Gold Price Forecast: XAU/USD buyers stay hopeful whilst key $2,630 support holds

- Gold price keeps the red near $2,650 at the start of a new week on Monday.

- The US Dollar retreats from seven-week highs amid softer Treasury yields, positive risk tone.

- Gold price outlook remains constructive so long as the key $2,630 support holds.

Gold price is in the red at the start of a new week on Monday but stays within a familiar range at around $2,650. Amidst the persistent Middle East geopolitical escalation, Gold price now shifts its attention to speeches from US Federal Reserve (Fed) policymakers on Monday, anticipating the critical US Consumer Price Index (CPI) data later in the week.

Gold price suffers in the US NFP aftermath

Gold price fails to benefit from a US Dollar (USD) pullback from seven-week highs against its major rivals. Risk flows remain in vogue on expectations of more stimulus coming through from China, as traders return after a week-long holiday break. The extended risk appetite into Asia weighs on the safe-haven assets such as the Gold price, the US Dollar, US government bonds etc.

Softer US Treasury bond yields also add to the weight on the Greenback, unable to motivate Gold buyers, as the People’s Bank of China (PBOC), the Chinese central bank, reported no Gold reserves purchases for the fifth straight month in September on Monday. China is the world’s top Gold consumer.

The main catalyst behind the softer undertone in Gold price so far this month is the fading expectations of a 50 basis points (bps) interest rate cut by the Fed next month. This less dovish turn in sentiment surrounding the Fed was accentuated after Friday’s blockbuster Nonfarm Payrolls data, which totally ruled out an outsized Fed rate cut probability for November.

Data published by the US Bureau of Labor Statistics (BLS) on Friday showed that Nonfarm Payrolls rose by 254,000 in September after gaining 159,000 (revised from 142,000) in August. The reading outpaced the market expectation of 140,000 by a wide margin. The annual wage inflation, as measured by the change in Average Hourly Earnings, edged a tad higher to 4% from 3.9% in August.

Markets are currently pricing in about a 94% chance that the Fed will opt for a 25 bps rate cut at its next meeting, the CME Group's FedWatch Tool shows, with a 6% probability of a no rate change decision.

However, Gold price has managed to keep its corrective downside restricted, thanks to the persistent geopolitical risks emanating from the escalating conflict between Israel and Iran. On Sunday evening, the Israel Defense Forces (IDF) said it struck multiple Hezbollah targets in Beirut, including Hezbollah’s intelligence headquarters. In retaliation, Hezbollah said it also launched a barrage of rockets at northern Israel Sunday night.

Mounting fears of the Israel-Iran conflict turning into a wider regional war in the Middle East remain a cause for concern for global markets. Gold traders, therefore, look forward to upcoming Fedspeak for further trading impetus in the lead-up to the main event risk for this week – the US consumer inflation data for September.

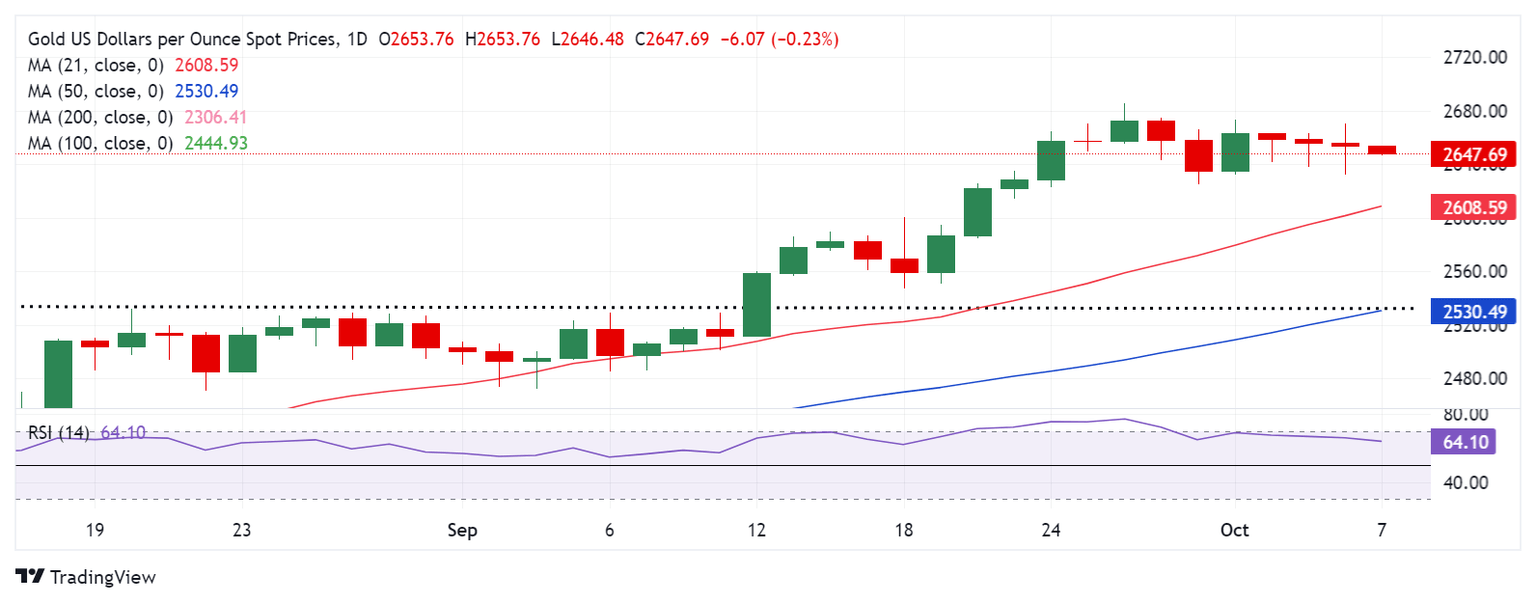

Gold price technical analysis: Daily chart

Despite the sluggish Gold price action recently, buyers refuse to give up as long as the static support of $2,630 holds the fort.

The 14-day Relative Strength Index (RSI) also stays well above the midline, currently near 64, backing the bullish potential.

Gold price, however, needs a daily candlestick closing above the strong resistance near $2,670 to revive the uptrend.

The next resistance is aligned at the record high of $2,686. Further up, buyers will target the $2,700 round level.

On the flip side, acceptance below the intermittent low near $2,630 is critical to unleashing further downside toward the $2,600 threshold.

Ahead of that level, the 21-day Simple Moving Average (SMA) at $2,609 will test bullish commitments.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.