Gold Price Forecast: Will Fed Chair Powell rescue XAU/USD?

- Gold price attempts a tepid bounce from three-week lows of $2,644 early Thursday.

- The US Dollar consolidates the Trump trades-led rally on the Republican candidate’s presidency.

- The daily technical setup for Gold price suggests that the tide has turned in favor of sellers.

Gold price is seeing a dead cat bounce from three-week lows of $2,644 in Asian trading on Thursday, as the dust settles in the aftermath of a massive sell-off, fuelled by Republican candidate Donald Trump’s victory in the US presidential race.

Gold price stays defensive, awaiting the Fed verdict

The US Dollar (USD) has entered a bullish consolidation phase after rallying to its highest level in four months against its major rivals, capitalizing on the return of Trump trades. Trump's policies on immigration, tax cuts and tariffs are expected to put upward pressure on inflation, Wall Street stocls, US Treasury bond yields and the USD.

These expectations from the Trump administration and their likely implications on the economy spelt doom for the non-yielding Gold price, smashing it about $100 from the static resistance of $2,750.

Attention now turns toward the US Federal Reserve (Fed) policy announcements due later this Thursday. Markets are fully pricing in a 25 basis points (bps) Fed rate cut this week but investors will closely scrutinize any hints on the central bank’s path forward on interest rates.

Donald Trump’s return to the White House could prompt the Fed to slow down on its easy cycle, as his expansionary fiscal policies are seen as highly inflationary.

Fed Chair Jerome Powell is expected to affirm the US central bank’s independence and that they will act as the economic and inflation outlook unfolds. Powell is likely to acknowledge the recent slack in the labor market and the progress on disinflation, reiterating that the Fed will remain ‘data-dependent’ while determining the next policy move.

Gold price technical analysis: Daily chart

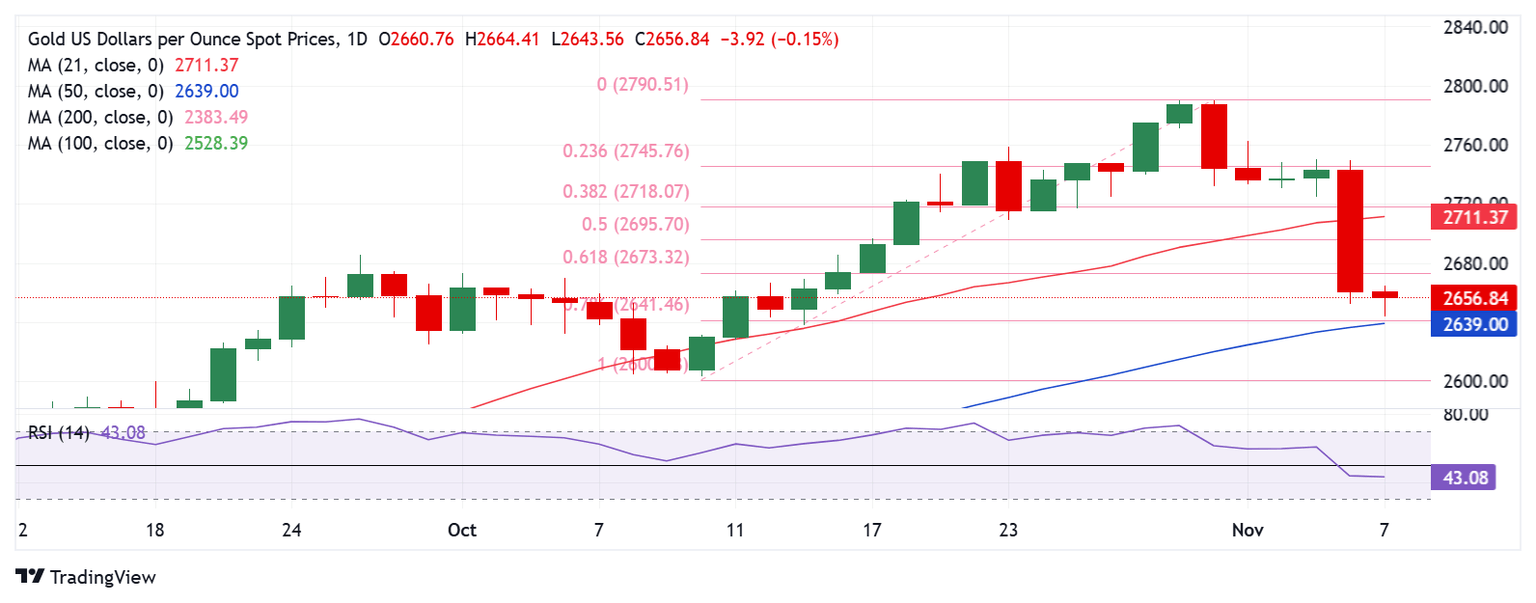

As observed on the daily chart, Gold price cracked all the major Fibonacci Retracement (Fibo) support levels amid the Trump trades-induced sell-off on Wednesday.

The 14-day Relative Strength Index (RSI) also pierced through the midline to dive into bearish territory, currently trending near 43.

The leading indicator suggests that more downside remains in the offing. However, a temporary pullback following the previous slump cannot be ruled out.

A dovish message by the Fed could rescue Gold buyers so long as they defend the critical support at $2,641, which is the confluence of the 50-day Simple Moving Average (SMA) and the 78.6% Fibo level of the latest record rally from the October 10 low of $2,604 to the new all-time high of $2,790.

Gold buyers will then aim for acceptance above the 61.8% Fibo support-turned-resistance at $2,673. Further up, a strong topside barrier near $2,700 will be tested, where the 50% Fibo of the same ascent level aligns.

If the Fed signals a slower pace of easing in the coming months, Gold price could see a sustained break below the abovementioned healthy support at $2,641.

A fresh downtrend will unleash toward the October 10 low of $2,604, below which the $2,550 psychological level will challenge the bullish commitments.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Thu Nov 07, 2024 19:00

Frequency: Irregular

Consensus: 4.75%

Previous: 5%

Source: Federal Reserve

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.