Gold Price Forecast: XAU/USD awaits high-impact US jobs data for fresh impetus

- Gold price licks its wounds early Wednesday amid a week-long losing streak.

- US economic resilience triggers Fed rate hike bets, boosts US Dollar, US Treasury bond yields.

- Gold price remains heavily oversold on the daily chart, eyes US ADP jobs and ISM Services PMI.

Gold price is licking its wounds near $1,820, having hit its lowest level in seven months at $1,815 on Tuesday. All eyes now turn toward the high-impact US ADP jobs data and the ISM Services PMI report for a fresh trading impetus in Gold price.

Gold price at the mercy of US Dollar, US Treasury bond yields

Gold price is slightly away from the multi-month troughs, looking to build on the previous rebound, as the US Dollar has entered a phase of bullish consolidation while the US Treasury bond yields sit at a 16-year peak. The benchmark 10-year US Treasury bond yields are up 0.90% on the day, trading at 4.85%.

The US Treasury bond yields keep pushing higher on the back of increased bets that the US Federal Reserve (Fed) will deliver one more rate hike by the year-end, as the US economy remains resilient. The US Labor Department said on Tuesday that Job Openings unexpectedly increased by 690,000 to 9.610 million in August, the biggest gain in over two years. The data pointed to a persistently tight labor market in the United States that could allow the Federal Reserve the leeway for more tightening.

The unrelenting upsurge in the US Dollar and the US Treasury bond yields fuelled another leg down in the non-interest-bearing Gold price. The bright metal hit a fresh seven-month low at $1,815 before attempting a modest recovery.

Heading toward the critical US ADP private sector Employment Change data release on Wednesday, Gold traders have turned cautious and refrain from placing fresh bets amid the ongoing uptrend in the US Treasury bond yields. The US ADP payrolls are expected to arrive at 153K in September vs. 177K reported in August. A slowdown in the US labor market could scale back bets for one final Fed rate hike this year, triggering a long-due correction in the US Dollar from YTD highs against its major rivals.

However, if the data surprises to the upside, a fresh US Dollar rally cannot be ruled out alongside the US Treasury bond yields, which could reinforce Gold sellers. Traders will also watch out for the US ISM Services PMI data and Fedspeak for further hints on the Fed rate outlook, impacting the US Dollar and Gold price valuations.

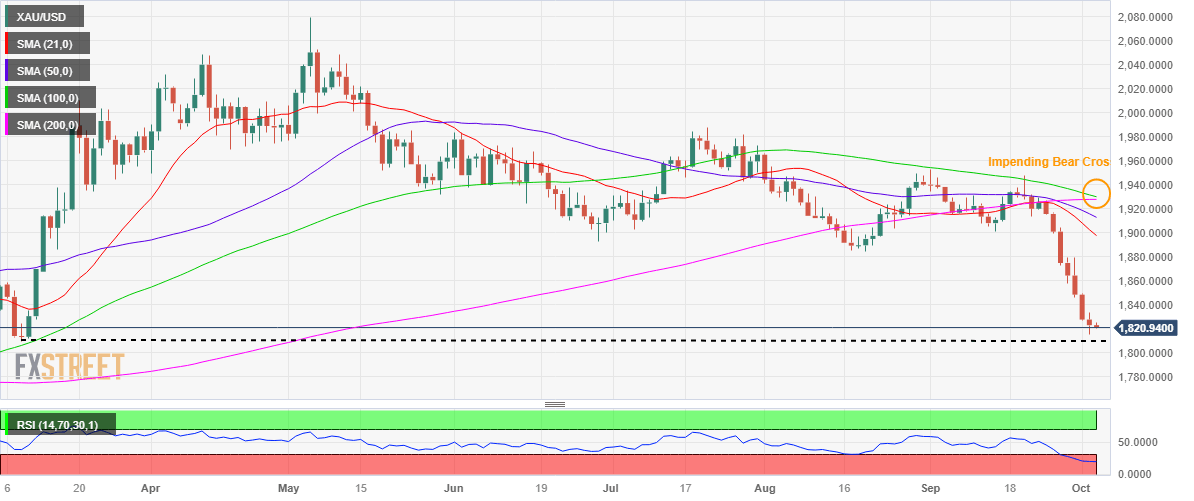

Gold price technical analysis: Daily chart

From a short-term technical perspective, nothing seems to have changed for Gold price, as a correction from a seven-month trough remains on the table.

The 14-day Relative Strength Index (RSI) indicator stays heavily oversold, justifying a case for a Gold price rebound anytime soon.

Should Gold price stage a decent comeback the initial support-turned-resistance at the $1,850 level will be challenged. The next upside barrier is aligned at the September 28 and 29 highs of $1,880 on the road to recovery.

However, if Gold buyers fail to find a strong foothold above the $1,850 mark, the downtrend could gather steam once again. Gold price will need to crack the previous day’s low of $1,815 to tale on the crucial support at the $1,810 level, where the March 8 low is registered.

The $1,800 threshold will be the level to beat for Gold sellers.

The 100-Daily Moving Average (DMA) is looking to cross the 200 DMA from above, suggesting that any pullback in Gold price from multi-month lows could prove temporary.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.