Gold Price Forecast: Sellers happily adding on spikes amid a lack of clear direction

XAU/USD Current price: $1,784.03

- Gold trades at the lower end of its daily range despite a dismal market’s mood.

- Mixed news about the Omicron coronavirus variant weighed on sentiment.

- XAU/USD is technically neutral, but the risk is skewed to the downside.

Gold trades lower in range, with the bright metal currently at around $1,781 a troy ounce. Trading has been choppy throughout the day as investors struggle to digest coronavirus developments. France and Germany had announced restrictive measures, while social distance may return to the UK, amid an escalation of contagions in Europe. On the other hand, Pfizer said that a booster jab of its coronavirus vaccine is effective against the Omicron variant. Early studies suggest that those that got covid plus two shots or those getting the third dose are highly protected against the heavily mutated strain.

XAU/USD retreated after peaking at 1,793.08, with the greenback trading without rhyme or reason, while US government bond yields kept advancing to fresh weekly highs. For the time being, the yield on the 10-year Treasury note stands at 1.52% after hitting a daily high of 1.532%. Meanwhile, global indexes trade with a sour tone, most of them in the red.

Gold price short-term technical outlook

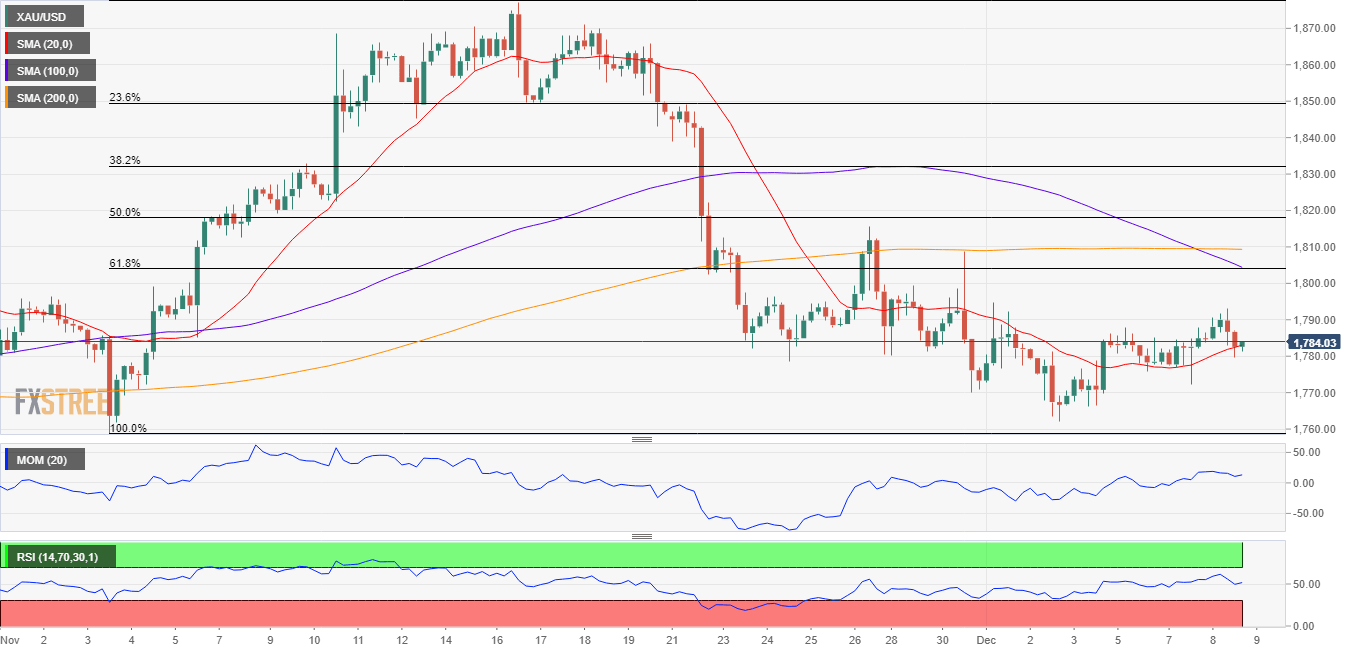

XAU/USD keeps showing no progress. On the daily chart, gold prices peaked at converging 100 and 200 SMAs, both flat. Meanwhile, the 20 SMA accelerated its slide below the longer ones, while technical indicators hold directionless within negative levels.

The near-term picture is also neutral, given that the precious metal is hovering around a mildly bullish 20 SMA in its 4-hour chart, while technical indicators lost directional strength, now stuck around their midlines.

Support levels: 1,772.05 1,758.80 1,745.20

Resistance levels: 1,793.00 1,803.85 1,810.65

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.