Gold Price Forecast: XAU/USD battles key $2,650 level at the start of the Fed week

- Gold price rebounds early Monday after two straight days of losses.

- US Dollar retreats with Treasury bond yields amid pre-Fed repositioning.

- Gold price looks for a clear direction amid neutral daily RSI while at around $2,650.

Gold price looks to start the final full week of 2024 positively, clinging to $2,650 early Monday. The US Dollar (USD) pulls back alongside the US Treasury bond yields ahead of the S&P Global Preliminary US business PMI data due later this Monday.

Gold price bounces amid pre-Fed repositioning

Gold buyers are coming up for air in Asian trades on Monday, snapping a two-day correction from five-week highs of $2,726 reached last Thursday. Traders seem to be cashing in on their USD long positions, adjusting ahead of Wednesday's all-important US Federal Reserve (Fed) policy announcements.

Markets have fully priced in a quarter percentage point interest rate cut by the Fed this week, according to CME's FedWatch tool. However, they expect the Fed to turn to a wait-and-see mode in January, anticipating inflationary risks from US President-elect Donald Trump’s likely protectionist policies.

This narrative helped the Greenback and the US Treasury bond yields extend their advance last week. Traders now eagerly await the Fed decision to gauge if the US central bank signal fewer rate cuts in 2025 than previously projected.

Gold price also draws support from the renewed Israel-Gaza tensions and the South Korean political turmoil. “An airstrike hit the civil emergency centre in the Nuseirat market area in the central Gaza Strip, killing Ahmed Al-Louh, a video journalist for Al Jazeera TV, and five other people,” Reuters reported, citing medics and fellow journalists.

South Korea’s parliament impeached President Yoon Suk Yeol on Saturday after a motion was tabled by the opposition-led alliance over Yoon’s short-lived martial law declaration earlier this month. The leader of the ruling party in South Korea, Han Dong-hoon, resigned after facing backlash over his calls for President Yoon’s impeachment. Gold price tends to benefit in times of geopolitical and political unrest.

However, it remains to be seen if the Gold price sustains the bounce. It witnessed a similar price action in Friday’s Asian session but gave into the USD’s strength heading into the weekend.

The further upside in the Gold price could be capped by mounting China’s economic concerns after the country’s Industrial Output growth quickened slightly in November, while Retail Sales disappointed. Widening Gold discounts in India amid curbed wedding season demand due to rising prices could also remain a drag on the bright metal. China and India are the world’s biggest Gold consumesrs,

Also of note remains the US PMI data for a fresh take on the Fed’s interest rate path next year, which could have a strong bearing on the value of the USD-sensitive Gold price.

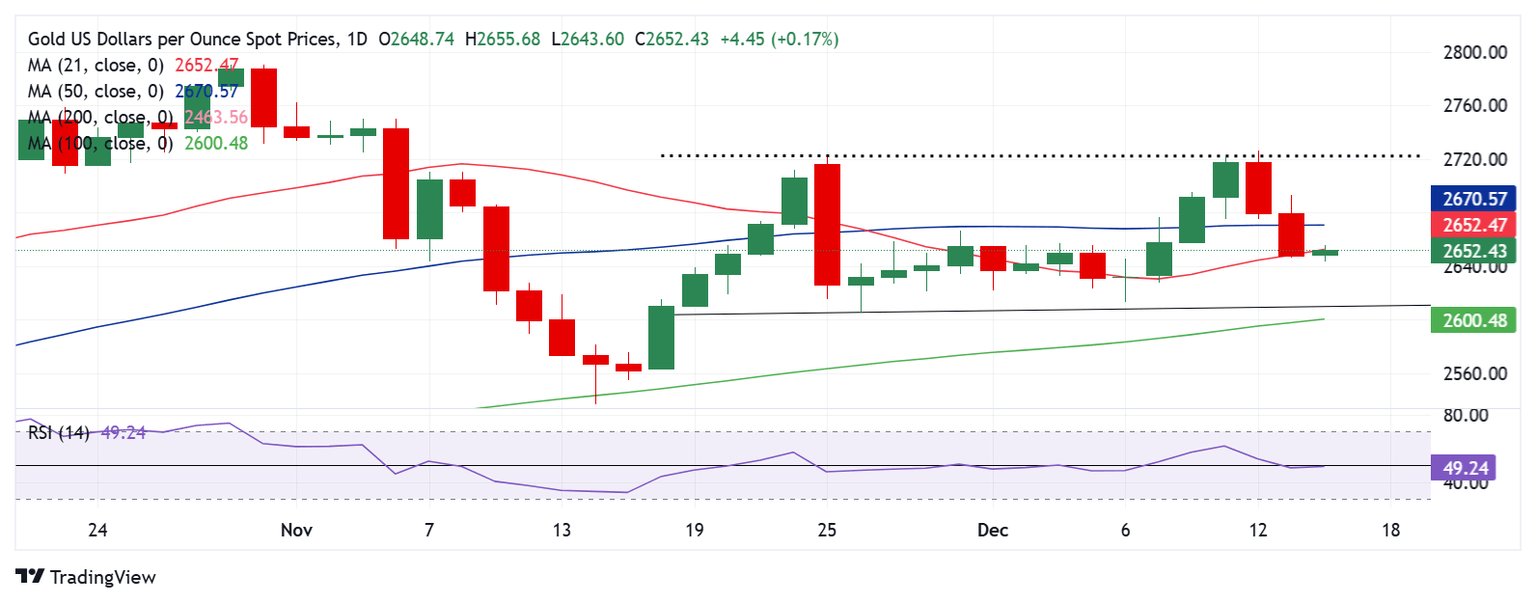

Gold price technical analysis: Daily chart

As observed on the daily chart, Gold price is battling the 21-day Simple Moving Average (SMA) support at $2,650.

The 14-day Relative Strength Index (RSI) is trading flat at around the 50 level, suggesting a lack of clear directional bias at the moment.

If Gold buyers flex their muscles, the rebound could test the 50-day SMA at $2,670, above which the $2,700 level will come into play.

Additional upside could retest the multi-week high of $2,726.

On the flip side, a daily candlestick close below the 21-day SMA at $2,650 could call for a retest of the December 6 low of $2,613.

The last line of defence for Gold buyers is seen at the $2,600 area, where the 100-day SMA coincides with the November 26 low.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.