Gold Price Forecast: XAU/USD approaches $2,450 as US Dollar corrects

XAU/USD Current price: $2,453.23

- The European Central Bank left interest rates unchanged, failed to trigger action.

- Mixed United States data and an uptick in Treasury yields helped the US Dollar.

- XAU/USD eases for a second consecutive day, the bearish potential is well limited.

Spot Gold trades with a soft tone on Thursday, hovering around its daily opening just below the $2,460 mark. The US Dollar found some demand as government bond yields pared losses and posted a modest rebound, while stock markets turned south amid a worsening market mood. Discouraging American data coupled with an uneventfull European Central Bank (ECB) monetary policy announcement, pushing investors into safety.

The ECB left interest rates unchanged as widely anticipated, while the accompanying statement showed policymakers would remain data-dependant and take decisions meeting by meeting. European officials are considering that only one more rate cut this year could be possible, as inflation remains above the central bank’s goal.

United States (US) data was mixed, as Initial Jobless Claims for the week ended July 12 unexpectedly jumped to 243K, much worse than the 230K anticipated by market players. On the other hand, the July Philadelphia Fed Manufacturing Survey improved to 13.9 after printing at 1.3 in June and beating the expected 2.9.

It is worth adding, however, that the US Dollar shows limited strength, suggesting the current advance will remain corrective.

XAU/USD short-term technical outlook

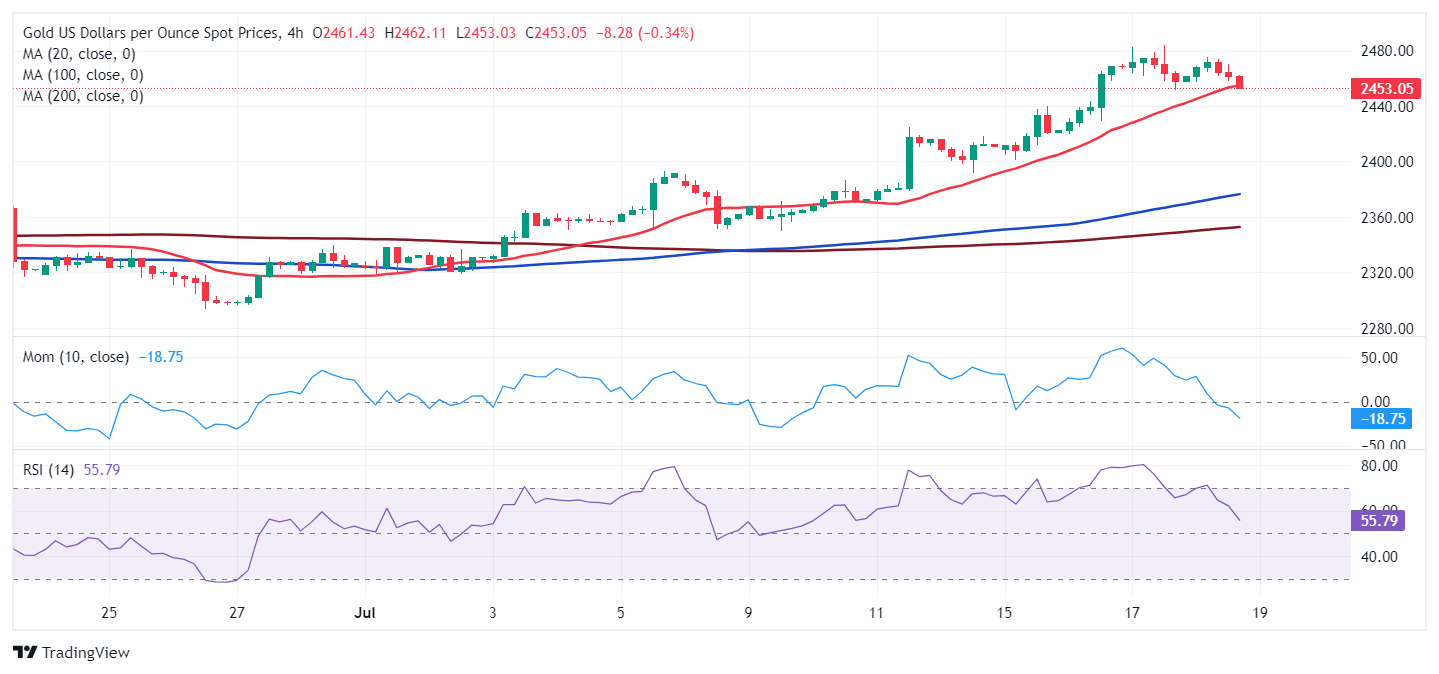

The XAU/USD pair is under mild selling pressure for a second consecutive day, albeit barely retreating from record highs. Technical readings in the daily chart are far from suggesting a stepper decline, as indicators have barely retreated from overbought territory while lacking clear directional strength. At the same time, the pair keeps developing well above bullish moving averages, with the 20 Simple Moving Average (SMA) providing dynamic support at around $2,370.

In the near term, and according to the 4-hour chart, the technical picture is pretty much the same. XAU/USD is developing just above a firmly bullish 20 SMA, while the 100 and 200 SMAs also head higher, well below the shorter one. Technical indicators, in the meantime, pulled back from overbought readings but turned flat within positive levels, suggesting limited selling interest at the time.

Support levels: 2,448.90 2,435.50 2,422.65

Resistance levels: 2,465.00 2,483.70 2,495.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.