Gold Price Forecast: XAU/USD bides time before the next push higher

- Gold price consolidates below record highs of $2,943, awaits Fed Minutes.

- Trump’s tariff threats return and power safe-havens - Gold price and the US Dollar.

- Gold price stays bullish on the daily time frame, with fresh record highs in sight.

Gold price is looking to refresh record highs while holding the recent upside early Wednesday as attention turns toward the Minutes of the US Federal Reserve (Fed) January policy meeting and US President Donald Trump’s tariff plans.

Gold price looks to further upside, Fed Minutes

The return of tariff threats from US President Donald Trump and a lack of breakthrough in the US-Russia peace talks support the demand for the traditional safe-haven – Gold. Trump told reporters on Tuesday that sectoral tariffs on pharmaceuticals and semiconductor chips would also kick in at "25% or higher, and it will go very substantially higher over the course of a year.”

This came after he said Friday that automobile levies would go in effect as soon as April 2. These tariffs pose a big threat for the global auto industry, weighing heavily on the European Union (EU) and Asia. The levies will likely disrupt global supply chains and ramp up inflationary pressures worldwide.

The renewed tariff concerns combined with a lack of any positive developments from the US-Russia peace talks without Ukraine on Tuesday sag investors’ confidence, supporting safe-havens such as the US Dollar, Gold price etc.

“Russian officials did not mention offering any concessions and US officials did not claim to have scored any in Tuesday's meeting, leading observers to doubt whether the talks would turn into serious peace negotiations,” Reuters reported.

However, Gold traders will likely remain wary ahead of the Fed Minutes release, which could pour cold water on the revival of expectations for two Fed interest rate cuts this year.

Meanwhile, on Tuesday, San Francisco Fed President Mary Daly said, “at this point, policy needs to remain restrictive until, from my vantage point, until I see that we are really continuing to make progress on inflation.”

The Fed’s prudence on the inflation and easing outlook could be affirmed by the Minutes, tempering the Gold price upside.

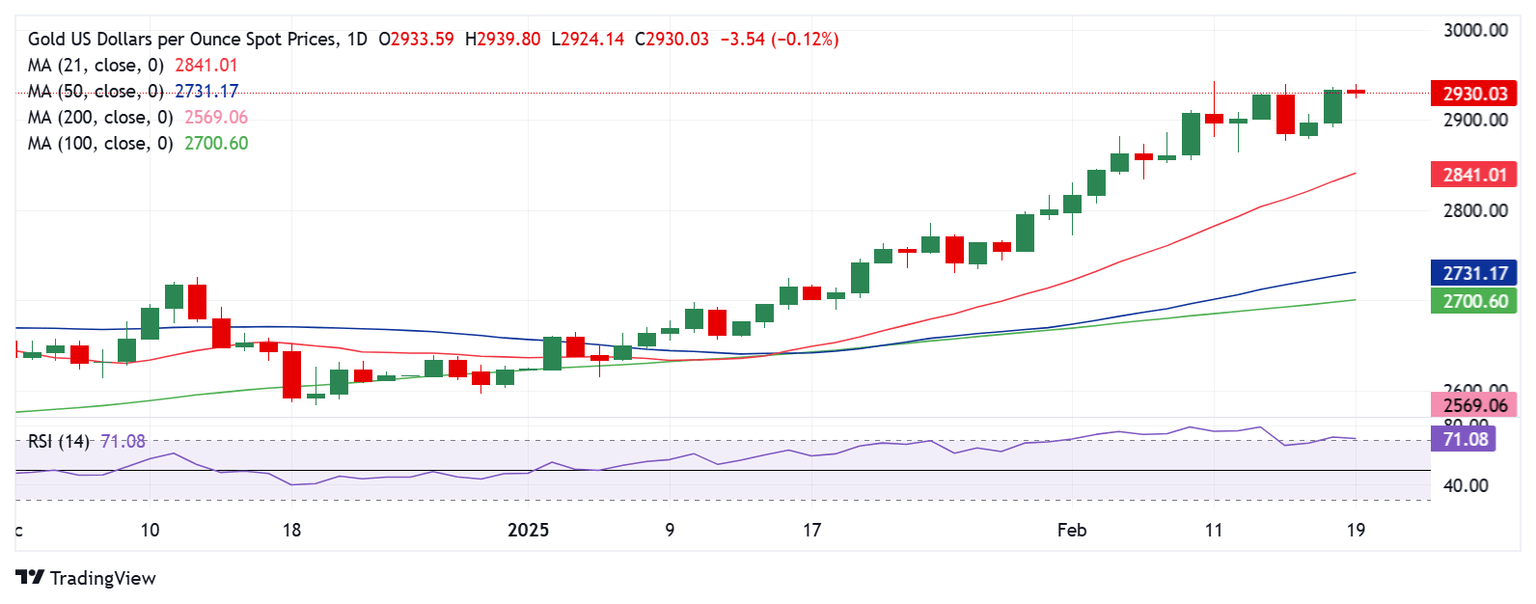

Gold price technical analysis: Daily chart

The daily chart shows that Gold price hangs near the record high of $2,943, with the 14-day Relative Strength Index (RSI) back in the overbought territory, currently near 71.

Amid a bullish technical setup, Gold buyers aim for a record high of $2,943. The next relevant resistance is seen at the $2,970 round level.

Conversely, a fresh pullback could call for a test of the $2,900 round level, below which the February 14 low of $2,877 will be threatened.

A firm break of that level will initiate a fresh downside toward the $2,850 psychological barrier.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.