Gold Price Forecast: Russia-Ukraine war favors US dollar but XAU/USD’s downside appears limited

- Gold price licks wounds as the King dollar reigns supreme amid anxiety over the Ukraine crisis.

- Soaring oil prices flag stagflation risks while Fed is ready for a 25bps March rate hike.

- Gold bears are likely to retain control while below the key $1,950 barrier.

Gold price has had a choppy week so far, having reversed half of Tuesday’s rebound amid a return of selling interest on Wednesday. Gold bears jumped back into the game after meeting stiff resistance at $1,950 on a couple of occasions this week, although bargain-buying is seen at lower levels. Wednesday’s sell-off in gold price was mainly attributed to the dominant US dollar strength across the board and a sharp rebound in the Treasury yields. Escalating tensions between Russia and Ukraine kept the safe-haven demand for the dollar alive and kicking in while Fed Chair Jerome Powell’s testimony offered the additional boost to the buck. Powell almost cemented a 25 basis points (bps) rate hike for the next week while leaving doors open for a series of rate increases alongside readiness for 50 bps hikes if inflation remains elevated. Further, gold came under additional bearish pressure after a Russian negotiator said on that a potential ceasefire will be discussed in upcoming talks with the Ukrainian delegation.

Gold price licking its wounds below $1,930 on Thursday, undermined by the persistent strength in the dollar. Investors continue to seek safety in the US currency amid a sense of caution ahead of the highly-anticipated Russia-Ukraine negotiations due later in the day. Meanwhile, the hostilities continue, as the Russian troops surround five Ukrainian cities. The preferred safe haven in the dollar also attracts demand, as the relentless surge in oil prices re-ignites stagflation risks. Should risk-aversion intensify in the upcoming sessions, the greenback will continue to remain the go-to safety net, exacerbating the pain in gold price. The updates on the Ukraine crisis will continue to be the main driver, eclipsing the impact of the US weekly Jobless Claims and the ISM Services PMI.

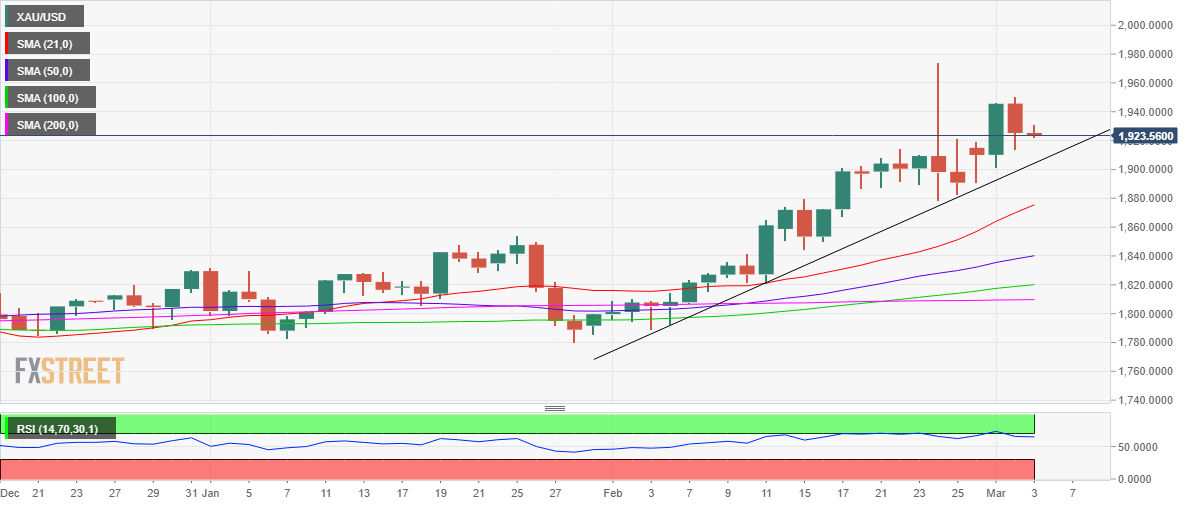

Gold Price Chart - Technical outlook

Gold: Daily chart

Gold’s daily chart shows that price is moving higher alongside the month-long rising trendline, which offers strong support at $1,904.

Meanwhile, the $1,950 barrier remains a tough nut to crack for gold bulls.

That said, gold price is likely to keep its range play intact within the abovementioned levels unless a breakout is yielded in either direction.

Gold bulls, however, seem supported amid a bullish 14-day Relative Strength Index (RSI), which currently stands at 64.81, having retraced from the overbought territory earlier this week.

Buyers need acceptance above $1,950 to resume the upside towards the multi-month highs of $1,975.

On the flip side, daily closing below the aforesaid trendline support will trigger a sharp sell-off towards the February 24 low of $1,878

Further south, the upward-sloping 21-Daily Moving Average (DMA) at $1,875 will then challenge the bullish commitments.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.