Gold Price Forecast: XAU/USD bulls take a breather ahead of Fed interest rate decision

- Gold price treads water on the Fed day after Tuesday’s range breakout to the upside.

- US Dollar extends pullback amid subdued US Treasury bond yields, as caution prevails.

- Gold price swings back above 21-day SMA resistance, as the daily RSI flips bullish. Will the rebound last?

Gold price has paused its previous upswing in Asian trading on Wednesday, as buyers take a breather and gather pace ahead of the all-important US Federal Reserve (Fed) policy announcements.

Gold price awaits Fed Chair Jerome Powell for fresh direction

Gold price continued to witness good two-way businesses on Tuesday, initially lurking in the red, as traders appeared non-committal and refrained from placing fresh bets in the countdown to an action-packed economic calendar on both sides of the Atlantic.

In anticipation of critical macro news, investors scurried for safety in the US Dollar (USD), weighing negatively on the USD-denominated Gold price.

However, in the second half of the day, Gold price rebounded firmly as the US Dollar lost its footing even though Wall Street indices were dragged lower by declines in megacap tech stocks pre-earnings results.

Additionally, US Dollar markets resorted to repositioning ahead of Wednesday's all-important US Federal Reserve (Fed) interest rate decision. Meanwhile, the end-of-the-month flows also played their part in the sharp US Dollar pullback, which helped Gold price stage an impressive comeback.

Gold traders paid little heed to the Euro area growth numbers and US JOLT Job Openings data ahead of the Fed showdown. The number of job openings on the last business day of June stood at 8.184 million, the US Bureau of Labor Statistics (BLS) reported in the Job Openings and Labor Turnover Survey (JOLTS) on Tuesday.

In Wednesday’s trading so far, Gold price has entered a cautious mode, shrugging off the upbeat China’s official Manufacturing and Services PMI data, as traders prefer to stay on the sidelines in the lead-up to the key event risks – the US ADP employment data and the Fed policy announcements.

In the meantime, the Bank of Japan (BoJ) policy decision is also eagerly awaited, with markets expecting the Japanese central bank to debate the timing of the next rate hike amid rising wage inflationary pressures and weakening consumption activity. Swap markets are pricing a 70% chance of a BoJ rate hike at the July meeting.

Therefore, the BoJ outcome is likely to infuse intense volatility around the USD/JPY pair, eventually impacting the value of the US Dollar and Gold price. Any reaction to the BoJ policy announcements could be limited, as Gold markets will adjust their positions again and await the Fed verdict.

The Fed is widely expected to hold policy rates but all eyes will be on any hints on the scope and the timing of the potential interest-rate cut. Fed Chair Jerome Powell’s words will hold the key to the next Gold price direction.

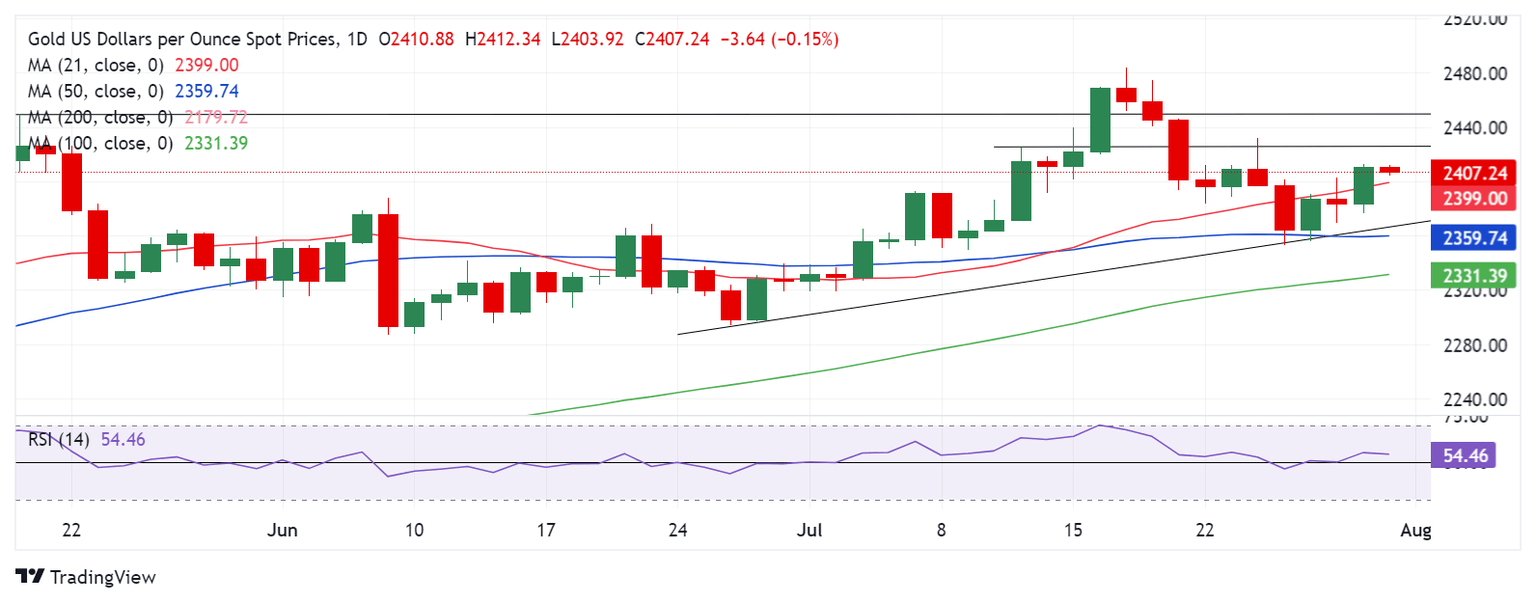

Gold price technical analysis: Daily chart

Gold buyers are back in the game in the countdown to the Fed event, represented by the 14-day Relative Strength Index (RSI) flipping back above the 50 level.

Gold price broke the consolidative range to the upside after closing Tuesday above the 21-day Simple Moving Average (SMA) resistance, then at $2,394.

Against this backdrop, further upside looks likely for Gold price, if buyers manage to seek a sustained break above the static resistance in the $2,412.

The next topside barrier is seen at the $2,425-$2,430 band. If the buying interest gains momentum, Gold price could retest the previous all-time highs at $2,450.

On the flip side, the immediate support is seen at the previous 21-day SMA resistance-turned-support now at $2,399.

Further down, Gold price will need a daily close below the rising trendline and 50-day SMA confluence support near $2,360 to initiate a fresh downtrend toward the 100-day SMA support at $2,331.

Buyers, however, could find some comfort at the $2,350 psychological level.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.