Gold Price Forecast: XAU/USD bears to test bulls’ commitments at critical resistance

- Gold price contemplates the next move after Friday’s solid turnaround.

- Investors digest Omicron covid updates, weigh in faster Fed prospects.

- Gold price needs a firm break above $1,792 to confirm a bullish reversal.

Gold price staged an impressive turnaround on the final trading day of the week, rebounding nearly $20 from near four-week troughs of $1,762 reached last Thursday. The move was largely seen as chart-driven, with a technical bounce seen after the recent downward spiral. On the fundamental front, the all-important US Nonfarm Payrolls rose by 210K in November vs. +550K expected. The US dollar whipsawed in an initial reaction to the US employment data before eventually returning to the lower bound, as the Treasury yields dived.

Although the headline NFP was a big miss, the details and the previous upward revision kept the Fed’s tightening expectations intact. The shorter-duration yields spiked while longer-end drowned, offering the much-needed respite to gold bulls. Omicron covid variant induced fears weighed on the Wall Street mood, boding well for the traditional safe-haven gold. Despite the upturn, gold price finished the day well below the critical supply zone around $1,792 while recovering most of its weekly losses.

Heading into a relatively quiet week this Monday, gold price is sitting close to a three-day high of $1,788, reached in early Asia. Gold’s rebound appears limited by the recovery in the dollar alongside the yields, as the risk tone remains cautious. Investors are digesting the latest developments surrounding the new variant, with optimism that the effects of it are mild and can be curable. Also, the implications of a potential Fed’s faster monetary policy normalization also keep investors on the edge ahead of the critical US inflation data due later this week. On the macroeconomic data front, Monday’s calendar is absolutely data dry and, therefore, the broader market sentiment, Omicron covid updates and Fed sentiment will continue to have a significant impact on gold’s price action.

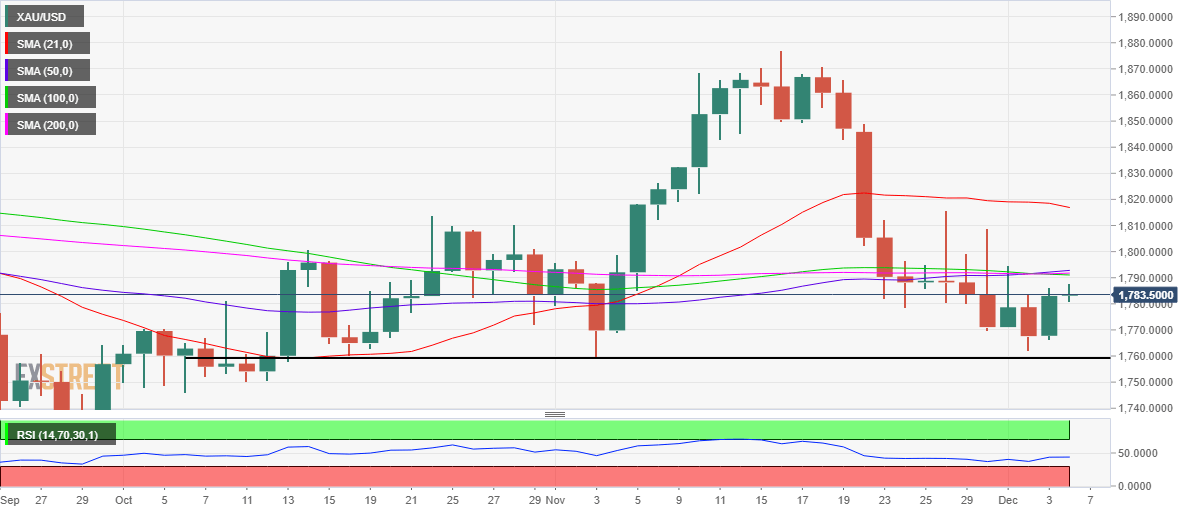

Gold Price Chart - Technical outlook

Gold: Daily chart

The Golden Cross continues to play out, as gold bulls gather pace to take on the powerful resistance (confluence of the 50-, 100- and 200-DMAs) around $1,792).

The 50-Daily Moving Average (DMA) crossed the 200-DMA for the upside last Wednesday, confirming a bullish reversal.

The 14-day Relative Strength Index (RSI) has flattened after the recent recovery, holding just below the midline, suggesting that bulls may face a hard time breaking through the aforesaid critical barrier.

A daily closing above the key confluence will expose the $1,800 barrier. The further recovery could call for a retest of Wednesday’s high at $1,809, above which the previous month’s high at $1,814 will be put to test.

On the downside, Friday’s low at $1,766 could come to the rescue of gold bulls., below which the crucial support is seen at the horizontal trendline at $1,760. Further south, the $1,750 psychological level will challenge the bullish commitments.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.