Gold Price Forecast: Will XAU/USD chart a bull penant on weak US NFP?

- Gold price is falling for the third straight day while holding ground above $1,700.

- USD and yields cling to recent gains, as pre-NFP anxiety joins the Fed uncertainty.

- XAU/USD needs acceptance above the 50 DMA barrier but payrolls hold the key.

Gold price is trading on the back foot but holding above the $1,700 mark on the final trading day of the week. Despite a three-day downtrend, the bright metal is on track for the largest weekly gain since March, up 3% so far this week. The US dollar and the Treasury yields are consolidating their recent rebound, leaving the USD-priced metal on the defensive in the lead-up to the all-important Nonfarm Payrolls data. The pre-NFP cautious trading prevails, as investors refrain from placing any directional bets on the bullion while a minor repositioning of positions cannot be ruled out. The US labor market report holds the key, as it will provide clarity on the Fed rate hike plans in the coming months. The American economy is seen creating 250K jobs in September vs. +315K recorded in August. A positive surprise on the headline numbers could revive expectations of a 75 bps Fed rate hike next month, fuelling a fresh upswing in the dollar at gold’s expense. However, gold’s reaction to the NFP event risk could be also influenced by the persisting risk trend as well as the end-of-the-week flows.

Also read: US September Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises

XAU/USD extended its corrective mode from three-week highs into the second day in a row on Thursday, as sellers continued to lurk at higher levels. The pullback in the yellow metal was mainly driven by sharp recovery gains in the dollar alongside the yields, as the recent slew of mixed US economic data raised doubts over the prospects of aggressive Fed tightening. Further, looming geopolitical tensions between Russia and the West combined with surging oil prices also kept investors unnerved, driving safe-haven flows into the greenback. Resurgent haven demand for the buck and a pause in the yields correction from a multi-year peak boded ill for the non-yielding gold price. Dollar bulls also cheered the hawkish Fed commentary, which added to the retreat in the metal. Earlier this week, The US ADP jobs grew by 208K vs. +200K expectations. Although, the dollar rally quickly faded after the US ISM Services PMI eased to 56.7 in September while the Prices Paid component fell to 68.7 vs. 69.8 consensus forecasts. Meanwhile, the US weekly Initial Jobless Claims increased by the most in four months last week.

Although the downside in the precious metal was limited by the Reuters report that gold-supplying banks have cut back shipments to India ahead of major festivals in favor of focusing on China, Turkey, and other markets where better premiums are offered.

Gold price technical outlook: Daily chart

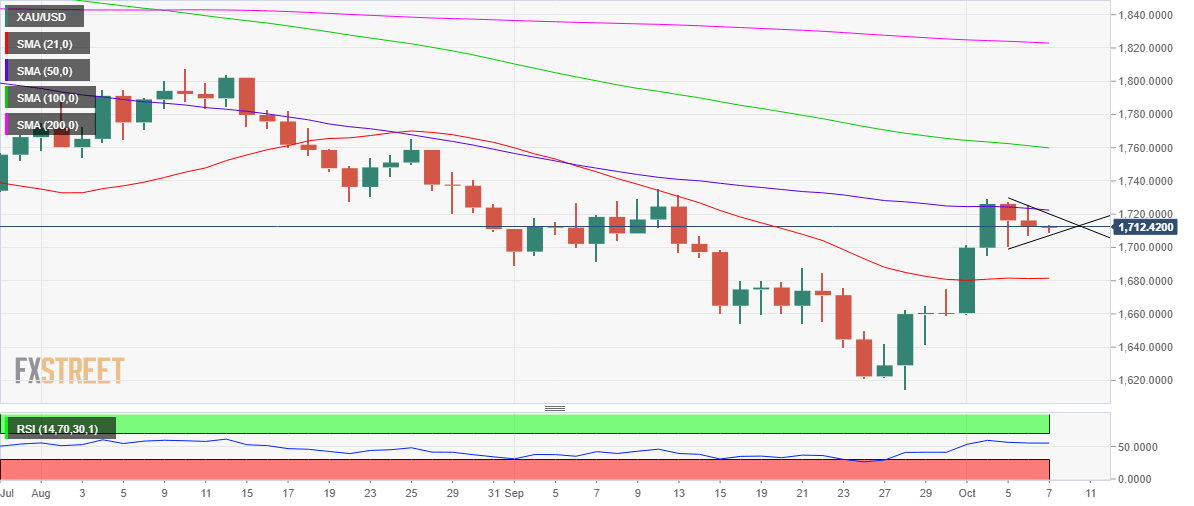

Gold price remains under the weight of the critical horizontal 50-Daily Moving Average (DMA), now at $1,722.

The rally to three-week tops earlier this week that followed the recent consolidation has taken the shape of a potential bull pennant on the daily sticks.

Buyers need a decisive break above the powerful resistance at around $1,722 to confirm the bullish continuation pattern. That level is the confluence of the 50 DMA and the falling trendline resistance.

The next relevant upside targets are aligned at the $1,730 round figure and the September high of $1,735, above which doors open up for a fresh uptrend towards the $1,750 psychological level.

The 14-day Relative Strength Index (RSI) remains bullish above the midline, supporting the bullish potential in the metal.

Alternatively, daily closing below the rising trendline support at $1,707 will invalidate the bull pennant, allowing bears to flex their muscles towards the previous critical resistance now cushion at $1,700 before approaching the weekly low of $1,695.

Deeper declines will expose the horizontal 21 DMA at $1,681, which will be the line in the sand for XAU bulls.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.