Gold Price Forecast: Eyeing a test of September high at 1,833.95

XAU/USD Current price: $1,824.23

- US Federal Reserve is facing challenging replacements early on 2022.

- US Treasury yields ticked higher but remain at the lower end of their latest range.

- XAU/USD is overbought in the near term but can still extend its rally.

Gold trades at its highest in a month, although off its intraday high. The bright metal hit $1,826.10 a troy ounce following the US opening, as a better market mood exacerbates the dollar's corrective decline. Stocks started the week with a backfoot, as Asian indexes closed in the red, while the upbeat tone of Wall Street helped European indexes to end the day with modest gains.

Several US Federal Reserve policymakers give speeches within different events, although references to monetary policy were scarce. Vice-Chair Richard Clarida said that benchmarks for rate hikes could be met by the end of 2022 but added that the Fed is still "a ways away" from considering lift-off, adding that he expects a full return to pre-pandemic employment levels by the end of 2022. Also, Fed's Randal Quarles said he is stepping down from his post around the end of the year. Vice-Chair Richard Charida leaves in January, while Powell's term ends in February. A lot of word for President Joe Biden that would need to fill multiple positions.

Meanwhile, US Treasury yields tick higher, ahead of US inflation-related figures. On Tuesday, the country will publish the Producer Price Index, while the turn of the Consumer Price Index will be on Thursday. Demand for gold is backed by the yield on the 10-year Treasury note holding below the 1.50% mark.

Gold price short-term technical outlook

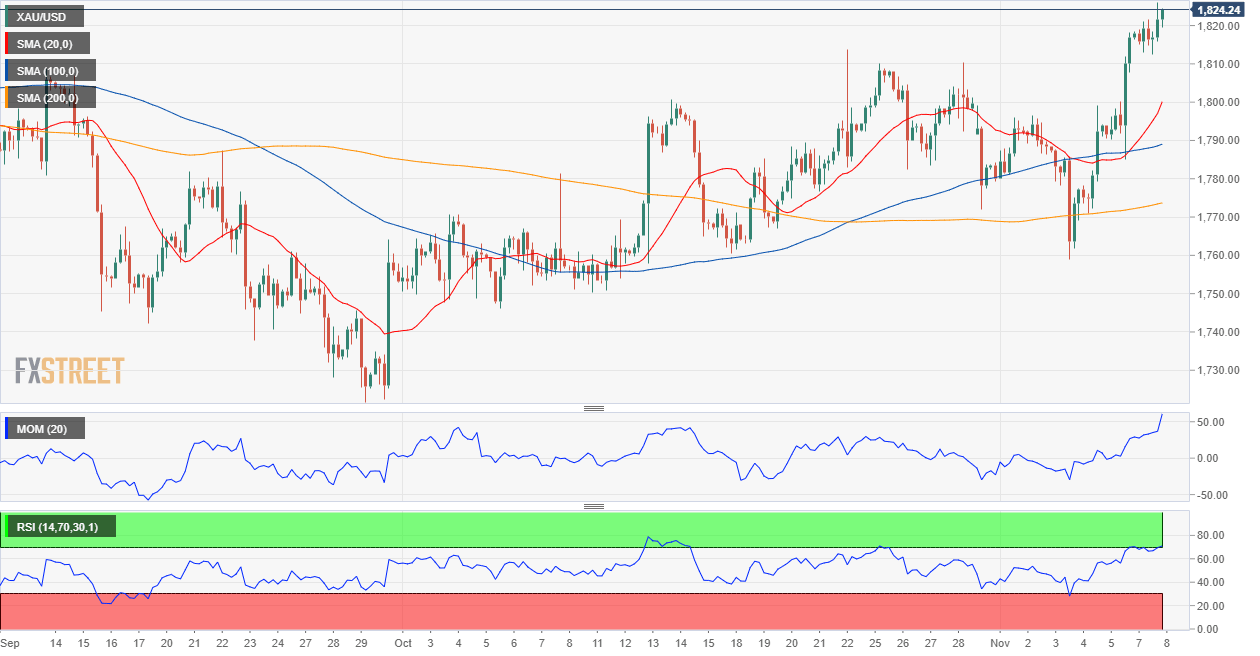

XAU/USD is trading around $1,823, up for a third consecutive day. The daily chart shows that the price is above its moving averages, which are confined to a tight range in the 1,785/92 area. The 20 SMA aims north, somehow hinting at further gains ahead. Meanwhile, technical indicators have stabilized near overbought readings.

In the near term, and according to the 4-hour chart, the bright metal is set to advance further. Gold is far above all of its moving averages, with the 20 SMA accelerating higher above the longer ones. Technical indicators have lost their bullish strength within overbought readings, yet as the price reaches higher highs and higher lows, chances of a downward move seem limited. More likely, the metal is set to extend its gains to 1,833.95, September monthly high.

Support levels: 1,819.20 1,810.40 1,798.50

Resistance levels: 1,826.10 1,833.95 1,844.30

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.