Gold Price Forecast: XAU/USD bulls target $1,773 hurdle after recapturing 21 DMA

- Gold price cheers recession woes, fading aggressive Fed rate hike expectations.

- US dollar drops with yields amid upbeat earnings, economic gloom.

- XAU/USD bulls gear up for a fresh advance towards $1,773 hurdle.

Gold price is on track to book the second straight weekly advance and the biggest gain over the week since mid-May. The sentiment around the Fed rate hike expectations and US economic gloom keeps the buoyant tone intact around the bright metal, as it holds near fresh three-week highs above $1,750. The US dollar licks its wounds alongside the Treasury yields, reeling from the second straight quarter of GDP contraction in America, which has spelled recession troubles. It’s a so-called technical recession in the world’s largest economy, despite Fed Chair Jerome Powell’s dismal during the Fed’s post-policy meeting press conference on Wednesday.

A wave of risk-aversion gripped the market in the first half of the US trading on Thursday, as investors digested the discouraging US economic news. American economy contracted at an annual pace of 0.9% in Q2 vs. 0.5% expected and -1.6% previous. However, risk flows returned after US equity futures jumped on upbeat earnings from Amazon.com Inc. and Apple Inc. The positive shift in the market’s perception of risk weighed further on the dollar, aiding gold’s rebound. The non-interest-bearing metal also capitalized on increasing odds of shallower monetary policy tightening by the Fed, in response to the negative US GDP growth. The probability of a 75 bps Fed rate hike in September dropped to just 22% from around 40% pre-GDP release.

Also read: Eurozone Inflation Preview: Signs of peak inflation, not yet

Looking forward, inflation data from the Eurozone and the US will grab the market's attention, with the Fed’s preferred inflation measure closely eyed after the less hawkish Fed and disappointing GDP. The rise in German HICP points to an acceleration in the bloc’s inflation reading, which could ramp up aggressive ECB rate hike expectations. However, the end-of-the-week flows and US PCE inflation impact alongside the earnings reports will also influence the sentiment around XAUUSD.

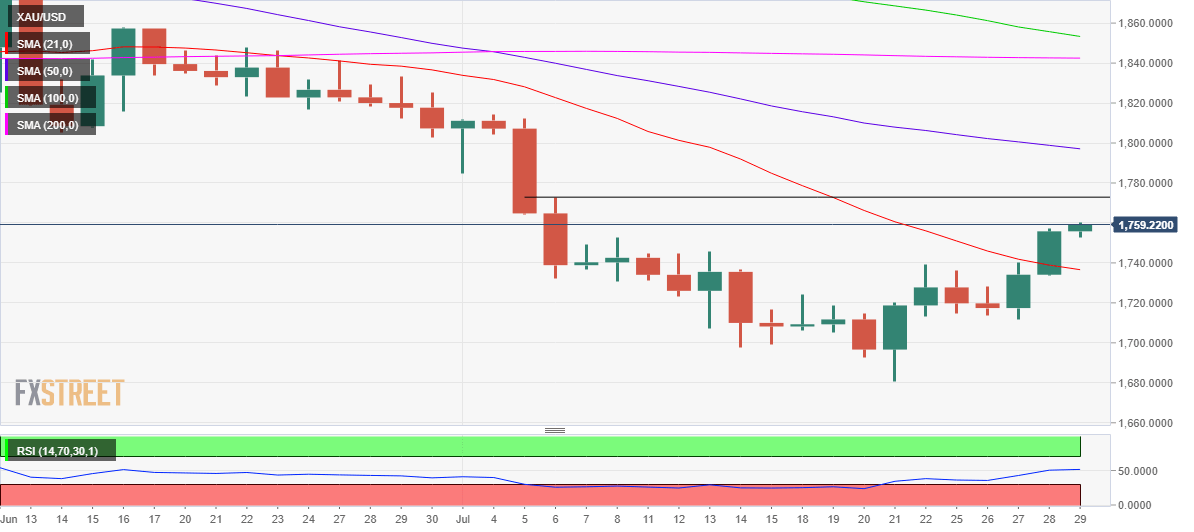

Gold price technical outlook: Daily chart

Gold price closed Thursday finally above the bearish 21-Daily Moving Average (DMA), now at $1,736, confirming a bullish reversal from yearly lows.

The 14-day Relative Strength Index (RSI) is holding firmer above the midline, justifying the renewed upside in the metal.

Bulls now look to recapture the horizontal trendline hurdle at $1,773 should the upswing extend. Further up, doors will open up for a test of the bearish 50 DMA at $1,797.

Alternatively, the immediate support is seen at $1,750 psychological level, followed by the critical 21 DMA – previous resistance turned support.

Should the downside extend, gold sellers will aim for the strong demand area around the $1,715 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.