Gold Price Forecast: XAU/USD battles to retain $3,100 in tumultuous markets

XAU/USD Current price: $3,105.62

- US President Donald Trump’s reciprocal tariffs triggered panic across financial boards.

- The US will publish the March Nonfarm Payrolls report on Friday.

- XAU/USD corrective slide may extend if the pair breaks below $3,040.

Spot Gold battles to retain the $3,100 threshold in the American session, easing from a fresh all-time high of $3,167.68. The XAU/USD pair soared during Asian trading hours, as market players panicked following United States (US) President Donald Trump, “Liberation Day” announcement.

In a press conference in the Rose Garden on Wednesday, Trump detailed widespread tariffs on roughly 180 different countries, with a baseline of 10%. Levies on China reached 54% after an additional 34% was added to the previously announced 20%. The EU got 20%, while some Asian countries like Vietnam or Cambodia will pay taxes of over 40% to sell their goods into the US.

Financial markets panicked amid speculation that inflation would soar while economic progress would stall. Concerns about a US recession rose, alongside speculation that the Federal Reserve (Fed) will have to adjust its monetary policy accordingly. The US Dollar plummeted, and so did stock markets around the world.

Meanwhile, the US will release the March Nonfarm Payrolls report on Friday. The country is expected to have added 135K, following the 151K gained in February. The Unemployment Rate is foreseen steady at 4.1% while wage inflation is seen pretty much unchanged, up by 0.3% on a monthly basis and 3.9% from a year earlier.

XAU/USD short-term technical outlook

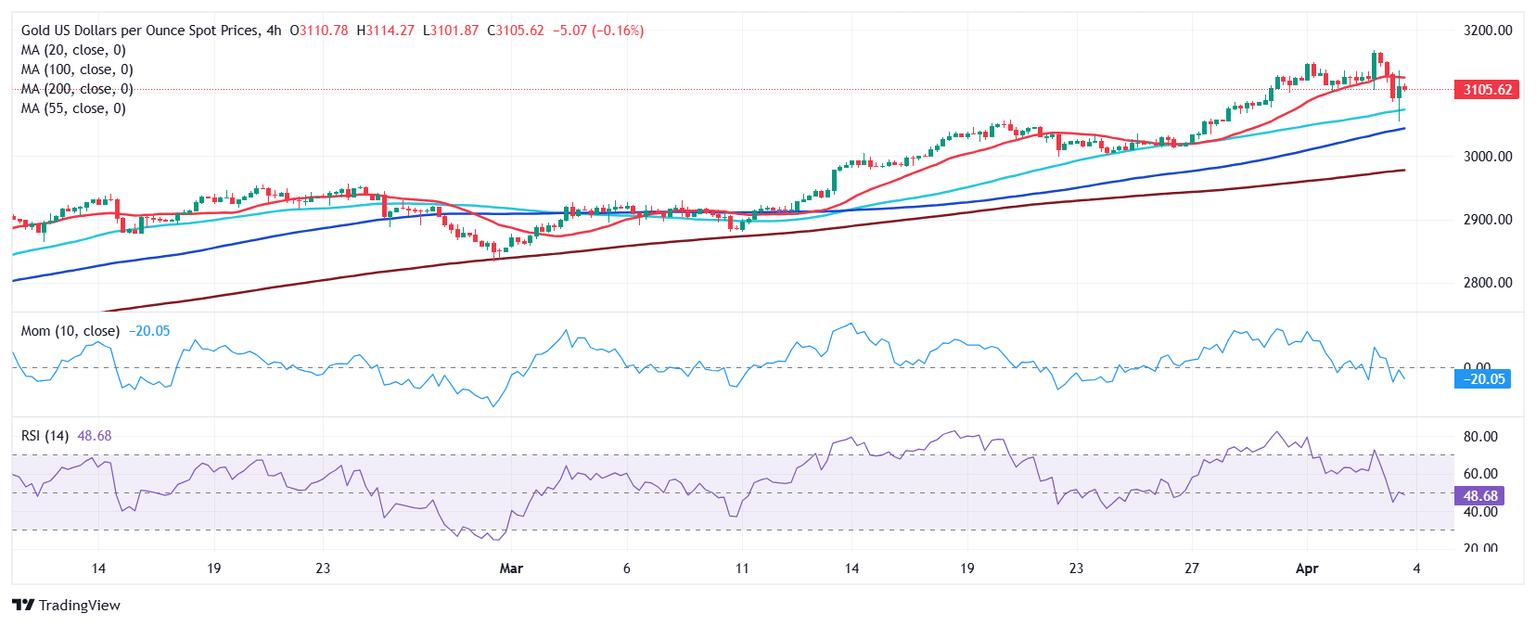

As per XAU/USD, the pair retreated sharply after reaching the aforementioned high amid profit taking, with buyers finally returning at around $3,050. From a technical point of view, Gold has a limited bearish scope, according to technical readings in the daily chart. The intraday slide stalled far above a bullish 20 Simple Moving Average (SMA), currently at around $3,022. The 100 and 200 SMAs, in the meantime, maintain their sharp upward slopes far below the shorter one. Finally, technical indicators ease from extreme readings, yet remain far above their midlines, not enough to confirm a top in place.

The XAU/USD pair 4-hour chart shows XAU/USD trading below a now flat 20 SMA, but still well above a bullish 100 SMA, providing support at around $3,040. Technical indicators, in the meantime, have recovered from near oversold readings to stabilize within negative levels. A steep decline could take place on a break below the mentioned $3,040 region.

Support levels: 3,086.70 3,073.90 3,061.10

Resistance levels: 3,123.10 3,136.70 3,150.00

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.