Gold Price Forecast: XAU/USD awaits the Fed and Bull Cross confirmation

- Gold price extends its struggle with 50 DMA at $1,932 amid risk aversion.

- US Treasury bond yields track Oil prices higher on inflation woes, ahead of Fed decision.

- Gold price awaits Bull Cross confirmation, Jerome Powell for a fresh directional move.

Gold price is off the two-week high at $1,937, treading water near $1,930 early Wednesday, as buyers eagerly await the US Federal Reserve (Fed) interest rate decision for resuming the recent uptrend.

Gold price gains from multiple catalysts ahead of the Fed

The United States Dollar (USD) has entered a phase of bullish consolidation near a six-month high against its main competitors, supported by the latest rally in the US Treasury bond yields and broad risk aversion.

Traders are risk averse, as a typical caution prevails ahead of the Fed policy announcement and Chairman Jerome Powell’s press conference. All eyes also stay focused on the Fed’s updated economic projections, the so-called ‘Dot Plot’ chart, which will be key to gauge whether one more rate hike remains in the offing. In light of these events, traders refrain from placing fresh bets on the US Dollar, leaving Gold price gyrating in a familiar range.

Additionally, risk-off flows gathered steam after the People’s Bank of China (PBOC) left the Loan Prime Rate (LPR) unchanged across the time horizon. Markets were expecting a rate cut to China’s prime lending rate, which would ease the property market concerns and help boost the economic recovery. Investors are also worried that the recent surge in Oil price could stoke up inflationary pressure worldwide, prompting the Fed to reiterate its rhetoric of ‘higher interest rate for longer.’

This narrative has helped US Treasury bond yields regain their upbeat momentum, with the benchmark 10-year Treasury yield sitting at the 16-yeat high of 4.3720%. The US Treasury bond yield rally could resume its uptrend on a hawkish Fed rate hike, extending the pullback in Gold price toward the $1,900 level. Conversely, Gold price could see a fresh upside toward $1,950 if the Fed disappoints hawks and remains ambiguous about the future policy path.

Gold price technical analysis: Daily chart

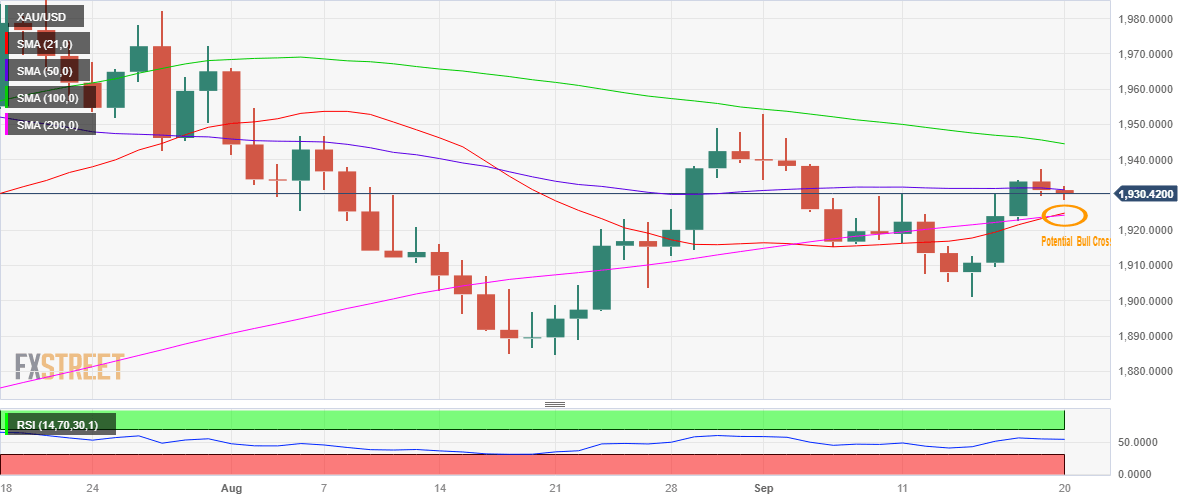

Gold price is clinging to the 50-Daily Moving Average (DMA) at $1,931, having managed to close above the latter on Tuesday, despite a modest pullback.

The 14-day Relative Strength Index (RSI) indicator is keeping its range above the 50 level, favoring Gold buyers.

Adding credence to the potential upside in Gold price, the 21 DMA has broken above the 200 DMA but a daily closing is eyed to validate a Bull Cross.

The Fed interest rate decision, however, will hold the key to determining the next direction for Gold price.

A hawkish Fed hike could provide extra legs to the ongoing correction in Gold price, fuelling a sell-off toward the $1,900 mark.

Ahead of that, the confluence of the 21 and 200 DMAs at $1,924 and the $1,910 round figure could lend support to Gold buyers.

On the other hand, if the Fed fails to convince markets about one more rate hike by year-end, a fresh upswing will be seen toward the September high of $1,953 should Gold price manage to take out the mildly bullish 100 DMA at $1,944.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.