Gold Price Forecast: Bulls maintain the pressure

XAU/USD Current price: $1,778.70

- Spot gold holds on to intraday gains as the market mood is upbeat.

- The US Federal Reserve announces its monetary policy, focus on tapering.

- XAU/USD is neutral-to-bullish in the near term, bears have chances once below 1,769.10.

Gold stands at the upper end of its weekly range, trading around $1,778 a troy ounce ahead of the US Federal Reserve’s announcement. The bright metal seesawed between gains and losses, although holding above a critical Fibonacci support level at 1,769.10. The US central bank is expected to maintain rates on hold, with the focus on whether or not it will start trimming quantitative easing and when.

Market participants seem to believe at this point that Powell & Co will refrain from announcing tapering before year-end. Stocks are firmly up, with the DJIA up over 400 points and the Nasdaq and the S&P over 1% higher for the day. The greenback is down unevenly across the board, although it could change course if the Fed is more hawkish than anticipated.

Gold price short-term technical outlook

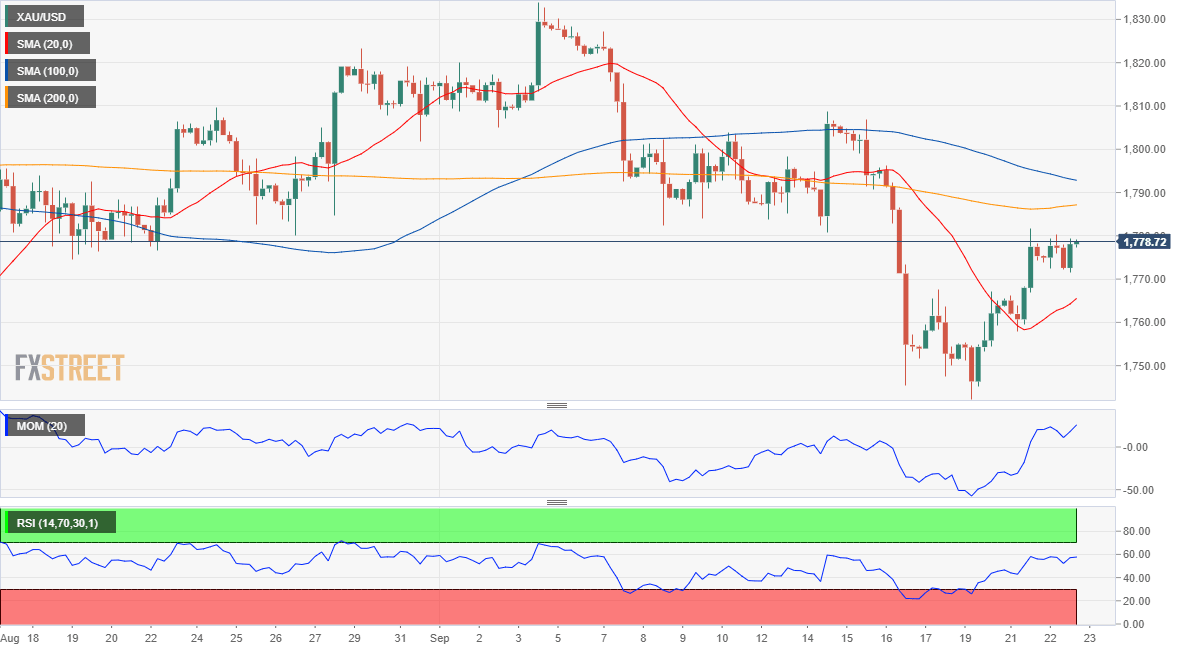

From a technical point of view and according to the daily chart, the bullish potential remains limited. XAU/USD is developing below all of its moving averages, although the 20 SMA is losing its bearish strength. Technical indicators have advanced just modestly within negative levels, lacking enough strength to confirm a steeper advance.

In the near term, and according to the 4-hour chart, the bright metal is neutral-to-bullish. It is advancing above a bullish 20 SMA but remains below the longer ones, which maintain their bearish slopes. The Momentum indicator ticks lower while the RSI indicator aims higher, both within positive levels. The risk will turn to the downside on a break below the mentioned Fibonacci support level, while bulls could have better chances on a break above 1,785.40.

Support levels: 1,769.10 1,754.20 1,742.00

Resistance levels: 1,785.40 1,796.90 1,806.70

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.