Gold Price Forecast: XAU/USD aims to retest record highs near $2,500

XAU/USD Current price: $2,464.29

- Speculation that the Fed has no choice but to trim interest rates weighs on the US Dollar.

- The United States will publish the July Consumer Price Index later this week.

- XAU/USD is poised to extend gains despite near-term overbought conditions.

Spot Gold kept rallying on Monday, up for a third consecutive day and currently trading above $2,460 a troy ounce. The bright metal kicked off the week with a positive tone amid easing demand for the US Dollar. Meanwhile, concerns about escalating tensions in the Middle East fueled demand for Gold. Western countries issued a warning about a potential attack from Iran on Israel that would dilute any chance of a cease-fire.

XAU/USD surged on the back of mounting speculation the United States (US) Federal Reserve (Fed) had no more room to delay rate cuts. The Fed is expected to deliver its first cut in the upcoming September meeting, with a potential 50 basis points (bps) trim on the table.

US data to be out this week may shed some light on the matter: The country will publish July inflation data next Wednesday. The Consumer Price Index (CPI) is foreseen to tick modestly lower compared to the previous month but still above the central bank’s goal of around 2%. However, it’s not all about inflation. Policymakers will have to assess the risk of an economic setback should they decide not to trim record rates.

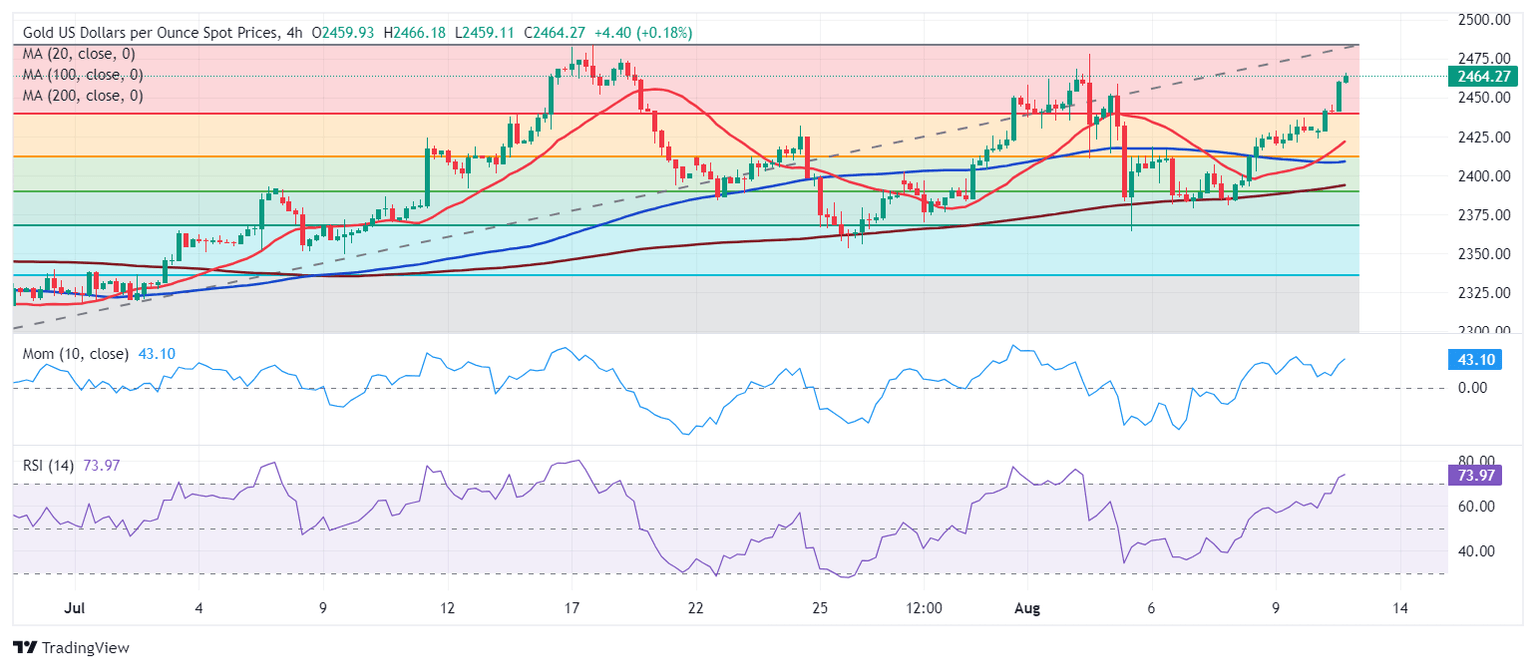

XAU/USD short-term technical outlook

From a technical point of view, XAU/USD is poised to extend its advance. In the daily chart, technical indicators have turned north after a brief consolidation within positive levels. Furthermore, the pair is trading above all its moving averages, with the 20 Simple Moving Average (SMA) gaining upward traction above already bullish 100 and 200 SMAs. XAU/USD has overcome the 23.6% Fibonacci retracement of the June/July rally at $2,438.80, a relevant support level in the case of a pullback.

In the near term, and according to the 4-hour chart, XAU/USD is overbought but giving no signs of changing course as the pair pressures its intraday high. Technical indicators, in the meantime, pared their advances and hover within extreme levels, reflecting the ongoing pause rather than suggesting an upcoming decline. Finally, the 20 SMA heads firmly north below the current level and above directionless longer ones, reflecting bulls’ dominance and maintaining the risk skewed to the upside.

Support levels: 2,442.90 2,438.80 2,425.10

Resistance levels: 2,466.00 2,483.70 2,495.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.