- Gold price extends a two-day losing streak early Tuesday but stays in a familiar range.

- Despite sluggish US Treasury bond yields, US Dollar holds the previous upwing as risk-off mood underpins.

- Gold price remains stuck between two key daily moving averages, as the BoJ and the Fed policy decision loom.

Gold price is treading water below $2,400 early Tuesday, as Gold traders turn to the sidelines ahead of a bunch of upcoming high-high macro news from the US and Europe.

Gold price stays cautious ahead of key EU/ US event risks

Traders seem non-committal and refrain from placing fresh bets on the Gold price, as the policy announcements from the US Federal Reserve (Fed) and the Bank of Japan (BoJ), due on Wednesday, remain in the spotlight.

Besides, they also brace for the Gross Domestic Product (GDP) reports from Germany and the Eurozone slated for release later on Tuesday. Germany is also due to publish its inflation data.

Additionally, the US JOLTS Job Openings data will grab the eyeballs in American trading. These data releases will likely shed light on the state of the economies on both sides of the Atlantic, having a significant impact on the broader market sentiment and the safe-haven US Dollar.

Therefore, Gold price’s fate hinges on the upcoming data flow and the central banks’ policy announcements, with the BoJ likely to debate the timing of the next rate hike while the Fed is seen opening the door for rate cuts.

Gold price witnessed good two-way price action on Monday, initially extending last week’s late recovery before sellers returned on a failure to resist above the $2,400 threshold.

The Asian advance in Gold price could be associated with fresh tensions in the Middle East over the weekend. On Saturday, 12 children and young adults were killed in a rocket strike while playing football in the Israeli-occupied Golan Heights. The Israel Defense Forces (IDF) blamed the Iran-backed militant group, Hezbollah for the attack, saying that it conducted air strikes against seven Hezbollah targets "deep inside Lebanese territory".

The rising tensions have the potential to trigger an all-out war between Israel and Hezbollah, which has prompted investors to scurry for safety in Gold price.

Additionally, the US Dollar remained on the back foot alongside the US Treasury bond yields on increased dovish Fed expectations, allowing Gold price to attract buyers. However, in the second half of the day, risk-aversion returned and lifted the demand for the safe-haven US Dollar, triggering a sharp pullback in Gold price from a three-day top of $2,403.

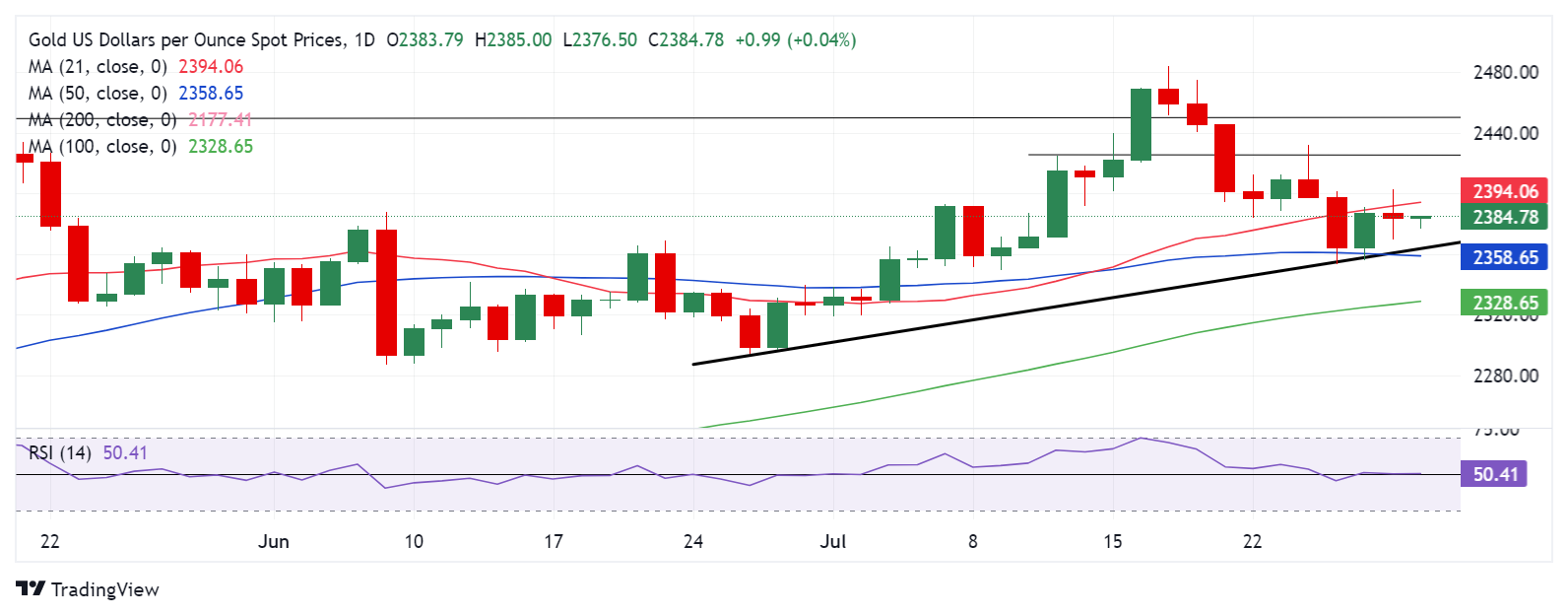

Gold price technical analysis: Daily chart

The bullish sentiment around the Gold price seems to have evaporated heading into the critical macro events, leaving Gold price without any clear directional bias so far this Tuesday.

The 14-day Relative Strength Index (RSI) flirts with the 50 level, retreating from the positive territory, justifying a neutral outlook for Gold price.

The bright metal remains stuck between the 21-day Simple Moving Average (SMA) resistance at $2,394 and the 50-day SMA at $2,359. The rising trendline coincides with the 50-day SMA, making it a strong support.

Acceptance above the previous support of the 21-day SMA at $2,394 is needed on a daily closing basis to resume the recovery toward the $2,400 mark.

The next upside targets are seen at the $2,412 area and the $2,425 static resistance.

On the flip side, the Gold price needs a daily close below the abovementioned key confluence support near $2,360 to initiate a fresh downtrend toward the 100-day SMA support at $2,329.

Buyers, however, could find some comfort at the $2,350 psychological level.

(This story was corrected on July 30 at 06:15 GMT to say that "the bright metal remains stuck between the 21-day Simple Moving Average (SMA) resistance at $2,394 and the 50-day SMA at $2,359.")

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD sits at yearly lows near 1.0550 ahead of EU GDP, US PPI data

EUR/USD is trading near 1.0550 in the European session on Thursday, sitting at the lowest level in a year. The Trump trades-driven relentless US Dollar buying and German political instability weigh on the pair. Traders await EU GDP data and US PPI report ahead of Fed Chair Powell's speech.

GBP/USD holds losses below 1.2700 on sustained US Dollar strength

GBP/USD is holding losses near multi-month lows below 1.2700 in European trading on Thursday. The pair remains vulnerable amid a broadly firmer US Dollar and softer risk tone even as BoE policymakers stick to a cautious stance on policy. Speeches from Powell and Bailey are eyed.

Gold price hits fresh two-month low as the post-election USD rally remains uninterrupted

Gold price drifts lower for the fifth consecutive day and drops to its lowest level since September 19, around the $2,554-2,553 region heading into the European session on Thursday. The commodity continues to be weighed down by an extension of the US Dollar's post-election rally to a fresh year-to-date.

XRP struggles near $0.7440, could still sustain rally after Robinhood listing

Ripple's XRP is trading near $0.6900, down nearly 3% on Wednesday, as declining open interest could extend its price correction. However, other on-chain metrics point to a long-term bullish setup.

Trump vs CPI

US CPI for October was exactly in line with expectations. The headline rate of CPI rose to 2.6% YoY from 2.4% YoY in September. The core rate remained steady at 3.3%. The detail of the report shows that the shelter index rose by 0.4% on the month, which accounted for 50% of the increase in all items on a monthly basis.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.