading on Wednesday, treading water amid the end-of-the-month flows while awaiting the critical United States (US) Core Personal Consumption Expenditures (PCE) Price index data.

Gold price eyes US PCE inflation for fresh cues

Gold price is eagerly looking forward to the US Federal Reserve’s (Fed) preferred inflation gauge amid growing acceptance that the Fed is likely to shift gears to the dovish side and cut interest rates as early as March 2024. Markets are pricing a 49% chance of a March Fed rate cut notwithstanding the upward revision to the third-quarter US Gross Domestic Product (GDP) data.

US Q3 GDP expanded at an annualized rate of 5.2%, the second estimate released by the Bureau of Economic Analysis (BEA) showed on Wednesday. The GDP data registered a sharp upward revision from the preliminary reading of 4.9%. Additional details showed that the PCE inflation was revised down to 2.8% on a quarterly basis in Q3 from 2.9% first readout while the Core PCE inflation was downgraded to 2.3% in Q3 from the flash estimate of 2.4%.

Therefore, it would come as a little surprise if the US Core PCE Price Index inflation declined to 0.2% MoM and 3.5% YoY, softening its pace of increase in October. The headline PCE inflation data is also seen dropping to 0.1% MoM and 3.0% annually. A softer-than-expected Core PCE print is likely to ramp up Fed rate cut expectations, reviving the US Dollar downtrend, as the US bond market is expected to rejoice in its monthly win.

The US Treasury bond yields are languishing in multi-month lows, with the benchmark 10-year US Treasury bond yields struggling near two-month lows of 4.2440%. Against this background, The non-interest-bearing Gold price remains exposed to further upside.

However, Gold traders could see the end-of-the-month profit-taking temporarily offsetting the optimism over the dovish Fed pivot. The US Dollar could also extend the previous recovery on short-covering, as it is set to book the worst month in a year.

Besides, the US Jobless Claims data and Fedspeak could also provide fresh hints on the US interest rate outlook, impacting the US Dollar-denominated Gold price. Attention will then turn toward Fed Chair Jerome Powell’s speech due on Friday. It will be Powell’s last appearance before the Fed’s ‘blackout period’ begins on Saturday, ahead of the December 12-13 policy meeting.

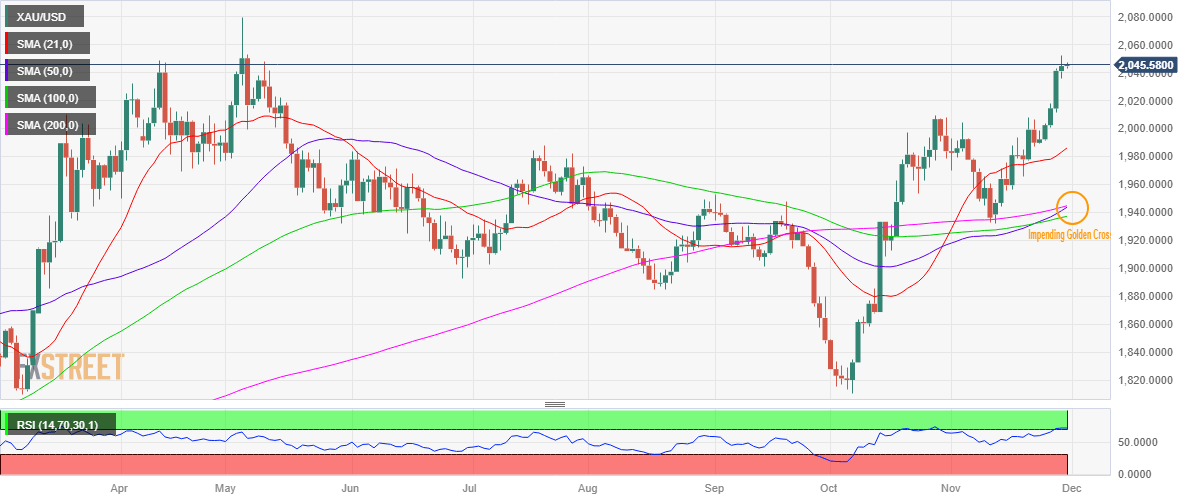

Gold price technical analysis: Daily chart

Gold price seems to be in a tricky spot, as chances of a pullback are more likely before a renewed uptrend kicks in.

The 14-day Relative Strength Index (RSI) indicator remains in the overbought territory, supporting the case for a pullback in Gold price.

However, the 50-day SMA is looking to seek a daily close above the 200-day SMA, which if happens will validate a Golden Cross.

Therefore, any dip in Gold price could be seen as a good buying opportunity for a fresh upside positioning.

On the upside, acceptance above the multi-month high of $2,052 will fuel a fresh uptrend toward the $2,070 static resistance.

The all-time high of $2,079 will be next on Gold buyers’ radars.

Conversely, the immediate support is seen at the previous day’s low of $2,035, below which a test of Tuesday’s low of $2,012 will be on the cards.

Further south, the $2,000 threshold could come to the rescue of Gold buyers.

Gold FAQs

Why do people invest in Gold?

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Who buys the most Gold?

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

How is Gold correlated with other assets?

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

What does the price of Gold depend on?

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.