Gold Price Forecast: Will US ADP deepen the pain for XAU/USD bulls?

- Gold price remains pressured near monthly lows amid firmer US Treasury yields.

- US dollar remains on the back foot amid a mixed market mood, ahead of critical data.

- XAU/USD’s path of least resistance appears down, with eyes on $1,712 and $1,700.

Gold price is nursing losses near the monthly lows of $1,720, replicating the similar price action seen in Tuesday’s Asian trading. Despite the broad weakness in the US dollar, the bright metal remains on the defensive, as the Treasury yields cling to the previous upside amid increased bets of a 75 bps September rate hike in September. Markets wager a 70% probability of an outsized Fed rate hike next month, the latest CME Group’s FedWatch Tool shows. Robust US Consumer Confidence and JOLTS job openings data released Tuesday also helped ramp up aggressive Fed tightening bets. Expectations of higher borrowing costs continue to weigh on global stocks, although the US S&P 500 futures gain 0.40% so far, exerting downside pressure on the greenback. Of

The non-interest-bearing yellow metal also remains weighed down by hopes that the ECB will go in for a 75 bps rate hike as early as next week as the Eurozone battles a record high inflation rate. Germany, Europe’s economic powerhouse, saw its inflation rate accelerating to a 40-year high of 8.8% in the year to August, bolstering expectations of another all-time-high inflation in the old continent. The Eurozone inflation (HICP) data will be released at 09:00 GMT later this Wednesday, with economists predicting a 9.0% YoY print. The bullion could come under renewed selling pressure if the inflation figures boost calls for the 75 bps September ECB hike. Top ECB policymakers continue to back the view that aggressive tightening needs to be considered to control raging inflation, even if it is at the cost of the economy.

Also read: Eurozone Inflation Preview: Hotter HICP to cement a 75 bps ECB hike next week

Meanwhile, on the US docket, the critical ADP Employment Change report will be published after a two-month break, potentially driving the next leg higher in the buck. An upside surprise in the ADP numbers cannot be ruled out, given the lower estimates at +200K in August. Gold’s next price direction remains south against a backdrop of higher rates and upbeat US data.

Gold price technical outlook: Daily chart

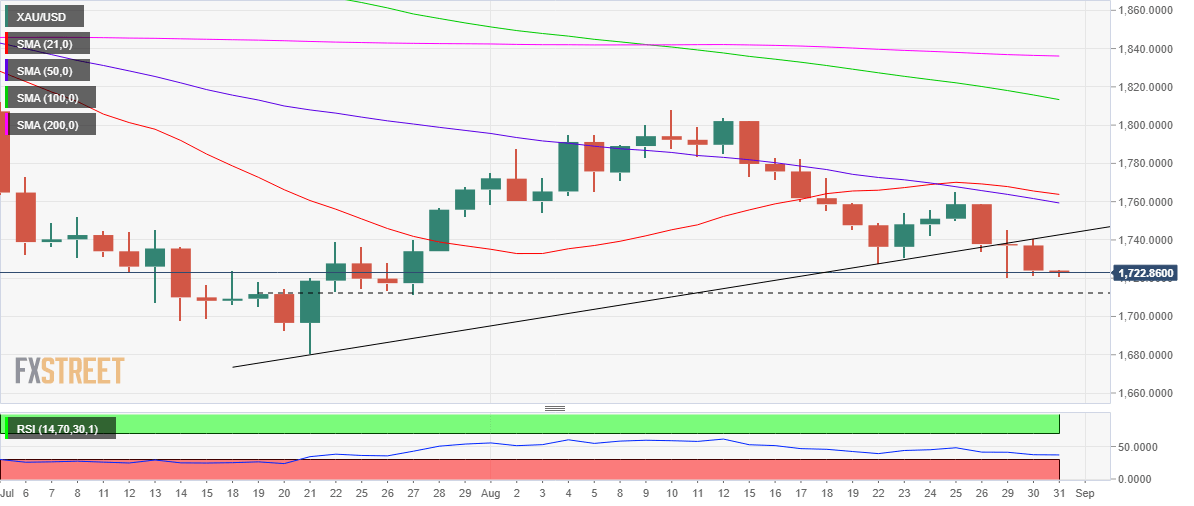

Nothing seems to have changed technically for the Gold price, as it remains exposed to additional downside risks after confirmation of a downside break from the rising trendline resistance, now at $1,743.

The 14-day Relative Strength Index (RSI) keeps pointing south towards the oversold region while below the midline. Sellers need a sustained move below monthly lows of $1,720 on their way towards the July 27 low of $1,712. The next significant downside target is seen at the $1,700 level.

Conversely, any recovery attempts will meet initial resistance at the $1,730 round figure. Bulls must find a firm foothold above the rising trendline support turned resistance at $1,743.

The $1,750 psychological level will be next on buyers’ radars, opening doors for a test of Friday’s high of $1,759, around where the bearish 50-Daily Moving Average (DMA) appears.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.