Gold Price Forecast: US-China trade optimism to limit XAU/USD’s rebound

- Gold’s bounce to falter as US-China trade optimism lifts risk appetite.

- Dollar bulls cautious ahead of Powell’s Jackson Hole appearance.

- US-China updates and US macro news eyed for fresh directives.

Gold (XAU/USD) started out the week on the back foot and closed Monday below $1930, extending Friday’s weakness. The spot once again failed to sustain above the $1950 level, as the coronavirus vaccine optimism lifted the risk sentiment and dulled the haven appeal of gold. Wall Street closed at record highs while the rally in the US Treasury yields prompted the US to stage a solid comeback across the board. Markets cheered the US Food and Drug Administration’s authorization of the use of blood plasma from recovered COVID-19 patients as a treatment option. The vaccine hopes offset the concerns over the virus resurgence in Europe.

Gold is showing some signs of life in Tuesday’s trading so far, as the greenback eased broadly amid a risk-on market environment. The overnight optimism got a further boost from the US-China ‘constructive’ talks on phase one trade agreement. The yellow metal’s upside attempts appear limited, as the risk-on action on the global markets could weigh on the metal. Gold also remains at the risk of the dollar replicating Monday’s comeback moves, in light of the rally in the Treasury yields. Markets will closely watch out for fresh US-China trade developments and US CB Consumer Confidence data for fresh trading impetus. The main highlight for this week remains the Fed Chair Powell's appearance at the Jackson Hole Symposium.

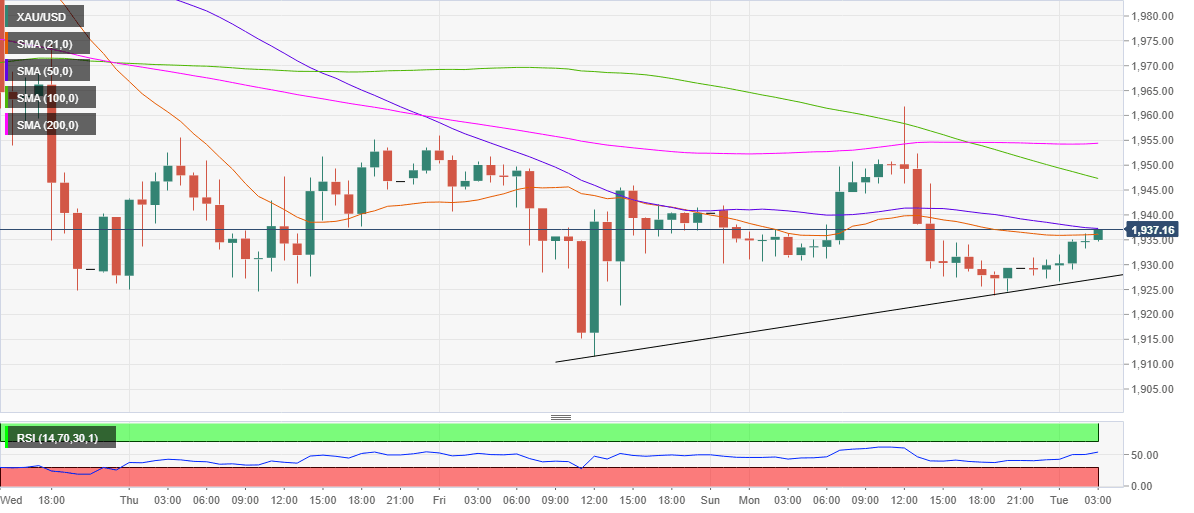

Gold: Hourly chart

Short-term technical perspective

Gold is fighting hard to regain the robust resistance near $1937, the confluence of the 21 and 50-hourly Simple Moving Averages (HMA). The hourly Relative Strength Index (RSI), currently at 52.80, is inching higher, suggesting that the bounce from $1924 lows could extend.

Although the bearish 100-HMA at $1947 could offer stiff resistance. Acceptance above the latter, the horizontal 200-HMA at $1955 could be tested. A convincing break above that level is critical to revivng the bullish momentum in the near-term.

To the downside, a break below the rising trendline support at $1927 could trigger a fresh drop towards the daily lows.

Friday’s low at $1912 could be put at risk, further south.

Gold: Additional levels to consider

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.