Gold Price Forecast: XAU/USD attempts another run to take out 100 DMA at $1,954

- Gold price is rebounding toward one-month highs above $1,950 on Monday.

- US Dollar holds previous gains amid US Labor Day-induced thin market conditions.

- Gold price remains poised to recapture 100-Daily Moving Average at $1,954.

Gold price is kicking off a holiday-shortened week on a firm footing early Monday, having witnessed volatile trading on Friday. The United States Dollar (USD) is consolidating the previous week’s solid recovery, as the dust settles over the US Nonfarm Payrolls aftermath.

US Labor Day thin trading to exaggerate Gold price action

Amidst US Labor Day holiday-led thin market conditions and increased dovish expectations surrounding the US Federal Reserve‘s (Fed) interest rate outlook, the US Dollar is seeing a modest pullback, as traders digest last Friday’s unusual action across the financial market.

The US Dollar tumbled on a weak labor market report from the United States, which showed that the headline Nonfarm Payrolls rose 187K in August, as against expectations of 170K. However, the previous reading was sharply downgraded to 157K. Further, the US Unemployment Rate unexpectedly climbed to 3.8% while the annual Average Hourly Earnings rose 4.3% in August, compared with the expected increase of 4.4% in the reported month. The discouraging US jobs data served as a perfect recipe for pushing back against expectations of any rate hike by the Fed this year, with the US central bank expected to remain on an extended pause.

Against this background, the non-interest-bearing Gold price jumped to hit fresh four-week highs at $1,953. However, the US Dollar bulls quickly jumped back into the game alongside the US Treasury bond yields, as traders resorted to closing out their short USD positions heading into the extended Labor Day weekend. This triggered a sharp pullback in the Gold price, as it ended the day flat at $1,940.

Gold price is regaining positive traction in Monday’s trading so far, as traders cheer dovish Fed expectations along with China’s stimulus optimism, limiting the upside in the US Dollar across the board. More policy action is expected from China, including relaxing restrictions on home buying. China’s embattled property developer, Country Garden, won approval from its creditors to extend payments for an onshore private bond.

Markets, however, could remain on a cautious footing, as thin volumes could exaggerate the moves in the Gold price. Traders will also await the speech by the European Central Bank (ECB) President Christine Lagarde for some trading incentives, in an otherwise quiet start to the week.

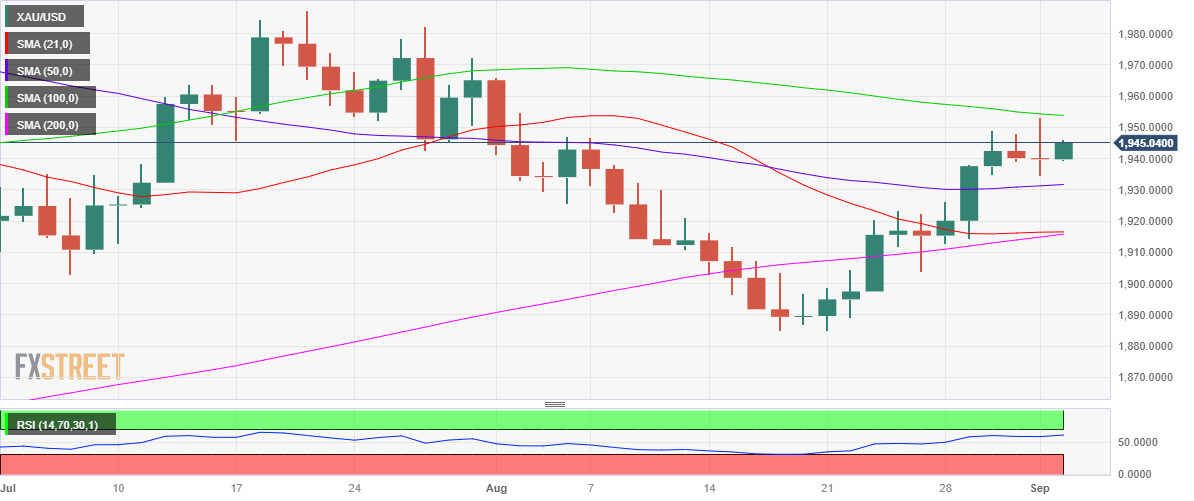

Gold price technical analysis: Daily chart

Gold price remains on track to take out the critical 100-Daily Moving Average (DMA) at $1,954, as the bullish 14-day Relative Strength Index (RSI) justifies the renewed upside.

A firm break above the latter will put the static resistance at $1,970 under risk. The next relevant barrier is seen at the July 27 high of $1,982.

On the downside, Gold buyers will aim for Friday’s low of $1,934 as the initial support area, below which the 50 DMA support of $1,931 will be challenged.

A sustained move below the latter will open up a fresh downswing toward the $1,916 level, where the 21 and 200 DMAs coincide.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.