Gold Price Forecast: Consolidating losses, November low within sight

XAU/USD Current price: $1,789.69

- European indexes closed in the green, but the mood is still sour.

- US markets will briefly return on Friday, no fireworks are expected.

- XAU/USD retains its bearish stance and could fall towards 1,758.80.

Gold prices hold within familiar levels on a quiet Thursday, with spot peaking at $1795.08 a troy ounce during the European session. The bright metal stabilized around $1,790, where it stands at the time being, as US markets are closed due to the Thanksgiving holiday. The American dollar experienced a modest corrective decline on Thursday, but resumed its gains ahead of London’s close, stabilizing near its recent multi-month highs against most major rivals.

US markets will work reduced hours on Friday, although the current quietness is expected to continue. The lack of first-tier news helped European indexes to settle in the green, although gains were modest. Concerns related to the coronavirus situation in Europe will likely keep stocks heavy at the end of the week.

Gold price short-term technical outlook

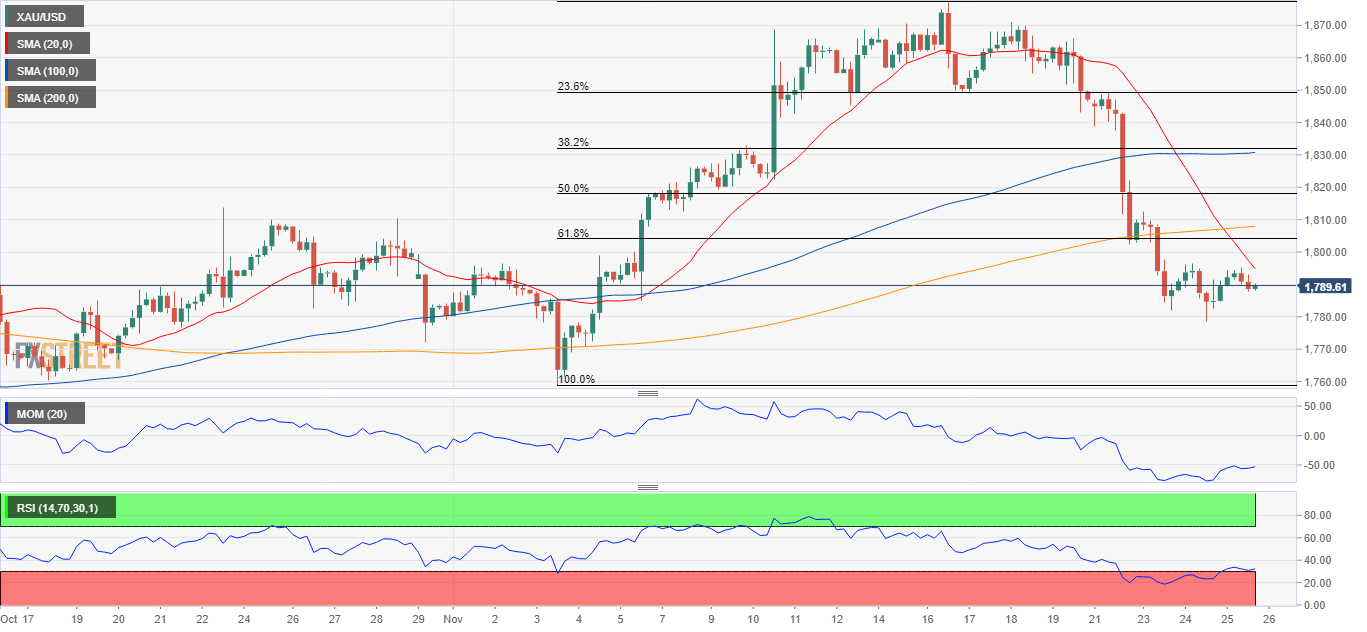

The XAU/USD pair is little changed for a second consecutive day, holding within Wednesday’s range amid thinned market conditions. The risk is skewed to the downside, according to the daily chart, as sellers continue appearing on spikes towards directionless 100 and 200 SMAs. The Momentum indicator keeps heading south within negative levels while the RSI indicator is stable around 42, in line with another leg south.

The 4-hour chart shows that a firmly bearish 20 SMA provides resistance near the daily high after crossing below the longer moving averages, as technical indicators stand pat within negative levels. The weekly low at 1,788.48 is the immediate support level ahead of November monthly low at 1,758.81.

Support levels: 1,778.80 1,771.95 1,758.80

Resistance levels: 1,796.00 1,803.85 1,817.75

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.