Gold Price Forecast: XAU/USD bears testing bullish commitments above $1700

- Gold turns south after facing rejection at $1740.

- US President Biden lauds vaccine progress, revives reflation trades.

- The 4H chart suggests that XAU/USD is at a critical juncture.

Gold (XAU/USD) failed to sustain at weekly highs around $1740 on Thursday, ending the day in the red at $1724. The rebound in the US Treasury yields from multi-day lows capped the recovery rally in the non-yielding gold. The returns on the markets rebounded, as the expectations of strengthening US economic recovery regained momentum after a strong jobs report. The number of Americans seeking jobless claim benefits dropped to a four-month low last week. Although the US dollar held onto the lower levels amid a record rally in Wall Street indices.

On the final trading day of this week, the reflation theme is back in play, thanks to the upbeat remarks from US President Joe Biden, who talked up the vaccine campaign amid the $1.9 trillion stimulus passage. Therefore, gold could bear the brunt if the uptrend in the US rates resumes. On the macro front, the US PPI release will be eyed while the focus will continue to remain on the yield play.

Gold Price Chart - Technical outlook

Gold: Four-hour chart

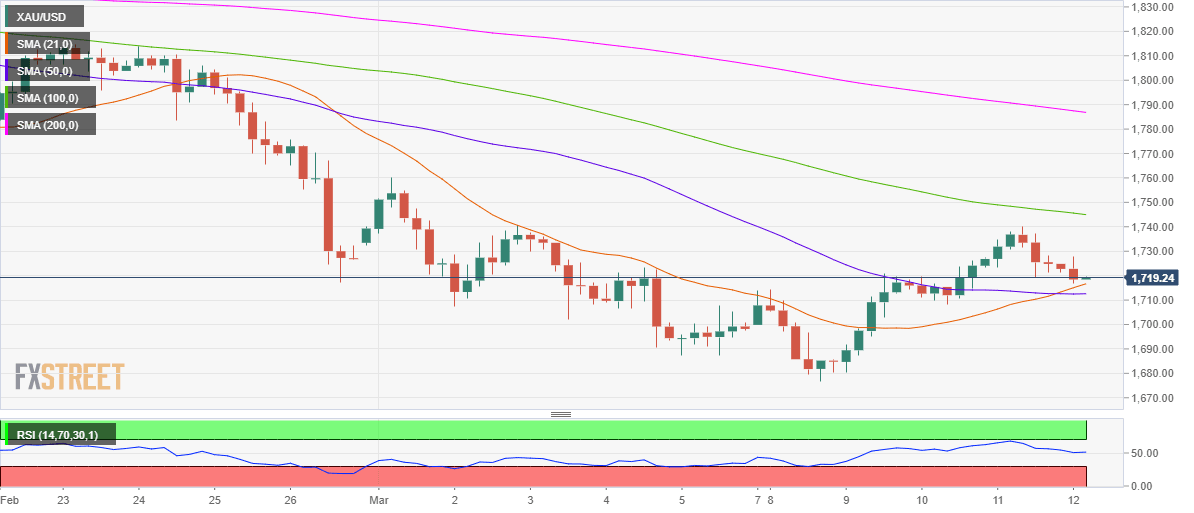

Gold’s four-hour chart shows that the price is testing the critical support at $1717, which is the bullish 21-simple moving average (SMA).

Thursday’s U-turn occurred after Gold bulls faced rejection below the 100-SMA at $1745.

The Relative Strength Index (RSI) has turned flat while holding above the midline, suggesting that the XAU buyers still remain hopeful.

To the upside, Thursday’s high at $1739 could be probed again, above which the 100-SMA remains on the buyers’ radars. The next stop for the bulls is seen at $1760, the March 1 high.

Alternatively, a breach of the 21-SMA could call for a test of the 50-SMA at $1713. The $1700 round number could offer some cushion to the XAU bulls before they target the multi-month troughs at $1677.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.