Gold Price Forecast: XAU/USD bulls up for a last dance ahead of US inflation?

- Gold price is attempting a bounce towards 21-SMA on 4H.

- USD bulls take a breather ahead of the all-important US inflation.

- US stimulus optimism and Delta covid woes lend support to gold price.

After a tumultuous start to a relatively light week on Monday, gold price licked it wounds and tried to stabilize around $1720-$1730 levels. The yellow metal sustained its recovery from five-month lows of $1688, although finished the day marginally lower amid persistent strength in the US dollar alongside the Treasury yields. The Fed’s tapering expectations remained the main narrative driving the markets, which weighed heavily on the non-yielding gold. However, the mounting fears over the economic impact of the Delta covid variant flareups helped to somewhat lift the pressure off gold price. Meanwhile, gold price also managed to find some support from the US Senate passage of the bipartisan $1 trillion infrastructure bill.

This Wednesday, the key event risk for gold traders remains the US Consumer Price Index (CPI), which is seen arriving a tad weaker at 0.5% in July vs. 0.9% expectations. Meanwhile, the monthly core CPI figure is also likely to drop to 0.4% in the reported month. The softening of price pressures is unlikely to change the recent hawkish Fed expectations, the world’s powerful central continue to dismiss higher inflation as ‘transitory.’ Although, a softer inflation data could fuel a corrective pullback in the dollar, especially after the recent advance, which could further aid gold’s recovery (for now), before the precious metal resumes its downside.

Gold Price Chart - Technical outlook

Gold: Four-hour chart

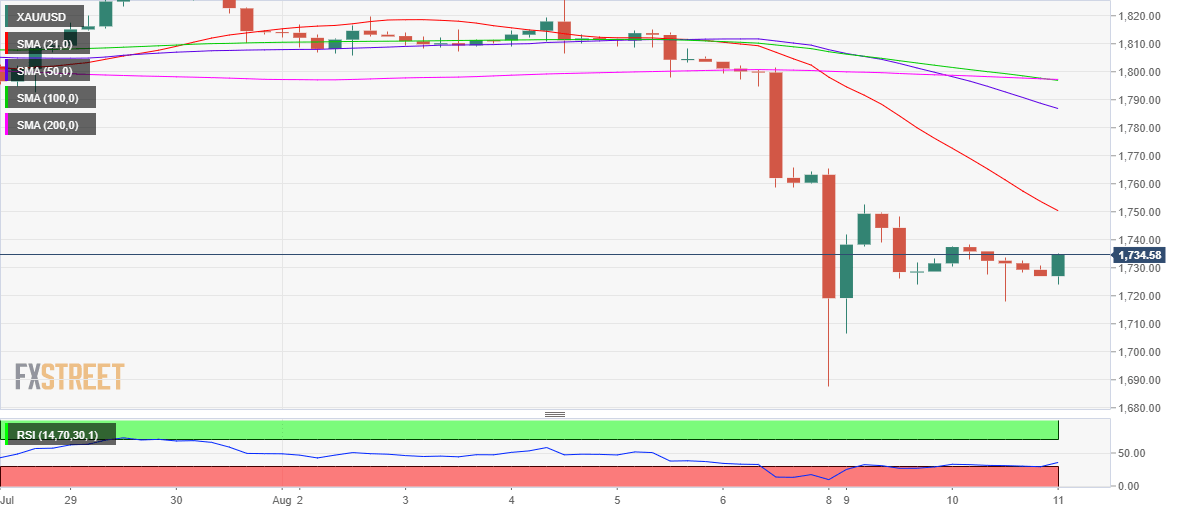

Gold’s four-hour technical chart shows that there is room for recovery, as the Relative Strength Index is witnessing an uptick while it remains below the 50.00 level.

Therefore, gold price looks to recapture the bearish 21-Simple Moving Average (SMA) at $1750.

Although, the further upside appears elusive amid a bearish cross on the said time frame. The 100-DMA has pierced through the 200-DMA from above, flashing bearish signals.

If the bearish pressures return, a test of the $1700 mark will be inevitable. Further south, the multi-month lows of $1688 could be on the sellers’ radars.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.