Gold Price Forecast: XAU/USD bears seize control as focus shifts to FOMC meeting

- Gold witnessed aggressive selling on Thursday and tumbled to over one-month lows.

- Upbeat US macro data lifted the US bond yields, the USD and exerted heavy pressure.

- Extremely oversold RSI on hourly charts helped limit losses amid COVID-19 woes.

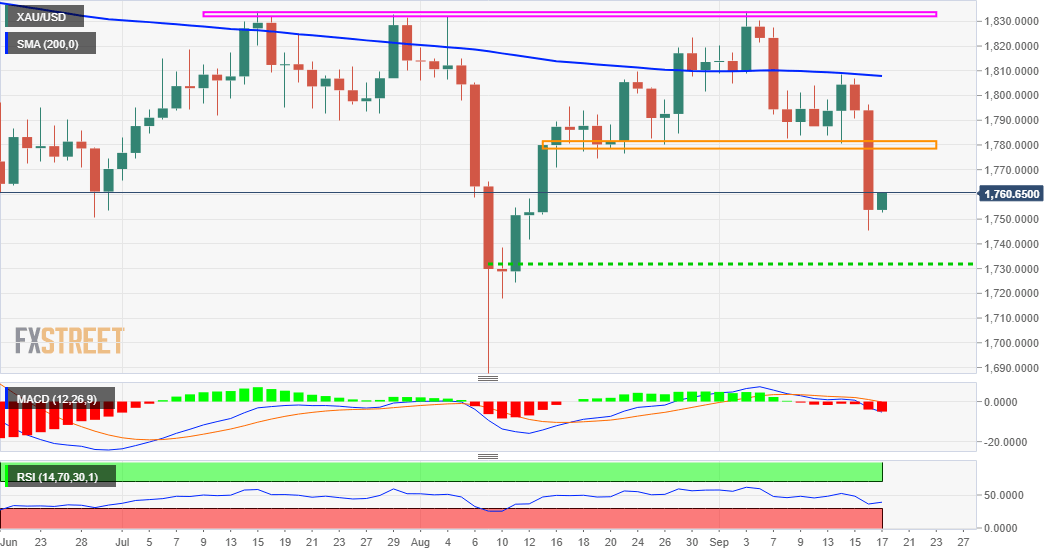

Gold extended the previous day's rejection slide from the very important 200-day SMA and witnessed aggressive selling for the second straight session on Thursday. The downward momentum dragged the XAU/USD to the lowest level since August 12 and was sponsored by a strong US dollar rally. Upbeat US Retail Sales data revived expectations for an early policy tightening by the Fed, which provided a strong boost to the greenback and weighed heavily on the dollar-denominated commodity.

The headline sales at US retail stores smashed consensus estimates and increased 0.7% in August. Adding to this, sales excluding autos recorded a much stronger growth and rose 1.8%, underscoring consumer confidence. Separately, the Philly Fed Manufacturing Index unexpectedly jumped to 30.7 in September. This helped offset a slight disappointment from Initial Weekly Jobless Claims, which rose from a pandemic-era low of 312K to 332K during the week ended September 10.

Nevertheless, the data underscored consumer confidence and pointed to the continuation of economic recovery. This, in turn, reinforced market expectations that the Fed would begin rolling back its massive crisis-era stimulus sooner than later. This was evident from a sharp spike in the US Treasury bond yields, which further drove flows away from the non-yielding yellow metal. In fact, the yield on the benchmark 10-year US government bond shot to an intraday swing high near the 1.35% threshold.

Apart from this, the underlying bullish sentiment in the financial markets was seen as another factor that exerted additional pressure on the safe-haven gold. The sharp fall took along some short-term trading stops placed near the previous monthly swing lows, around the $1,780 horizontal zone, and aggravated the bearish pressure. The commodity recorded the sharply daily fall in nearly six weeks, through extremely oversold RSI on hourly charts helped limit any further losses.

Meanwhile, worries about the fast-spreading Delta variant and a global economic slowdown extended some support, rather assisted the precious metal to gain some positive traction on Friday. Market participants now look forward to the release of the Prelim Michigan US Consumer Sentiment Index, due later during the early North American session. This, along with the US bond yields, might influence the USD price dynamics. Apart from this, the broader market risk sentiment might produce some trading opportunities around gold as the focus now shifts to next week's crucial FOMC meeting.

Short-term technical outlook

From a technical perspective, the overnight slump below the $1,780 support was seen as a key trigger for bearish traders and might have already set the stage for additional losses. Some follow-through selling back below the $1,750 level will reaffirm the negative outlook and turn the XAU/USD vulnerable. The next relevant support is pegged near the $1,729-28 area before the commodity eventually drops back to challenge the $1,700 round figure.

On the flip side, any attempted recovery move might now be seen as a selling opportunity near the $1,772-74 region. This, in turn, should cap the upside for the precious metal near the $1,780 zone, which should now act as a strong barrier. A sustained move beyond might trigger a short-covering move and push the XAU/USD back above the key $1,800 mark, towards the $1,808-10 area (200-DMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.