Gold Price Forecast: Poised to resume its decline amid inflation concerns

XAU/USD Current price: $1,813.93

- Soaring US government bond yields boost demand for the American currency.

- Global indexes are a sea of red amid renewed inflation-related concerns.

- XAU/USD is biased south and could pierce the 1,800 threshold in the near term.

Gold fell to an intraday low of $1,805.74 a troy ounce as the greenback firmed up through the European session, following US Treasury yields soaring to fresh two-year highs. Risk-off sentiment persisted after Wall Street’s opening, with the metal bouncing towards the 1,820 price zone but quickly giving up and resuming its decline.

In the absence of relevant data, investors' attention turned to inflationary pressures and US government bond yields, which jumped to fresh two-year highs. The 10-year US Treasury yield soared to a fresh two-year high of 1.856%, while the yield on the 2-year bond reached 1.06%. Meanwhile, the greenback head firmly higher against most major rivals as stocks turned red.

The US Federal Reserve is having a monetary policy meeting on January 25-26, and market participants are looking for another hawkish tilt to the current monetary policy.

Gold price short-term technical outlook

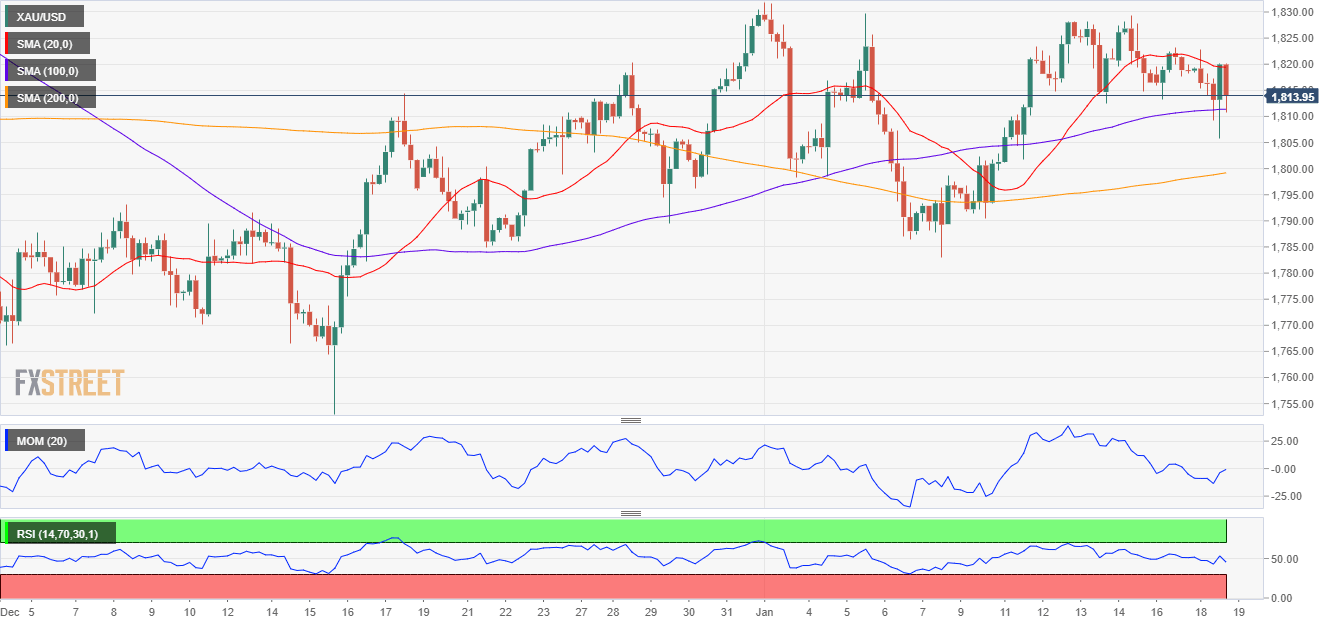

XAU/USD currently trades around 1,814 with a bearish bias. The daily chart shows that the price holds above its moving averages, although it briefly pierced a mildly bullish 20 SMA. Technical indicators remain within neutral levels, offering modest bearish slopes.

In the near term, and according to the 4-hour chart, the bearish case is clearer. Gold is trading above its 100 SMA but meeting sellers around a bearish 20 SMA. Technical indicators, in the meantime, resumed their declines within negative levels, although they are still above their intraday lows, indicating decreasing bearish momentum. Nevertheless, bears hold the grip and will likely look for a break below 1,800.

Support levels: 1,805.70 1,797.70 1,784.60

Resistance levels: 1,820.10 1,829.60 1,842.85

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.