Gold Price Forecast: XAU/USD advances for a third consecutive day

XAU/USD Current price: $2,345.71

- The US Dollar is under modest selling pressure amid a better market mood.

- The US Federal Reserve and Nonfarm Payrolls figures dominate keep investors on hold.

- XAU/USD offers a neutral-to-bullish stance in the near term.

Gold trades with a positive tone on Monday, now hovering around $2,345 a troy ounce, as the US Dollar eases on the back of a better market mood that also sees stock markets advancing and government bond yields retreating. Speculative interest, however, maintains major pairs confined to familiar levels ahead of first-tier events scheduled for this week.

On the one hand, the United States (US) Federal Reserve (Fed) will hold its monetary policy meeting and announce the outcome on Wednesday. Chair Jerome Powell and co. are widely anticipated to keep interest rates on hold while delivering a hawkish message that will probably harm the US Dollar. US data released this past month showed slowing growth alongside stubbornly high inflation.

On the other hand, the country will release multiple employment-related figures, ending Friday with the April Nonfarm Payrolls (NFP) report. Employment and inflation are the key measures the Fed considers when making monetary policy decisions. The fact that figures will be out after the central bank’s announcement could be little relevant in the near term, but it will count towards speculation about what could happen in the June Fed meeting.

XAU/USD short-term technical outlook

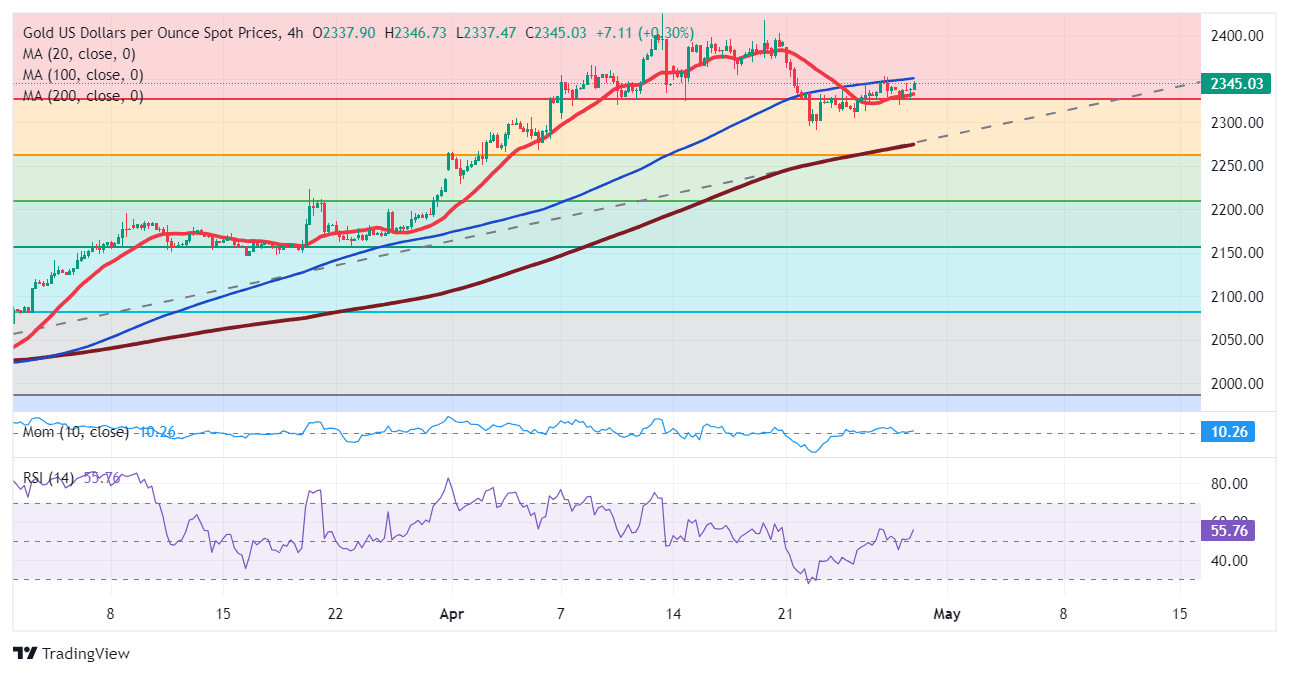

XAU/USD is in the green for the third consecutive day, modestly bouncing from a Fibonacci level, the 23.6% retracement of the $1,996.06/$2,431.43 rally at $2,326.50. Technical readings in the daily chart offer a neutral-to-bullish stance, as XAU/USD is currently surpassing a bullish 20 Simple Moving Average (SMA) while the longer ones picked up far below the current level, in line with increasing buying interest. The Momentum indicator remains stuck around its 100 level, although the Relative Strength Index (RSI) indicator slowly grinds north at around 60, also reflecting upward pressure.

XAU/USD offers a similar picture in the near term. The 4-hour chart shows the pair is just below a mildly bullish 100 SMA, while a directional 20 SMA provides intraday support. Finally, technical indicators lack directional strength but develop within positive levels, suggesting bulls are ready to jump in.

Support levels: 2,326.50 2,310.00 2,295.20

Resistance levels: 2,361.55 2,372.90 2,389.15

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.