Gold Price Forecast: Near-term bias remains tilted in favour of XAU/USD bulls

- A combination of diverging factors failed to provide any meaningful impetus to gold on Thursday.

- Resurgent USD demand exerted some intraday pressure, COVID-19 jitters helped any the downside.

- A goodish rebound in the US bond yields prompted some selling during the Asian session on Friday.

Gold seesawed between tepid gains/minor losses on Thursday and finally settled with modest gains for the third straight session. Following an early uptick to the highest level since June 16, the XAU/USD witnessed some intraday selling and fell to the $1,820 area amid a strong pickup in the US dollar demand. Despite Fed Chair Jerome Powell's dovish testimony, investors seem convinced that the US central bank will tighten its policy sooner than anticipated amid rising inflationary pressures. This, in turn, was seen as a key factor that acted as a tailwind for the greenback and undermined dollar-denominated commodities, including gold.

Meanwhile, the USD bulls largely shrugged off mixed US economic releases. The Initial Weekly Jobless Claims matched expectations and dropped to 360K during the week ending July 10 from the previous week's upwardly revised reading of 386K. Adding to this, the NY Fed's Empire State Manufacturing improved sharply to 43 in June. This was offset by weaker than anticipated Philly Fed Manufacturing Index, which fell to 21.9 for the current month. Separately, Industrial Production recorded a modest growth of 0.4% as against the 0.7% increase anticipated. The data did little to influence the USD or provide any meaningful impetus to the precious metal.

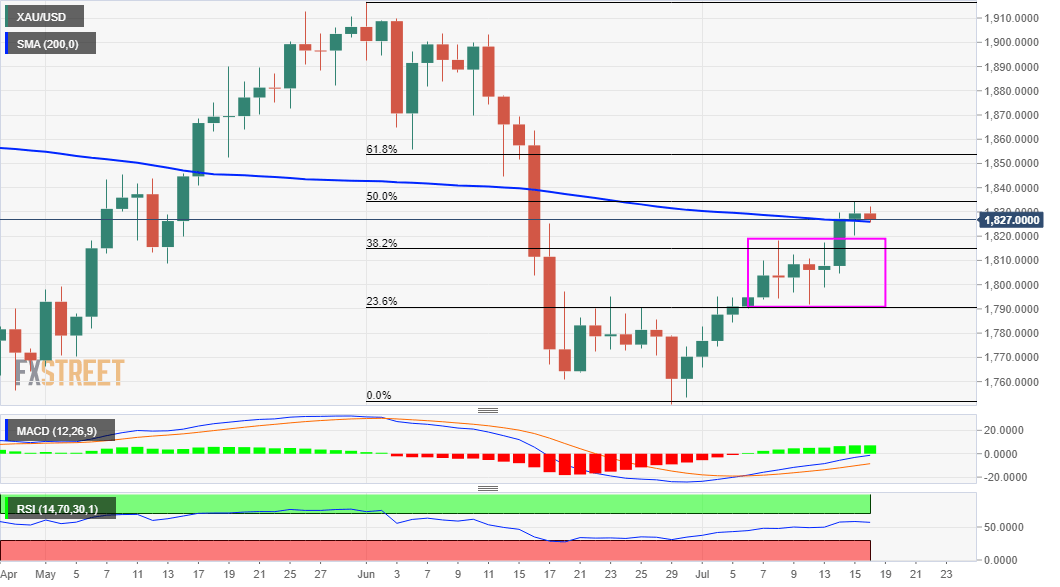

That said, concerns about the ongoing COVID-19 outbreaks involving the Delta variant helped limit losses for the safe-haven commodity. The global flight to safety was reinforced by an extension of the steep decline in the US Treasury bond yields. This was seen as another factor that extended some support to the non-yielding yellow metal. The intraday uptick, however, lacked any strong follow-through buying and bulls, so far, have struggled to capitalize on the move beyond the very important 200-day SMA. A goodish rebound in the US bond yields on Friday kept a lid on any further gains, rather prompted some selling during the Asian session.

Market participants now look forward to the release of the US monthly Retail Sales figures, due later during the early North American session. Apart from this, the US bond yields, will influence the USD price dynamics and provide some impetus to the XAU/USD. Traders will further take cues from the broader market risk sentiment and developments surrounding the coronavirus saga for some meaningful opportunities on the last day of the week.

Short-term technical outlook

From a technical perspective, Wednesday’s strong move up confirmed a near-term bullish breakout through a one-week-old trading range. A subsequent move beyond the 200-day SMA might have already set the stage for additional gains. Hence, some follow-through strength towards the $1,845-46 region, en-route the next major hurdle near the $$1,866 area, now looks a distinct possibility. The momentum could further get extended towards the $1,880 level before bulls eventually aim to reclaim the $1,900 round-figure mark.

On the flip side, the overnight swing lows, around the $1,820 region, nearing the trading range resistance breakpoint, now seems to protect the immediate downside. Any further pullback might be seen as a buying opportunity near the $1,808-07 zone. This is followed by the $1,800 mark, which if broken decisively will negate any near-term positive bias and prompt some aggressive technical selling around the XAU/USD.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.