Gold Price Forecast: XAU/USD aiming to re-conquer the $2,400 level

XAU/USD Current price: $2,393.71

- Financial markets are in risk-on mode amid a potential escalation in Middle East tensions.

- The odds for a Federal Reserve rate cut in July dropped to roughly 41%.

- XAU/USD resumed its advance after a brief downward correction, could reach fresh all-time highs.

XAU/USD extends its recovery on Tuesday, approaching the $2,400 threshold mid-American session. Gold started the week on the back foot, sliding towards $2,324.12 on Monday, but slowly recovered the ground lost amid a persistently sour market mood.

Market players keep dropping bets on a Federal Reserve (Fed) rate cut in July, currently betting on a roughly 41% chance of happening. Strong United States (US) data coupled with concerns about the Middle East conflict between Iran and Israel will push inflation back up amid upward pressure in oil prices.

Asian and European indexes closed in the red, reflecting market fears, while Wall Street trades mixed. The Dow Jones Industrial Average (DJIA) managed to bounce back, but the Nasdaq and the S&P500 remain under pressure, weighed by the tech sector.

Fed Chairman Jerome Powell will participate in a panel discussion with other central banks’ authorities, although he is not expected to surprise markets. If something, Powell may reaffirm the Fed’s hawkish stance, further weighing on the market sentiment. Meanwhile, the Israeli war cabinet finished its post-Iran attack over the weekend, and news outlets indicate retaliation is coming.

XAU/USD short-term technical outlook

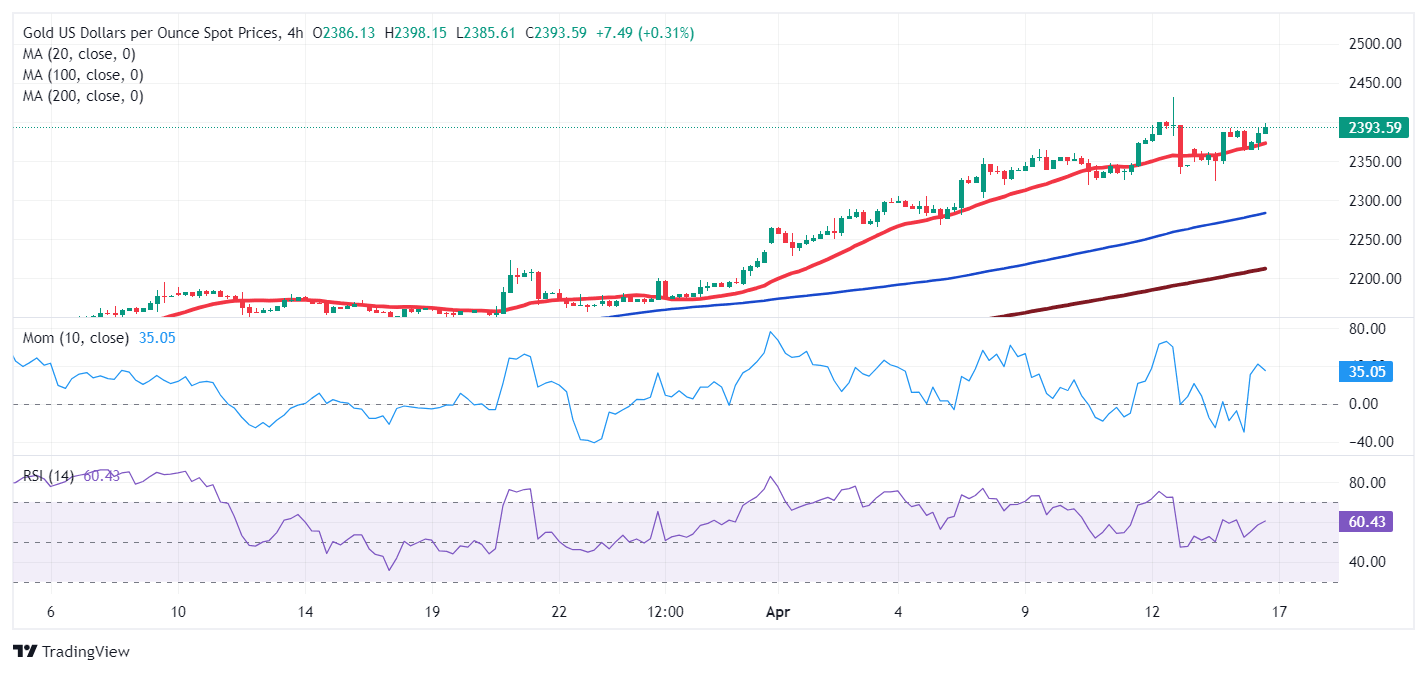

From a technical point of view, XAU/USD is poised to extend gains. The daily chart shows technical indicators resumed their advances after correcting extreme overbought conditions, with the pair posting a higher high and a higher low. Additionally, all moving averages head firmly south, well below the current level, reflecting persistent buying interest.

In the near term, and according to the 4-hour chart, the bullish case is even more evident. XAU/USD met intraday buyers around a bullish 20 SMA, now bouncing sharply from the indicator. The 100 and 200 SMAs, in the meantime, maintain their bullish slopes below the shorter one. Finally, technical indicators resumed their advances, with the Relative Strength Index (RSI) indicator accelerating north around 63.

Support levels: 2,391.80 2,378.05 2,363.35

Resistance levels: 2,409.20 2,431.43 2,450.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.