Gold Price Forecast: Sell the XAU/USD bounce above $1,700?

- Gold price lacks follow-through recovery momentum amid fresh US dollar demand.

- The European energy crisis spells recession fears, spooks markets and lifts dollar.

- XAU/USD sellers look to keep upper hand amid an impending bear cross on 1D.

Gold price is treading water above $1,700, lacking a clear direction at the start of the week. The bright metal has stalled its recovery mode from six-week lows as investors have flocked to the safe-haven US dollar amid a risk-off market environment. The deepening European energy crisis has exacerbated concerns about an imminent global recession and renewed US-China tensions, killing the appetite for riskier assets.

Gazprom halted its key European gas pipeline indefinitely after G7 leaders agreed to implement a price cap on Russian oil last Friday. Some media outlets reported on Saturday that the Russian oil giant had restarted gas deliveries to Europe via Ukraine, although there is no official confirmation about it so far. The energy crisis-led slide in the EUR/USD pair also supports the dollar gains. Bloomberg carried a story over the weekend that US President Joe Biden’s administration is considering restricting investment in Chinese technology companies.

Also read: Gold, Chart of the Week: Bears eye a break of multi-decade uptrend near $1,676

Meanwhile, expectations that global central banks, including the Fed and the ECB, will continue with their aggressive tightening path keep a lid on any upside in the non-interest-bearing bullion. Although the odds for a 75 bps September Fed rate hike have dropped sharply to around 55% following Friday’s US jobs data vs. 75% pre-NFP, markets remain hopeful for hawkish central banks’ response in their fight against rampant inflation. The ECB remains on track for a 75 bps rate hike this week, with markets wagering an 80% probability.

On Friday, the US headline Nonfarm Payrolls rose by 315K in August vs. 300K expected and 526K previous while the Unemployment Rate showed an unexpected uptick to 3.7% vs. 3.5% forecast. Meanwhile, the average hourly earnings eased slightly in the reported month. Mixed US employment data faded expectations of an outsized Fed rate hike later this month and triggered a sharp dollar retracement from multi-year highs on Friday, allowing the yellow metal to witness a dead cat bounce from six-week troughs of $1,689. The end-of-the-week flows also came into play, exaggerating the gold price action.

Gold price technical outlook: Daily chart

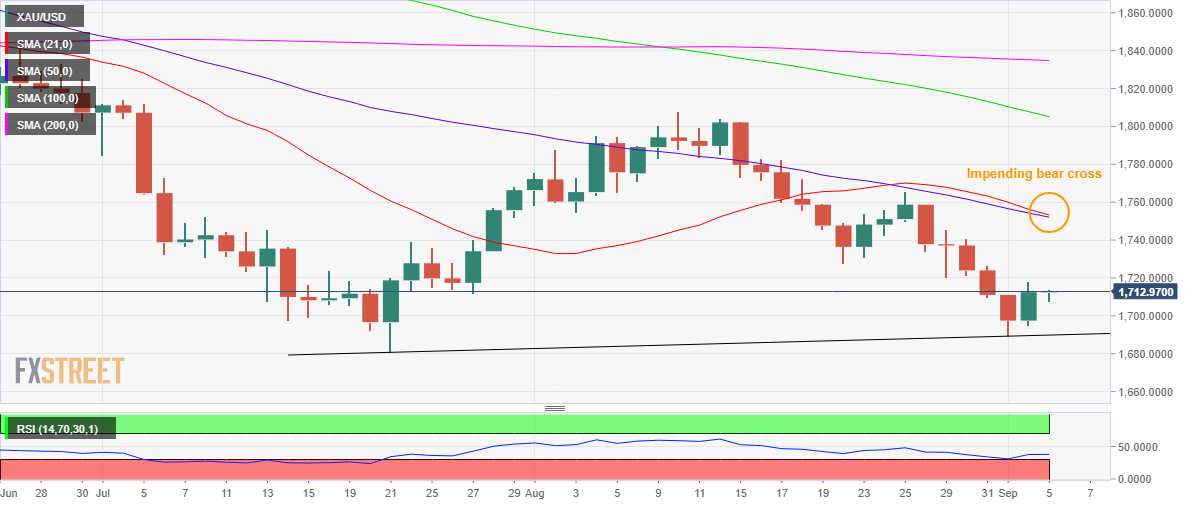

The short-term technical outlook for gold remains bearish, despite the previous rebound. Bears, however, need to find footing once again below $1,700 to resume the downside momentum.

The next cushion is seen at the rising trendline support at $1,690. Should the decline accelerate below the latter, a test of the 2021 low of $1,677 will be on the table, below a break of the yearly lows.

The 14-day Relative Strength Index (RSI) is still holding below the midline while above the oversold zone, suggesting that there is scope for additional downside.

Further, the 21-Daily Moving Average (DMA) is set to cut the 50 DMA from above, which if confirmed on a daily closing basis will represent a bear cross. The bearish crossover will add credence to the bearish potential in the metal.

On the flip side, bulls will meet initial resistance at Friday’s high of $1,718, above which the $1,720 round number could come into play. The August 31 high of $1,727 could be a tough nut to crack for XAU buyers.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.