Gold Price Forecast: Steady consolidation above $1,950

XAU/USD Current price: $1,965.10

- Financial markets remain optimistic, although caution surged ahead of relevant data releases.

- US and EU Inflation updates take center stage in the last days of the week.

- XAU/USD consolidates at around $1,965 a troy ounce as investors await fresh catalysts.

The macroeconomic calendar will come back to life on Thursday and provide some relevant figures that could end up moving financial boards. On the one hand, Germany and Spain will publish the preliminary estimate of their March Harmonized Index of Consumer Prices (HICP) ahead of the Eurozone figure to be out on Friday. Also, on Thursday, the United States will publish the final estimate of the Q4 Gross Domestic Product (GDP), expected to confirm an annualized growth of 2.7%. Finally on Friday, the US will unveil the February Core Personal Consumption Expenditures - Price Index, the Federal Reserve's (Fed) favorite inflation measure, foreseen at 4.7% YoY.

XAU/USD price short-term technical outlook

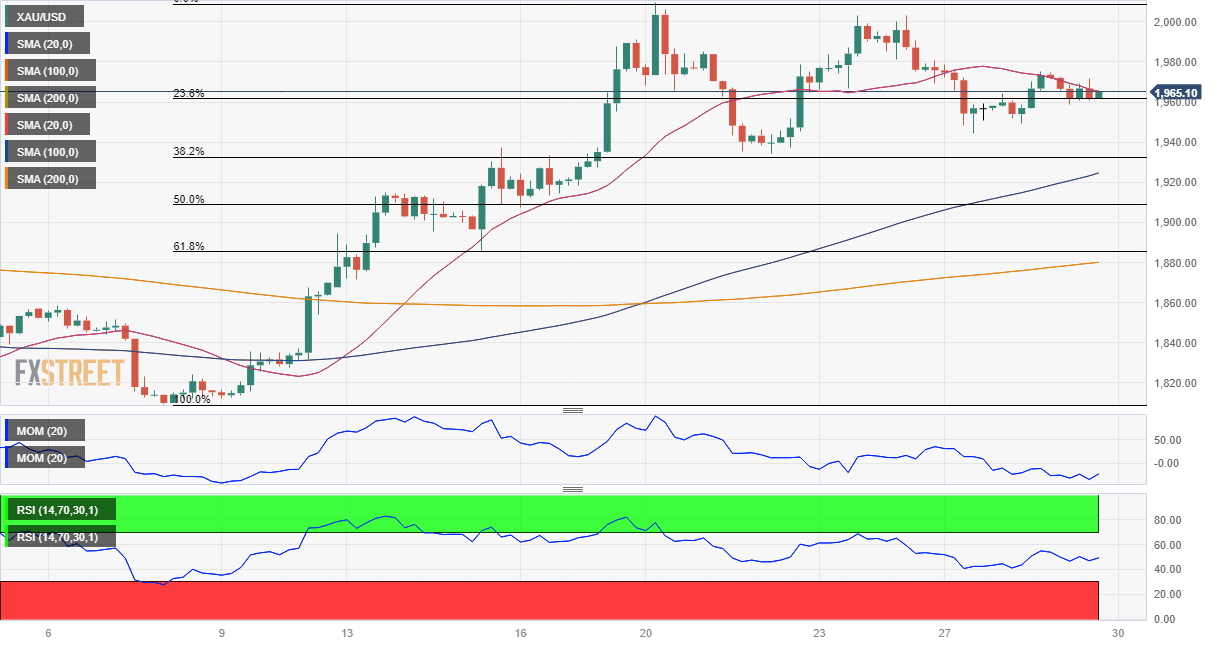

The XAU/USD pair trades just above $1,962.30, the 23.6% Fibonacci retracement of the latest daily advance measured between $1,824.27 and $2,009.77. Technical indicators have eased from their recent highs but fall short of suggesting an upcoming decline in the daily chart. Furthermore, the pair keeps developing above moving averages, with the 20 Simple Moving Average (SMA) heading firmly north above the longer ones.

The 4-hour chart offers a neutral stance, as the price is stuck around a bearish 20 SMA, while the longer moving averages head north far below the current level. Finally, technical indicators seesaw around their midlines without clear directional strength, reflecting the absence of speculative interest.

Support levels: 1,962.30 1,947.50 1,932.65

Resistance levels: 1,978.95 1,988.30 2,000.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.