Gold Price Forecast: Pre-US Nonfarm Payrolls repositioning could sideline XAU/USD buyers

- Gold price pulls back from 2023 highs above $2,000 as US Dollar rebounds.

- Downbeat United States data fuelled recession fears and risk aversion.

- Gold price could see dip-buying following a pennant breakout on the 1D chart.

Gold price is correcting from the highest level since March 2022 reached at $2,032 on Wednesday. Gold buyers are taking a breather after the recent upsurge, gearing up for volatility on Friday’s United States US Nonfarm Payrolls data release.

Poor United States ADP jobs, ISM Services PMI spur recession fears

Amid resurgent safe-haven demand for the United States Dollar (USD), Gold price paused its three-day winning streak, retreating for the second day in a row. Another set of downbeat United States economic data, in the Automatic Data Processing (ADP) Employment Change and ISM Services PMI, bolstered expectations of a pause in the US Federal Reserve (Fed) tightening cycle as early as May. The US ADP private sector employment increased by 145,000 jobs in March vs. 200K expected and 261K previous. US ISM Services PMI dropped from 55.1 to 51.2 in March, below the expectation of 54.5. Meanwhile, all of the ISM Services sub-components slowed their pace of expansion. Markets are now pricing in a 53% probability of no rate hike by the Fed in the next meeting.

The recent run of weak United States economic data rekindled recession fears, prompting investors to run for safety in the US Dollar while the US Treasury yields tumbled across the curve after the data release on Wednesday. On Tuesday, available positions totaled 9.93 million, a drop of 632,000 from January’s downwardly revised number, the Labor Department reported Tuesday in its monthly Job Openings and Labor Turnover Survey. Job openings fell below 10 million in February for the first time in nearly two years. US Factory Orders dropped by 0.7% in February vs. -0.5% expected, registering the second straight monthly decline.

Upbeat Chinese PMI ignored, US Jobless Claims next in focus

So far this Thursday’s trading, the US Dollar rebound extends, as risk aversion seeps into Asia while the US Treasury bond yields attempt a minor bounce, weighing negatively on the non-yielding Gold price. Stronger-than-expected China’s Caixin Services PMI for March also failed to lift sentiment around the Gold price. China is the world’s biggest Gold consumer. Later in the day, the US weekly Jobless Claims could offer fresh trading incentives, as Gold traders brace for the top-tier US Nonfarm Payrolls data on Good Friday. Gold price could witness a profit-taking decline amid repositioning ahead of the key US labor market report and thin liquidity conditions.

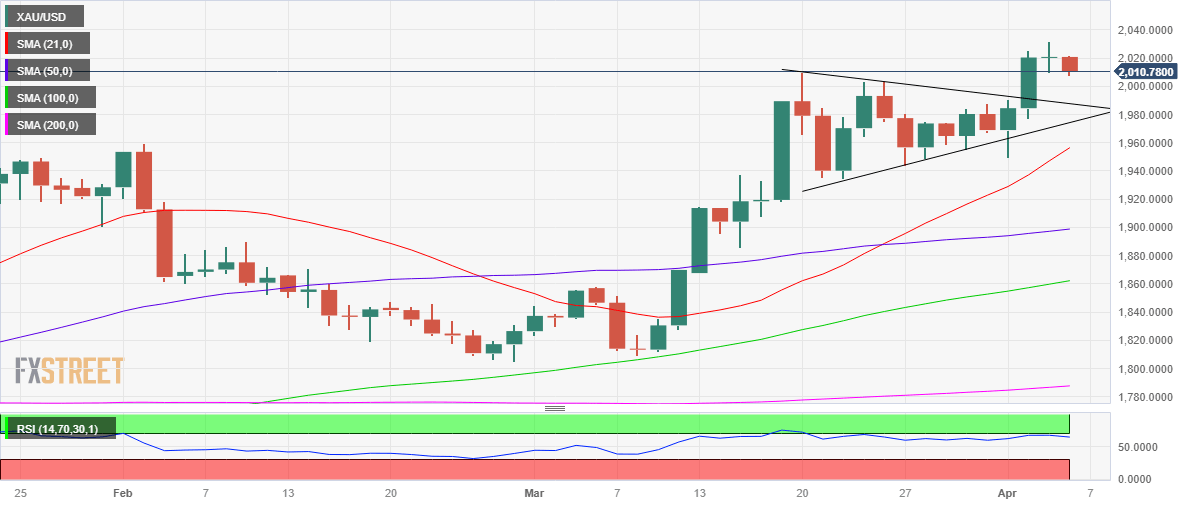

Gold price technical analysis: Daily chart

Gold price paused its bullish momentum triggered by a pennant breakout on Wednesday, as bulls failed to sustain above the $2,030 round figure.

At the moment, Gold price is retreating toward the $2,000 mark, below which the pennant resistance-turned-support at $1,988 will be challenged.

The next critical line of defense for Gold buyers is seen at the confluence of Tuesday’s low and the pennant support near $1,975.

The 14-day Relative Strength Index (RSI) is turning south toward the midline, justifying the latest downtick in the Gold price.

Should Gold bulls jump back into the game, the upside would resume toward the $2,020 figure. Bulls will then reattempt the yearly top at $2,032.

Acceptance above the latter is needed to make fresh headways toward the pennant target measured at $2,043.

However, the Gold price action is likely to remain choppy ahead of Friday’s United States Nonfarm Payrolls data.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.